Global Synthetic Aperture Radar Market (SAR) Size, Share, and COVID-19 Impact Analysis, By Component (Receiver, Transmitter, and Antenna), By Platform (Airborne (Spacecraft, Aircraft and Unmanned Aerial Vehicle (UAV) and Ground), By Application (Military and Defense, Monitoring and Exploration), By Frequency Band (X, L, C, S, K/Ku/Ka, UHF/VHF), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Aerospace & DefenseGlobal Synthetic Aperture Radar (SAR) Market Insights Forecasts to 2032

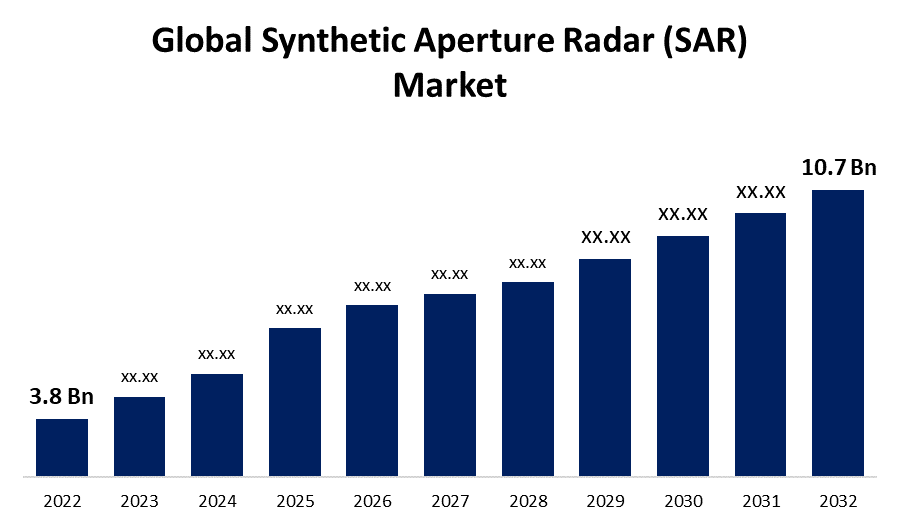

- The Global Synthetic Aperture Radar (SAR) Market Size was valued at USD 3.8 Billion in 2022.

- The Market Size is Growing at a CAGR of 10.9% from 2022 to 2032.

- The worldwide Synthetic Aperture Radar Market size is expected to reach USD 10.7 Billion by 2032.

- Asia Pacific is expected To Growth the fastest during the forecast period.

Get more details on this report -

The Global Synthetic Aperture Radar (SAR) Market Size is expected to reach USD 10.7 Billion by 2032, at a CAGR of 10.9% during the forecast period 2022 to 2032.

Market Overview

The term "synthetic aperture radar market" (SAR) refers to ground-based and space-based SAR that works on the theory of sending and receiving reflected signals that interact with the ground to help with imaging, tracking, detection, and characterization. Because microwaves may pass through clouds and give reliable 24-hour, all-weather data efficiency, synthetic aperture radar has many more uses than traditional electro-optical (EO) imaging systems. In contrast to conventional optical vision, SAR systems are largely underutilized despite their many benefits. Licensing of Private Remote Sensing Space Systems, published by the Department of Commerce and the National Oceanic and Atmospheric Administration (NOAA) in response, updated the requirements for obtaining a license to use a private remote sensing space system under the Land Remote Sensing Policy Act of 1992.

Report Coverage

This research report categorizes the global synthetic aperture radar market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global synthetic aperture radar market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global synthetic aperture radar market. Technological innovation and advancement will further optimize the performance of the product, enabling it to acquire a wider range of applications in the downstream market.

Global Synthetic Aperture Radar Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022 : | USD 3.8 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 10.9% |

| 2032 Value Projection: | USD 10.7 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 125 |

| Segments covered: | By Component, By Platform, By Application, By Frequency Band, By Region. |

| Companies covered:: | Lockheed Martin Corporation, Airbus SE, Aselsan A.S., BAE Systems Plc, Cobham Plc (Advent), General Atomics Aeronautical Systems Inc., L3Harris Technologies, IMSAR LLC, Israel Aerospace Industries Ltd, Leonardo SpA, Maxar Technologies Ltd, MetaSensing Group, Northrop Grumman Corporation, Raytheon Company, Saab AB, SAR AERO, SRC Inc., Thales Group |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Increasing demand from military applications for synthetic aperture radar, which is utilized to identify surface characteristics including missile locations, building complexes, and topographical aspects of the nearby landscape. In addition, synthetic aperture radar is employed for mission planning for impending operations as well as for weapon guidance and battlefield observation. The development of missiles with higher precision targeting is made possible by the rising military and defense budget. Missile-borne SAR differs from airborne SAR in several important ways, including fast flight speed and straight movement, which are needed for real-time measurement of accuracy. The adoption of airborne and spaceborne SAR systems is anticipated to be higher than that of ground-based systems in missions involving surveillance, intelligence gathering, and reconnaissance. However, the government's limited bandwidth allocation and the high development cost of SAR due to frequent customization will further challenge the synthetic aperture radar market in the forecast period mentioned above. The market for synthetic aperture radar is currently being restrained by an increase in the development cost of the technology.

Restraining Factors

A significant element restraining the growth of the worldwide market for synthetic aperture radar is the expense associated with its development. Different points throughout the synthetic aperture radar industry's value chain need large expenditures. But over the projected period, problems with debris and deorbiting in space will be a key limitation on the market for synthetic aperture radar.

Market Segmentation

- In 2022, the antenna segment is influencing the largest market share during the forecast period.

Based on the components, the global synthetic aperture radar market is segmented into receiver, transmitter, and antenna. Among these segments, the antenna segment is dominating the market with the largest revenue share during the forecast period. The antenna plays a crucial role in transmitting and receiving radar signals. It facilitates the emission of the transmitted signals and captures the reflected signals, enabling the SAR system to gather information about the target area. Antennas can come in various forms, including fixed or movable, depending on the application requirements.

- In 2022, the airborne segment is dominating the largest market growth over the forecast period.

Based on the platform, the global synthetic aperture radar market is bifurcated into different segments such as airborne (spacecraft, aircraft, and unmanned aerial vehicle (UAV) and ground. Throughout these segments, the airborne segment is dominating the market. The use of airborne synthetic aperture radars in unmanned aerial vehicles (UAVs) enables simple data collection of rapidly changing terrains like snow slopes and active volcanoes. The development of customized airborne synthetic aperture radars for unmanned aerial vehicles (UAVs) is being pursued by airborne synthetic aperture radar manufacturers.

- In 2022, the military and defense segment is leading the market with the largest market growth during the forecast period.

Based on the application, the global synthetic aperture radar market is segmented into military and defense, monitoring and exploration. Among these segments, the military and defense segment is dominating the market with the largest revenue share during the forecast period. A synthetic aperture radar is used in military applications to find surface characteristics such as apartment buildings, missile launch pads, and topographical aspects of the landscape. To plan missions for upcoming operations, it is utilized for battlefield observation, weapon guidance, and mission planning. Enhanced precise targeting for missiles is made possible by the rising military and defense budget. As opposed to airborne SAR, missile-borne SAR includes several key qualities, including a high flight speed with straight movement and a significant squint angle, both of which are required for measuring accuracy in real time. In addition, ground-based systems are anticipated to be widely used in applications such as weapons fire control (missiles or guns) and precision control, intelligence, surveillance, and reconnaissance operations, as well as air and spaceborne SAR systems.

- In 2022, the UHF/VHF segment is dominating the largest market growth over the forecast period.

Based on the frequency band, the global synthetic aperture radar market is segmented into X, L, C, S, K/Ku/Ka, and UHF/VHF. Throughout these segments, the UHF/VHF segment is dominating the market. The UHF (Ultra High Frequency) band generally refers to frequencies ranging from 300megahertz (MHz) to 3 gigahertz (GHz), while the VHF (Very High Frequency) band covers frequencies from 30 to 300 MHz. UHF and VHF bands are commonly used for various terrestrial communication systems, including radio and television broadcasting. In underwater acoustic communication, these bands are sometimes used for short-range communications.

Regional Segment Analysis of the synthetic aperture radar market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

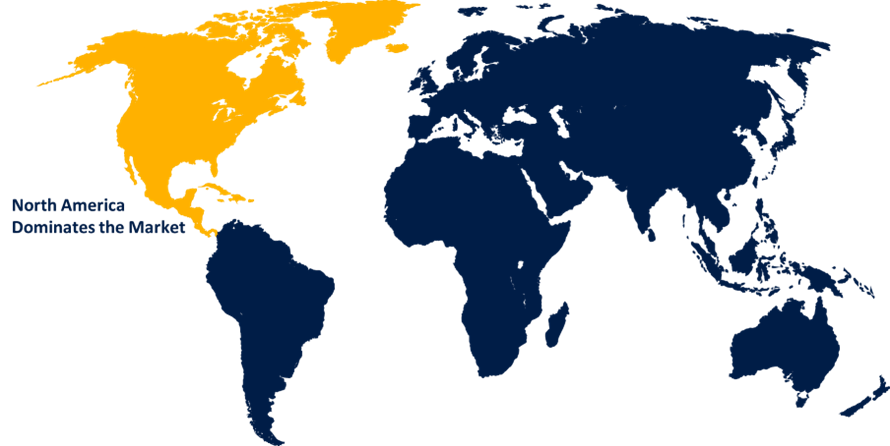

North America dominates the market with the largest market share during the forecast period

Get more details on this report -

North America influencing the largest market during the forecast period, due to enormous growth in R&D activity for space-based SAR satellites has resulted from cooperation between the US Department of Defense (DoD) and the National Aeronautics and Space Administration (NASA). The nation also contributes to more than 40% of the world's defense budget. The desire for company expansion in the region is anticipated to be fueled by these factors.

Asia-Pacific is expected the second-largest growing region during the forecast period

Asia-Pacific is expected the second largest-growing region during the forecast period. It is anticipated that expanding defense expenditures and research activities in the Asia Pacific, particularly in China, South Korea, India, and Japan, would present major development potential.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the global synthetic aperture radar market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lockheed Martin Corporation

- Airbus SE

- Aselsan A.S.

- BAE Systems Plc

- Cobham Plc (Advent)

- General Atomics Aeronautical Systems Inc.

- L3Harris Technologies

- IMSAR LLC

- Israel Aerospace Industries Ltd

- Leonardo SpA

- Maxar Technologies Ltd

- MetaSensing Group

- Northrop Grumman Corporation

- Raytheon Company

- Saab AB

- SAR AERO

- SRC Inc.

- Thales Group

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2022, the manufacturer of microsatellites ICEYE disclosed a collaboration with the European Space Agency to give Copernicus Emergency Services flood information. We'll give crucial ICEYE flood impact data that shows the flood's depth and breadth.

- In November 2022, synthetic aperture radar (SAR) satellite data and solution provider synspective and solution, consultancy, and advisory service provider Geo Climate Risk Solutions Pvt. Ltd. (GCRS), which focuses on natural hazards risk analytics and environmental and sustainability challenges, are pleased to announce a new partnership for SAR-based analysis solutions for critical infrastructure and mining industries in India and across South Asia.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the Global Synthetic Aperture Radar Market based on the below-mentioned segments:

Global Synthetic Aperture Radar Market, By Component

- By Component Receiver

- Transmitter

- Antenna

Global Synthetic Aperture Radar Market, By Platform

- Airborne

- Spacecraft

- Aircraft

- Unmanned Aerial Vehicle {UAV})

- Ground

Global Synthetic Aperture Radar Market, By Application

- Military and Defense

- Monitoring and Exploration

Global Synthetic Aperture Radar Market, By Frequency Band

- X

- L

- C

- S

- K/Ku/Ka

- UHF/VHF

Synthetic Aperture Radar Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?