Global Tobacco Packaging Market Size By Product (Primary, Secondary, Bulk), By Material (Paper Boxes, Metals), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2032

Industry: Consumer GoodsGlobal Tobacco Packaging Market Insights Forecasts to 2032

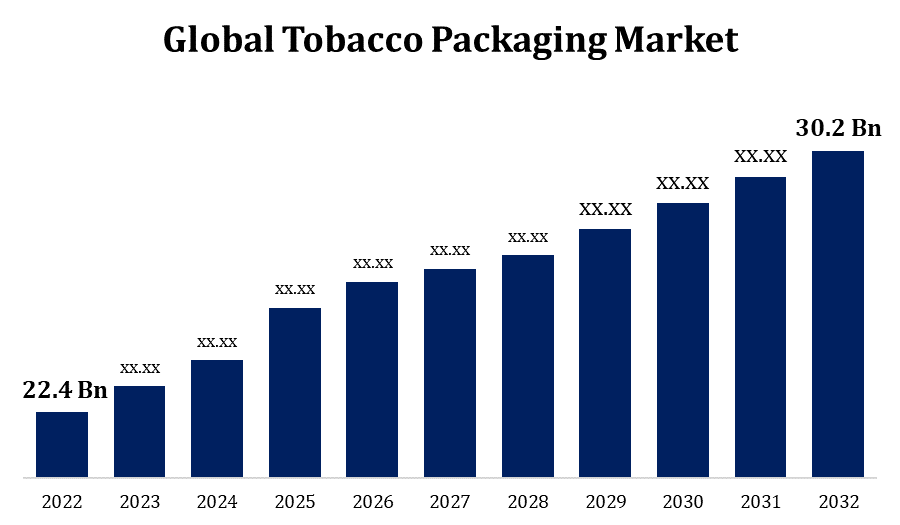

- The Tobacco Packaging Market Size was valued at USD 22.4 Billion in 2022.

- The Market Size is Growing at a CAGR of 4.5% from 2022 to 2032

- The Global Tobacco Packaging Market Size is expected to reach USD 30.2 Billion by 2032

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Tobacco Packaging Market Size is expected to reach USD 30.2 Billion by 2032, at a CAGR of 4.5% during the forecast period 2022 to 2032.

Tobacco packaging has become more plain or standardised in recent years, with graphic health warnings prominently visible. This strategy tries to lessen the appeal of tobacco products, particularly among young people. Some businesses, on the other hand, invest in inventive and eye-catching packaging to differentiate their products and attract customers. Sustainability is also becoming a major concern across the packaging sector, particularly tobacco packaging. Consumers are becoming more aware of environmental issues, which has resulted in a push for more environmentally friendly packaging solutions. The tobacco packaging market is dynamic and is driven by a variety of regulatory, marketing, and sustainability concerns.

Tobacco Packaging Market Value Chain Analysis

The value chain starts with the acquisition of raw materials. This comprises paper, cardboard, plastic, and other packaging materials. Choices at this level may be influenced by sustainability concerns. Following that, the raw ingredients are processed and converted into packaging materials. To develop the final package items, this stage incorporates numerous production procedures such as printing, moulding, and shape. Graphic designers and marketing teams collaborate to create packaging designs that are not only visually appealing but also meet regulatory criteria. In this stage, branding, logos, and health warnings are important considerations. After that, the designed package is printed with the appropriate information, such as brand identity, health warnings, and regulatory information. Once completed, the packaging is given to tobacco makers. This includes logistics and transportation to ensure that goods are delivered on schedule to the next step of the value chain. Tobacco makers incorporate packaging into their manufacturing processes. Tobacco goods are placed in the packing, and automated systems may be used for efficiency. Packaging is very important in marketing and branding. To identify their products in the market, businesses engage in developing a distinct and recognisable packaging design. Packaging is very important in marketing and branding. To identify their products in the market, businesses engage in developing a distinct and recognisable packaging design.

Tobacco Packaging Market Opportunity Analysis

Sustainable packaging solutions are in high demand across industries. Creating and implementing environmentally acceptable materials into tobacco packaging might be a huge potential. This is consistent with rising consumer knowledge of environmental issues. The incorporation of smart packaging technology, such as RFID tags or QR codes, can create chances for improved monitoring, authentication, and consumer involvement. This could be used for anti-counterfeiting efforts as well as providing additional product information. Given the growing emphasis on health and wellbeing, there is an opportunity to create packaging that reflects this trend. This could include integrating features emphasising lower environmental effect or packing materials seen as healthier. Collaboration with anti-smoking organisations to develop packaging that discourages smoking could be an option.

Global Tobacco Packaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 22.4 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 4.5% |

| 2032 Value Projection: | USD 30.2 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product, By Material and By Region |

| Companies covered:: | Westrock Company, Amcor Limited, Mondi Group, Innovia Films Ltd, Philip Morris International Inc., British American Tobacco P.L.C., Ardagh Group, Altria Group, Reynolds American Inc., ITC Limited, and Other Key Vendors. |

| Growth Drivers: | Rise in global cigarette consumption |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Tobacco Packaging Market Dynamics

Rise in global cigarette consumption

Increased cigarette usage directly correlates to an increase in packing material demand. To accommodate increased cigarette output, tobacco businesses will require more packaging. If the surge in consumption is especially noticeable in emerging countries, it may open up new market potential for packaging companies in those countries. As these countries' economies grow, there may be an increase in demand for packaged tobacco products. To distinguish out in a competitive market, tobacco businesses may seek inventive and unique packaging as use rises. This could result in increasing investments in packaging design and technology, providing opportunity for packaging providers to create distinctive solutions. Packaging firms may need to adjust to changing market patterns brought about by growing consumption.

Restraints & Challenges

Tobacco usage has declined in some places as a result of increased awareness of the health dangers connected with smoking, along with anti-smoking programmes. This development has the potential to have a direct impact on the demand for tobacco packaging. Alternative tobacco products, such as e-cigarettes and smokeless tobacco, are posing a threat to traditional cigarette packaging. Packaging firms may need to adapt to these items' special requirements or face a shift in market demand. Consumers are increasingly interested in eco-friendly and sustainable packaging. This presents a problem for the tobacco packaging industry, which has traditionally relied on materials that may not be compatible with these preferences. Adapting to sustainable practises while maintaining product integrity might be difficult. The tobacco packaging sector, like many others, is vulnerable to global supply chain disruptions. Pandemics, natural disasters, and geopolitical tensions can all have an impact on the availability and cost of raw resources, influencing production and distribution.

Regional Forecasts

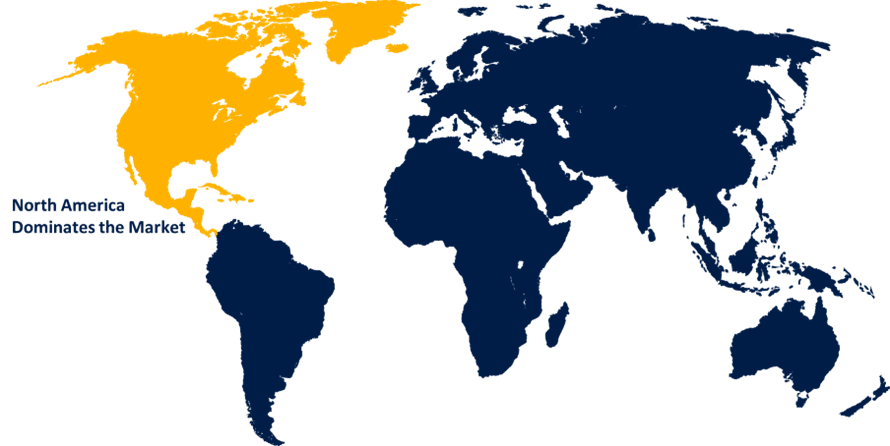

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Tobacco Packaging Market from 2023 to 2032. Tobacco packaging is governed by strict rules in North America, which includes the United States and Canada. This includes graphic health warnings, advertising limits, and rules aiming at limiting the appeal of tobacco products, particularly to young people. Alternative tobacco and nicotine products, such as e-cigarettes and vaping devices, have gained in popularity in North America. These products' packaging requirements may differ from typical cigarette packaging, posing both obstacles and opportunities for the industry. North America has been at the forefront of anti-smoking programmes, which has helped to reduce smoking rates. The effectiveness of these advertisements, in conjunction with regulatory measures, has an impact on market dynamics and demand for tobacco packaging. The growing emphasis on health and wellbeing influences consumer choices, especially smoking habits. This development may contribute to a decrease in traditional tobacco consumption, affecting packaging demand.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2032. Tobacco usage is prevalent in many Asian Pacific countries. This is influenced by cultural and socioeconomic factors, which contribute to a steady demand for tobacco products and packaging. Several Asian Pacific countries are considered emerging markets for tobacco products. The growing middle class and changing lifestyles contribute to greater demand for cigarettes, which benefits the packaging sector. There is a rising market for smokeless tobacco products such as chewing tobacco and snuff in several parts of Asia Pacific. Packaging standards for these items may differ from those for regular cigarettes.

Segmentation Analysis

Insights by Product

Secondary packaging segment accounted for the largest market share over the forecast period 2023 to 2032. Secondary packaging adds another layer of branding and distinctiveness. Tobacco businesses may utilise this space for advertising messages, logos, and one-of-a-kind designs that improve the product's visual attractiveness on the shelf. Companies are looking for inventive secondary packaging to help them stand out as competition grows. Secondary packaging protects tobacco goods during shipping, handling, and storage by adding an extra layer of protection. This is especially critical for preserving product quality and freshness. As global supply networks increase, so does the demand for strong secondary packaging solutions. Tobacco firms entering new markets may face changing packaging requirements and consumer preferences. Secondary packaging enables for localization while preserving a uniform worldwide brand image.

Insights by Material

Paper box segment accounted for the largest market share over the forecast period 2023 to 2032. Paper packaging is frequently perceived positively by consumers, particularly those who are ecologically sensitive. The usage of paper boxes can improve a brand's image and appeal to a market niche that values environmentally friendly packaging. Paper boxes can be made and customised to evoke feelings of grandeur and superior quality. Paper boxes with high-quality printing, embossing, and finishing techniques contribute to the overall branding strategy, enticing consumers seeking a sophisticated product presentation. Packaging is critical to brand awareness. Paper boxes can be branded with unique logos, colours, and designs, allowing consumers to readily recognise and recall a certain tobacco brand on the store. Because of the increase of e-commerce in the tobacco industry, packaging that is durable, protective, and visually appealing is required.

Recent Market Developments

- In June 2021, Smurfit Kappa Group increased its presence in Latin America with the acquisition of Cartoons del Pacifico, a Peruvian paper-based packaging manufacturer.

Competitive Landscape

Major players in the market

- Westrock Company

- Amcor Limited

- Mondi Group

- Innovia Films Ltd

- Philip Morris International Inc.

- British American Tobacco P.L.C.

- Ardagh Group

- Altria Group

- Reynolds American Inc.

- ITC Limited

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2032.

Tobacco Packaging Market, Product Analysis

- Primary

- Secondary

- Bulk

Tobacco Packaging Market, Material Analysis

- Paper Boxes

- Metals

Tobacco Packaging Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Need help to buy this report?