Global Trade Surveillance Market Size, Share, and COVID-19 Impact Analysis, By Component (Solution, Services), By Deployment (On-Premise, Cloud), By Enterprise Size (Large Enterprises, SMEs), By End User (Banks, Institutional Brokers, Retail Brokers, Market Centers & Regulators, Others) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Banking & FinancialGlobal Trade Surveillance Market Insights Forecasts to 2032

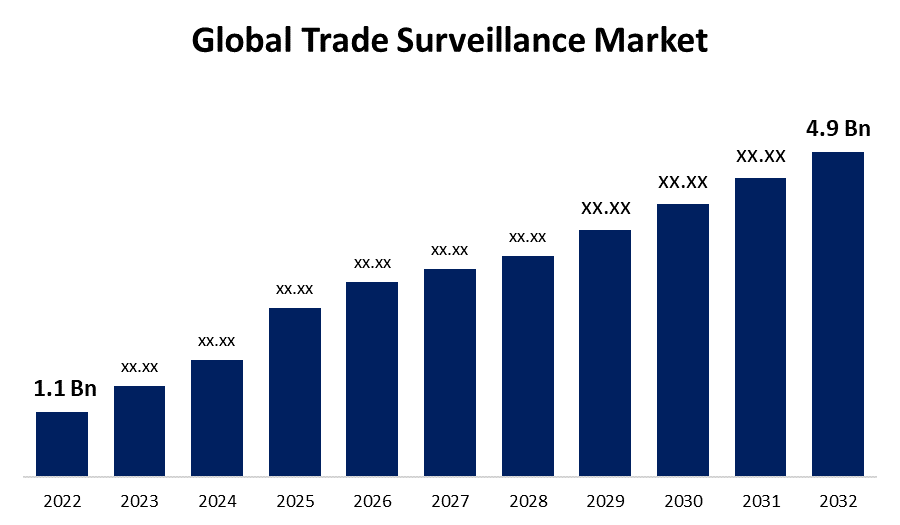

- The Global Trade Surveillance Market Size was valued at USD 1.1 Billion in 2022.

- The Market Size is Growing at a CAGR of 16.1% from 2022 to 2032

- The Worldwide Trade Surveillance Market Size is expected to reach USD 4.9 Billion by 2032

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Trade Surveillance Market Size is expected to reach USD 4.9 Billion by 2032, at a CAGR of 16.1% during the forecast period 2022 to 2032.

Trade surveillance, sometimes known as market surveillance, is the monitoring of securities trading activity by financial firms and their personnel to discover and prevent market abuse, insider trading, market manipulation, and other illegal acts. It is crucial for sustaining fair and transparent markets, the integrity of financial systems, and investor confidence. The trade surveillance systems solutions help companies and market professionals in detecting fraud, wrong, or abusive trading. This also assists firms and market specialists in preventing fraud, updating trading plans in less time, and comply with regulatory rules. Trade surveillance systems are primarily used by IT service providers, government regulators, consulting organizations, and system integrators.

Global Trade Surveillance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 1.1 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 16.1% |

| 2032 Value Projection: | USD 4.9 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 249 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Component, By Deployment, By Enterprise Size, By End User, By Region and COVID-19 Impact Analysis |

| Companies covered:: | IBM, CRISIL, b-next, FIS, Nasdaq, IPC, SIA S.p.A., ACA Group, NICE, Software AG, OneMarketData, Aquis Technologies, BAE Systems, Scila, Trading Technologies, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Vendors provide holistic trade surveillance system solutions and services with 360-degree monitoring in response to difficult regulatory compliances and rising trade malpractices. These trade surveillance tools track and analyze transactions, conversations, and behavioral trends to give a more thorough examination. The 360-degree approach to trade surveillance systems enhances true positives, reduces efforts to process false positives, and improves trade surveillance pattern identification. The demand for strong trade surveillance solutions that collect data from many channels, such as trade and order data, social networking site data, phone communications, and behavioral data, is continuously expanding. Moreover, with technology advancements and automated trading dominating the market, speed has emerged as the most important component in high-frequency trading, with consumers shifting from seconds to microsecond operations. This has increased the likelihood of market manipulation and fraud, making transaction surveillance systems a required necessity for trading. Also, rising fraud and scandals are expected to open up new avenues for providers in the coming years.

Restraining Factors

Regulatory uncertainty and cost-versus-benefit objections, where new regulatory demands are frequently subjected to significant changes before implementation, or they are simply postponed for an extended period. Although the advantages of implementing a surveillance and monitoring system are obvious, business leaders will continue to protest high spending restrictions for technology that does not contribute to profit-generating operations, making a real ROI assessment unachievable

Market Segmentation

By Component Insights

The Solution segment dominates the market with the largest revenue share over the forecast period.

Based on components, the global trade surveillance market is segmented into solutions and services. Among these, the solution segment is dominating the market with the largest revenue share over the forecast period. The greater use of internet protocol in surveillance systems accounts for the bigger share. Risk and compliance, reporting and monitoring, surveillance and analytics, and case management are all services provided by trade surveillance providers. These companies provide trade surveillance services such as managed and professional services. The smart trade surveillance system beats traditional trade surveillance, resulting in market growth. Implementing an efficient surveillance system solution also reduces operating expenses because fewer employees are required to monitor the data, resulting in more efficient use of all resources.

By Deployment Insights

The on-premise segment is witnessing significant CAGR growth over the forecast period.

Based on deployment, the global trade surveillance market is segmented into on-premise and cloud. Among these, the on-premise segment is witnessing significant CAGR growth over the forecast period. Data security is provided by on-premise trade surveillance systems, which include pattern recognition and behavioral analysis. There are various enterprises with sensitive information, such as the government and banking industries, who need the security and privacy that an on-premise environment affords. Because of concerns about information security and privacy in the cloud, as well as the fact that analytics usually deal with very valuable data, many firms are opting to remain on-premise, contributing to market growth.

By Enterprise Size Insights

The large enterprises segment is expected to hold the rapid revenue growth of the global trade surveillance market during the forecast period.

Based on enterprise size, the global trade surveillance market is classified into large enterprises and SMEs. Among these, large enterprises are expected to grow at a rapid pace during the forecast period. Industrial and other corporate enterprises are deploying upgraded physical and electronic security solutions to boost operational efficiency. Trade surveillance technology, which provides business analytics to minimize operational risk, is making large-scale enterprises safer and smarter. Risk assessment, remote viewing and administration, live monitoring, electronic and biometric access control, seamless solutions for improved security management and reporting, and mobile security management are all part of the trade surveillance system for large-scale organizations. The necessity to preserve data and raise awareness of security incidents is driving the expansion of the trade surveillance market among multinational organizations.

By End User Insights

The institutional brokers segment is projected to grow at the highest CAGR in the market during the forecast period.

Based on end-users, the global trade surveillance market is segmented into banks, institutional brokers, retail brokers, market centers & regulators, and others. Among these, the institutional brokers segment grows at the highest CAGR growth over the forecast period. Businesses, insurance, and investment firms are all represented by institutional brokers. They help their clients, who include banks, mutual funds, pension funds, and others, make large-scale acquisitions and sales of securities. Because they are a type of fiduciary holding money for others, these companies provide institutional brokerage services that are completely different from those given by retail brokers in terms of compliance, disclosure, clearing, and settlement rules.

Regional Insights

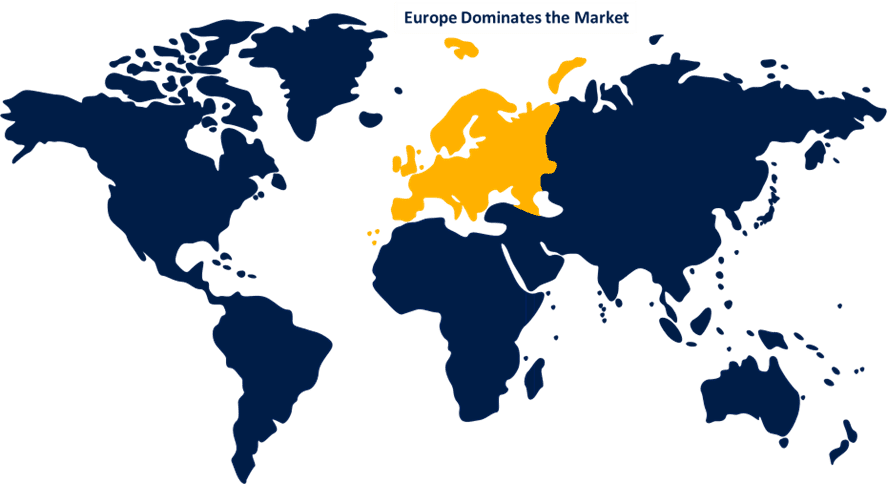

Europe dominates the market with the largest market share over the forecast period.

Get more details on this report -

Europe is dominating the largest market share over the forecast period. Europe provides market participants with profitable opportunities. The growing usage of cloud-based trade monitoring systems by enterprises of all sizes, as well as the expansion of the European economy, are driving the market. Rising living standards, rising per capita income, and increased acceptance of technology developments in surveillance and security systems are likely to drive growth in the region's industry. The market for trade surveillance systems is growing as a result of an increase in suspicious conduct among European enterprises, such as insider trading and market manipulation, caused by digitalization, electronic devices, and networks. Furthermore, the government has placed a several and regulations on financial institutions to increase organizational security and privacy, which is fueling the market for trade surveillance systems.

Asia-Pacific market is expected to grow the fastest during the forecast period. the growth of the banking and insurance industries in Asia-Pacific countries such as India, China, Singapore, South Korea, and Japan. Because financial firms are increasingly concerned about the security of trading activities, governments in these countries have begun to invest extensively in trade surveillance systems. Owing to a surge in market abuse and fraud instances, as well as the complexity of regulatory compliance requirements for firms, banks, and insurance companies, the Asia-Pacific region's trade surveillance system is expanding significantly. Several large regional enterprise organizations are also actively considering advanced trade monitoring solutions to improve their technology infrastructure for proactive surveillance and regulatory compliance.

North America is a big contributor to the expansion of the trade surveillance business. Moreover, because of its dominance with powerful and established economies that allow it to invest in R&D activities and thus encourage the creation and innovation of new technologies, the area is expected to take the lead in adopting trade surveillance systems.

List of Key Market Players

- IBM

- CRISIL

- b-next

- FIS

- Nasdaq

- IPC

- SIA S.p.A.

- ACA Group

- NICE

- Software AG

- OneMarketData

- Aquis Technologies

- BAE Systems

- Scila

- Trading Technologies

- Others

Key Market Developments

- In October 2022, OneMarketData, for faster access to market data and analytics, OneMarketData introduced the OneTick market data research environment.

- In September 2022, FIS introduced Worldpay for Platforms, a software-as-a-service (SaaS) solution that allows small and medium-sized businesses to gain access to embedded payments and financial solutions via software providers.

- In February 2022, Crisil and Apparity LLC announced a cooperation to provide financial institutions with end-user computing and governance solutions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the global trade surveillance market based on the below-mentioned segments:

Trade Surveillance Market, Component Analysis

- Solution

- Services

Trade Surveillance Market, Deployment Analysis

- On-Premise

- Cloud

Trade Surveillance Market, Enterprise Size Analysis

- Large Enterprises

- SMEs

Trade Surveillance Market, Technology Analysis

- Banks

- Institutional Brokers

- Retail Brokers

- Market Centers & Regulators

- Others

Trade Surveillance Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?