Global Testing, Inspection, and Certification Market Size Share, and COVID-19 Impact Analysis By Service Type (Testing, Inspection Service and Certification Service), By Sourcing Type (Outsourced and In-house), By End-user Vertical (Consumer Goods and Retail, Food and Agriculture, Oil and Gas, Construction and Engineering, Energy and Chemicals, Manufacturing of Industrial Goods, Transportation (Rail and Aerospace), Industrial and Automotive, and Other End-user Verticals), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 - 2030.

Industry: Information & TechnologyGlobal Testing, Inspection, and Certification Market Insights Forecasts to 2030

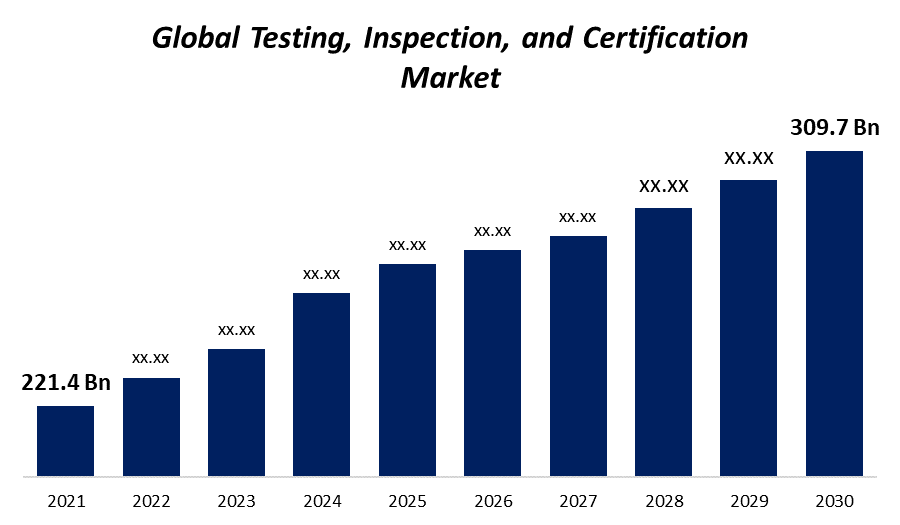

- The global testing, inspection, and certification market was valued at USD 221.4 billion in 2021.

- The market is growing at a CAGR of 3.8% from 2021 to 2030

- The global testing, inspection, and certification market is expected to reach USD 309.7 billion by 2030

- Europe is expected to grow the fastest during the forecast period

Get more details on this report -

The global testing, inspection, and certification market is expected to reach USD 309.7 billion by 2030, at a CAGR of 3.8% during the forecast period 2021 to 2030. Methods of testing and inspection that are reliable and work well are important to make sure that companies continue to meet the highest quality standards and work at their most productive and efficient levels. When businesses use TIC approaches, they can make their operations more efficient by changing the tasks in their supply chains to better meet their own needs and goals. It is expected that the increase in the number of large companies in the manufacturing, automotive, and consumer goods industries that outsource testing, inspection, and certification services will help the TIC market grow. The growth of the TIC industry is helped by the fact that businesses and companies are becoming more aware of how important it is to do testing, inspection, and certification activities that are both safe and effective.

Market Overview:

The testing, inspection, and certification business is a big part of the global economy because it helps improve the quality of goods used in a wide range of industries by a wide range of end users. More and more industries are using cutting-edge technology. This has increased the need for TIC services, which promote the safe development and use of innovations while also making sure they follow the rules. TIC services also provide the certifications that are needed. This is because some industries, like the healthcare and pharmaceuticals industries, the food and beverage industries, the automotive industry, and the industrial manufacturing industry, need products and technologies that are internationally certified. Testing, inspection, and certification (TIC) is growing because more and more businesses and companies want to use safe and effective methods for testing, inspection, and certification. Businesses can guarantee the highest quality standards, as well as high productivity and the most efficiency, by putting in place reliable and effective inspection and testing procedures. When businesses use TIC techniques, they can change their supply chain operations to fit their needs and preferences. This makes business procedures easier. For example, in January 2022, Temasek, an investment firm based in Singapore that specializes in restructuring, growth capital, and divestment deals, announced that it had bought Element Materials Technology, a well-known company that offers testing, inspection, and certification services. Temasek's main goals are restructuring, providing growth capital, and getting rid of companies. The acquisition is meant to be a big deal in the TIC industry and a key step in the Group's efforts to grow. These two goals will both be reached.

Report Coverage

This research report categorizes the market for global testing, inspection, and certification market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global testing, inspection, and certification market. Recent market developments and competitive strategies such as expansion, product launch and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each global testing, inspection, and certification market sub-segments.

Global Testing, Inspection, and Certification Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 221.4 billion |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 3.8% |

| 2030 Value Projection: | USD 309.7 billion |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 234 |

| Tables, Charts & Figures: | 141 |

| Segments covered: | By Service Type, By Sourcing Type, By End-user Vertical, By Region, COVID-19 Impact Analysis |

| Companies covered:: | ALS Limited, Applus+, Bureau Veritas SA, DEKRA SE, DNV GL, Element Materials Technology, Eurofins Scientific, Intertek Group plc, MISTRAS Group, Inc., SGS SA, TÜV NORD GROUP, TÜV Rheinland, TÜV SÜD, UL LLC |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Segmentation Analysis

- In 2021, the testing segment dominated the market with the largest market share of 39% and market revenue of 86.3 billion.

Based on service type, the testing, inspection, and certification market is categorized into Testing, Inspection Service and Certification Services. In 2021, the testing segment dominated the market with the largest market share of 39% and market revenue of 86.3 billion. This is because the manufacturing industry, the automotive industry, the energy and utilities industry, the oil and gas and petroleum industry, all make extensive use of testing techniques. Product testing in the real world helps businesses to keep their quality criteria at a high level and satisfy the requirements of their clients. This is encouraging businesses in a wide variety of sectors to boost their operational expenditures on the investment of testing equipment, which will ultimately serve as a stimulus for the expansion of the market.

- In 2021, the in-house segment accounted for the largest share of the market, with 57% and market revenue of 126.1 billion.

Based on sourcing type, the testing, inspection, and certification market is categorized into Outsourced and In-house. In 2021, in-house dominated the market with the largest market share of 57% and market revenue of 126.1 billion. When companies use in-house testing and inspection techniques, they are able to do real TIC activities because they can do so on-site. Companies can also hire people and set up practices that fit their needs and wants. Also, having TIC teams in-house allows for better control and a deeper understanding of business processes, both of which may be good for an organization.

- In 2021, the consumer goods and retail segment accounted for the largest share of the market, with 25% and a market revenue of 55.35 billion.

Based on end-user vertical, the testing, inspection, and certification market is categorized into Consumer Goods and Retail, Food and Agriculture, Oil and Gas, Construction and Engineering, Energy and Chemicals, Manufacturing of Industrial Goods, Transportation (Rail and Aerospace), Industrial and Automotive, and Other End-user Verticals. In 2021, Consumer goods and retail dominated the market with the largest market share of 25% and market revenue of 55.35 billion. The number of inspections done by businesses in the consumer goods and retail sector is rising, which has directly led to a big increase in the sector's share of revenue. Manufacturers of consumer goods have to follow several quality standards and rules to make sure that their customers get the best service possible. This makes it much easier to make full inspection systems that work very well, which opens the door for the market to grow. Retail businesses are also responsible for ensuring that their customers have access to the best products and customer experiences. This will help the market grow and spread TIC services and technologies even more.

Regional Segment Analysis of the Testing, Inspection, and Certification Market

Get more details on this report -

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

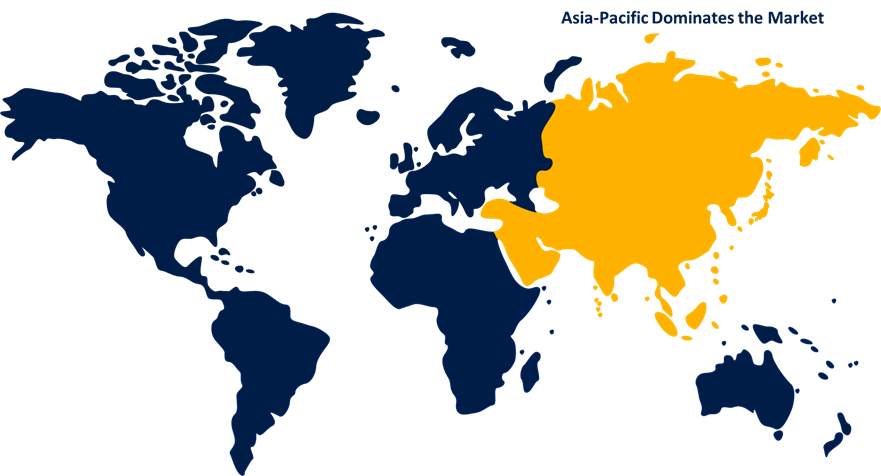

Among all regions, Asia-Pacific emerged as the largest market for the global testing, inspection, and certification market, with a market share of around 32.78% and 221.4 billion of market revenue in 2021.

- In 2021, Asia-Pacific emerged as the largest market for the global testing, inspection, and certification market, with a market share of around 32.78% and 221.4 billion of the market revenue. India's exports are growing, and the export of food goods is a big part of that. The most important exports are fish, shrimp, clams, mussels, cuttlefish, octopus, squid, crabs, and other crustaceans. Most of these things are sold in the United States and Japan. Exports of seafood from India are limited by the rules of the country or area they are going to. Because of this, the food business will likely spend a lot more time inspecting and testing.

- The Europe market is expected to grow at the fastest CAGR between 2022 and 2030. Rising investments in building and developing infrastructure are expected to be a major factor in the market growth in the European area. Recent technological advances and the growing use of the Internet of Things have helped the inspection and maintenance industries by introducing predictive maintenance. A big reason for the growing need to test, inspect, and maintain essential assets and systems is that more attention is being paid to minimizing the time that machines and other equipment can't be used. Because there are so many competitors in the TIC market and the level of competition is so high, the number of merger and acquisition deals has increased. The biggest players in the market are putting a lot of weight on mergers and acquisitions as a way to increase their sales and profits.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global testing, inspection, and certification market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Market Players:

- ALS Limited

- Applus+

- Bureau Veritas SA

- DEKRA SE

- DNV GL

- Element Materials Technology

- Eurofins Scientific

- Intertek Group plc

- MISTRAS Group, Inc.

- SGS SA

- TÜV NORD GROUP

- TÜV Rheinland

- TÜV SÜD

- UL LLC

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Third-party knowledge providers

- Value-Added Resellers (VARs)

Recent Development

- In March 2022, the UL Group built a brand-new testing facility with the latest technology in Hai Duong. This building offers end-to-end service solutions, such as testing for certification and helping Vietnam-made products get into global markets.

- In January 2022, Bureau Veritas said that it would buy PreScience. With the purchase of PreScience's services, Bureau Veritas can offer a wider range of Buildings & Infrastructure services in North America.

Market Segment

This study forecasts global, regional, and country revenue from 2019 to 2030. Spherical Insights has segmented the global testing, inspection, and certification market based on the below-mentioned segments:

Global Testing, Inspection, and Certification Market, By Service Type

- Testing

- Inspection Service

- Certification Service

Global Testing, Inspection, and Certification Market, By Sourcing Type

- Outsourced

- In-house

Global Testing, Inspection, and Certification Market, By End-user Vertical

- Consumer Goods and Retail

- Food and Agriculture

- Oil and Gas

- Construction and Engineering

- Energy and Chemicals

- Manufacturing of Industrial Goods

- Transportation (Rail and Aerospace)

- Industrial and Automotive

- Other

Global Testing, Inspection, and Certification Market, Regional Analysis

- North America

- THE US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- The Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?