Global Thermal Interface Materials Market Size By Product Type (Gap Fillers, Metal-Based Thermal Interface Materials, Greases & Adhesives), By Application (Medical Devices, Industrial Machinery, Computers), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2032

Industry: Advanced MaterialsGlobal Thermal Interface Materials Market Insights Forecasts to 2032

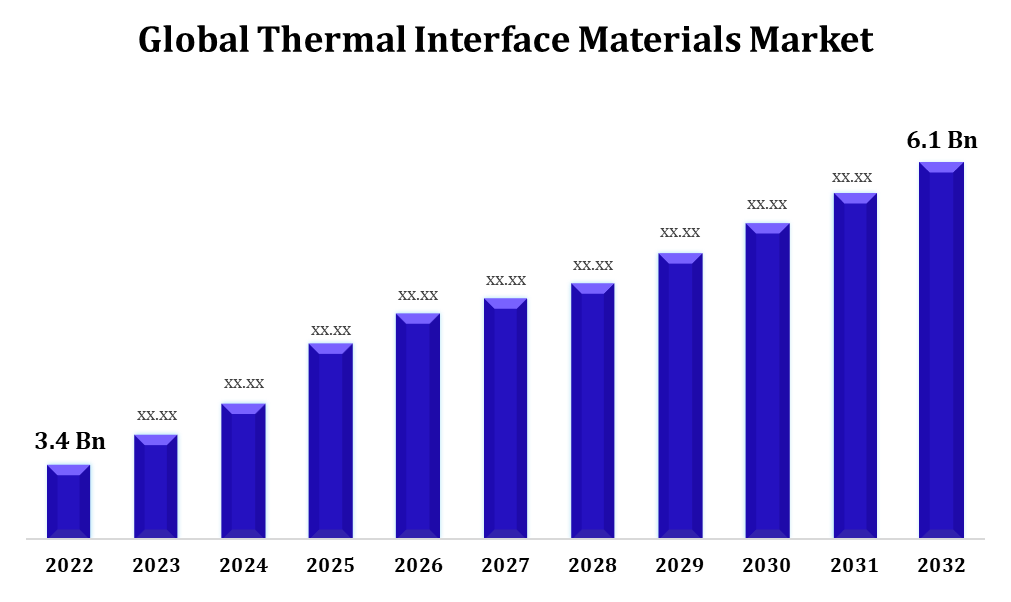

- The Global Thermal Interface Materials Market Size was valued at USD 3.4 Billion in 2022.

- The Market Size is Growing at a CAGR of 12.4% from 2022 to 2032

- The Worldwide Thermal Interface Materials Market Size is expected to reach USD 6.1 Billion by 2032

- Asia Pacific Market is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Thermal Interface Materials Market Size is expected to reach USD 6.1 Billion by 2032, at a CAGR of 3.4% during the forecast period 2022 to 2032.

The expansion of the Thermal Interface Materials (TIM) sector has been a hot topic (pun intended). With the growing demand for electronic gadgets and technological breakthroughs, there is a greater need for good thermal management. As electronic components become smaller and more powerful, the problem is to efficiently disperse heat. TIM innovations, including as the development of high-performance materials, the rise of electric vehicles, and the adoption of 5G technology, are propelling the market ahead. The global push for sustainability and energy efficiency also helps, because effective thermal management can improve the overall performance and lifespan of electrical gadgets.

Thermal Interface Materials Market Value Chain Analysis

Raw materials make their way into the production process, where they are turned into thermal interface materials such as greases, adhesives, and pads. The TIMs are subsequently distributed, with suppliers ensuring that they reach the appropriate manufacturers and end-users. These TIMs are integrated into electronic devices during assembly to ensure effective heat management. Smartphones, laptops, and high-performance computing devices all make their way into the hands of end customers. The TIMs are essential for keeping everything cool and working efficiently. The dance does not always go as planned. This is where aftermarket services come in, providing solutions such as TIM replacements or upgrades. Continuous R&D keeps the beat going, driving innovation and the evolution of new and enhanced TIMs.

Thermal Interface Materials Market Opportunity Analysis

The ever-increasing demand for technological devices creates a huge potential. As devices become smaller, quicker, and more powerful, efficient thermal management becomes increasingly important. The deployment of 5G networks is having an impact. As data speeds increase, so does the manufacture of 5G-enabled devices, and TIMs play an important role in keeping them cool. Vehicle electrification is advancing, and TIMs are critical for keeping electric vehicle batteries and power electronics at appropriate temperatures. The global shift towards sustainability creates chances for environmentally friendly TIMs. Manufacturers who focus on ecologically friendly solutions will benefit. Cloud computing and data-intensive applications are increasing the requirement for effective thermal management in data centres. The demand for tiny, efficient, and dependable electrical components grows in tandem with the Internet of Things (IoT). TIMs are crucial in guaranteeing the longevity and dependability of IoT devices. The healthcare industry's reliance on electronic medical devices creates an additional opportunity for TIM market expansion. The demand for effective thermal solutions grows in lockstep with developments in medical technology.

Global Thermal Interface Materials Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 3.4 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 3.4% |

| 2032 Value Projection: | USD 6.1 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Application, By Region, By Geographic Scope |

| Companies covered:: | Bergquist Company, Henkel Corporation, Indium Corporation, Dow Corning, Parker Chomerics, Laird Technologies, Honeywell International Inc., 3M, Zalman Tech Co., Ltd., Momentive Performance Materials Inc. and Other Key Vendors. |

| Growth Drivers: | Growing demand for electronic devices |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Thermal Interface Materials Market Dynamics

Growing demand for electronic devices

As gadgets become smaller and more powerful, controlling heat becomes a significant concern. Efficient TIMs keep these devices from overheating, ensuring peak performance and dependability. The steady influx of new smartphones, laptops, tablets, and other consumer devices drives up demand for TIMs. Consumers want devices to be not only powerful but also dependable, and TIMs play an important part in this. With its high-performance consoles and PCs, the gaming sector contributes significantly to the demand for improved TIMs. Gamers put their systems to the test, necessitating the need of robust thermal solutions to minimise overheating during long gaming sessions. Wearables, like as smartwatches and fitness monitors, are creating new potential for TIMs. These devices are frequently tiny, and excellent thermal management is required to ensure user comfort and device longevity.

Restraints & Challenges

Managing the heat created by electronics becomes increasingly difficult as they become more powerful. TIMs must keep up with the ever-increasing thermal demands of high-performance devices. Different electronic gadgets have different heat management requirements. Customising TIMs for unique applications adds complexity and necessitates a careful approach. While improved TIMs provide higher performance, their price can be significant. Balancing performance and affordability is difficult, particularly in price-sensitive markets. Electronic equipment are anticipated to last for a long time. It is difficult to ensure that TIMs retain their thermal conductivity and effectiveness over time, especially in severe conditions. Disruptions in the global supply chain, as seen recently, might impair the availability of raw materials and components, influencing the stability of the TIM market.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Thermal Interface Materials Market from 2023 to 2032. North America is a technical powerhouse, with Silicon Valley at its centre. Because of the region's significance in innovation and technological growth, there is a high need for superior TIMs. The growing use of electronic devices in North America, ranging from cellphones to high-performance computing systems, increases the requirement for efficient heat management solutions. With the advent of cloud computing and the presence of various data centres, there is a significant demand for effective TIMs in ensuring server stability and performance. In North America, the electric vehicle (EV) revolution is gaining traction. TIMs serve an important role in cooling EV batteries and power electronics, making them an important component in the automobile industry's transition to electrification. The substantial manufacturing industry in the region, along with a focus on accuracy and quality.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2032. Asia Pacific is a manufacturing behemoth, producing a sizable part of the world's technological devices. The need for high-performance TIMs is fueled by this manufacturing prowess. The Asia Pacific area, which is home to major electronics manufacturers, suffers a constant increase in demand for smartphones, laptops, and other consumer devices, boosting the need for efficient heat management. The Asia Pacific region is well-known for its rapid adoption of new technologies. The need for sophisticated TIMs is increasing as industries embrace cutting-edge electronic components. Consumer spending on electronic devices is increasing in Asia Pacific emerging markets. As more individuals adopt technology, this development boosts to the total demand for TIMs.

Segmentation Analysis

Insights by Product Type

The greases and adhesives segment accounted for the largest market share over the forecast period 2023 to 2032. Grease and adhesives are intended to improve thermal conductivity between two surfaces, allowing for efficient heat transmission. The necessity for excellent heat dissipation increases the demand for these materials as electronic gadgets become more compact and powerful. The simplicity of use of greases and adhesives is a major element in their appeal. Manufacturers and assemblers find these materials easy to employ during the manufacturing process, which contributes to their widespread use. Grease and adhesives are widely used in the automotive industry, where heat control is critical. They play an important role in maintaining the efficient cooling of electronic components in automobiles, which contributes to the segment's growth. For thermal solutions, the thriving consumer electronics business relies on greases and adhesives.

Insights by Application

The electronics segment accounted for the largest market share over the forecast period 2023 to 2032. The ongoing need for increasingly powerful computer processors has a direct impact on the TIM industry. Thermal management is critical for preventing overheating and ensuring optimal CPU performance. The increasing rise of the gaming sector contributes considerably to the demand for high-performance TIMs. Gaming PCs and consoles, which have high processing needs, rely on efficient thermal solutions to avoid performance throttling. Data centres and servers require robust heat control as cloud computing and data storage become more popular. TIMs are critical to ensuring the dependability and efficiency of modern computing systems. The ubiquitous usage of laptops and notebook computers in both professional and personal contexts drives demand for TIMs.

Recent Market Developments

- In 2022, DOWSIL TC-4040 TIMs were introduced by Dow Corning Corporation. This gap filler is easy to apply, does not sink, and transfers heat efficiently.

Competitive Landscape

Major players in the market

- Bergquist Company

- Henkel Corporation

- Indium Corporation

- Dow Corning

- Parker Chomerics

- Laird Technologies

- Honeywell International Inc.

- 3M

- Zalman Tech Co., Ltd.

- Momentive Performance Materials Inc.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2032.

Thermal Interface Materials Market, Product Type Analysis

- Gap Fillers

- Metal-Based Thermal Interface Materials

- Greases & Adhesives

Thermal Interface Materials Market, Application Analysis

- Medical Devices

- Industrial Machinery

- Computers

Thermal Interface Materials Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Need help to buy this report?