Global Synbiotic Product Market Size, Share, and COVID-19 Impact Analysis, By Product (Functional Food & Beverages, Dietary Supplements, Others), By Distribution Channel (Offline, Online), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Food & BeveragesSynbiotic Product Market Size Summary

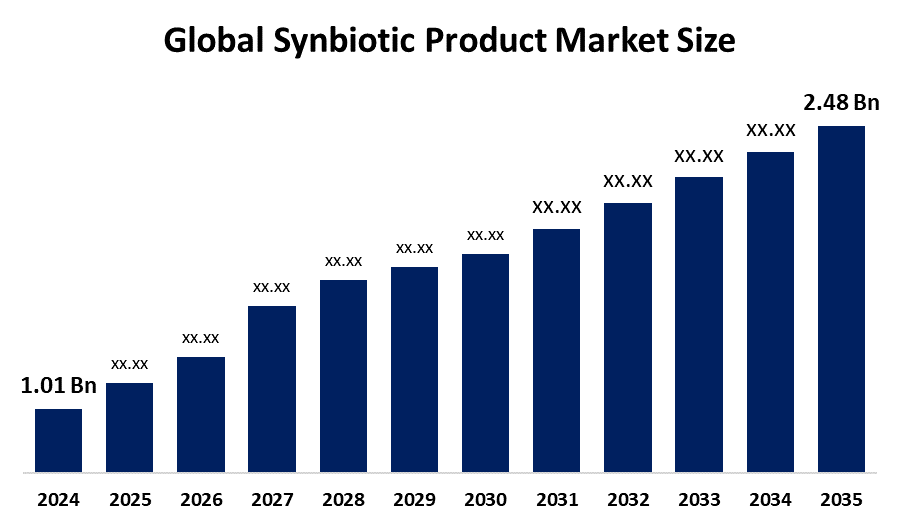

The Global Synbiotic Product Market Size Was Estimated at USD 1.01 Billion in 2024 and is Projected to Reach USD 2.48 Billion by 2035, Growing at a CAGR of 8.51% from 2025 to 2035. The increased prevalence of digestive problems, expanding consumer knowledge of gut health, growing demand for functional foods, and an increase in health-conscious lifestyles that advocate probiotics and prebiotics for general well-being are all factors driving the market expansion for synbiotic products.

Get more details on this report -

Key Regional and Segment-Wise Insights

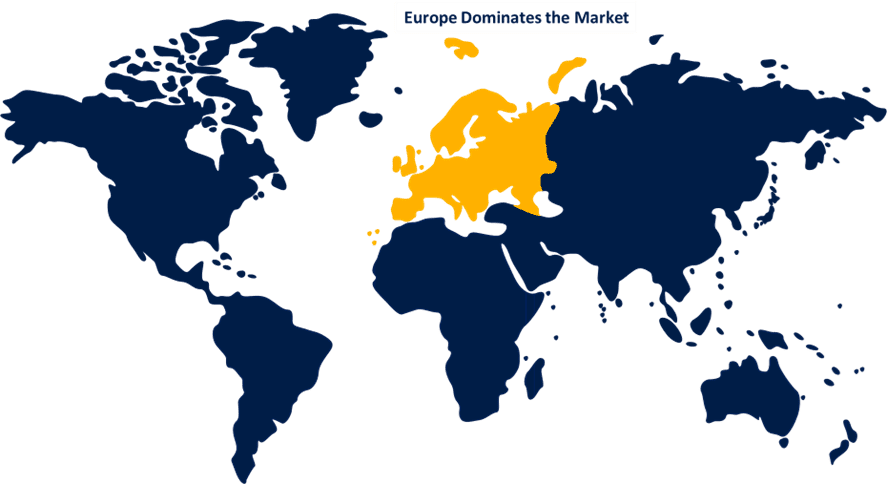

- In 2024, the European synbiotic product market held the largest revenue share of 34.5% and dominated the global market.

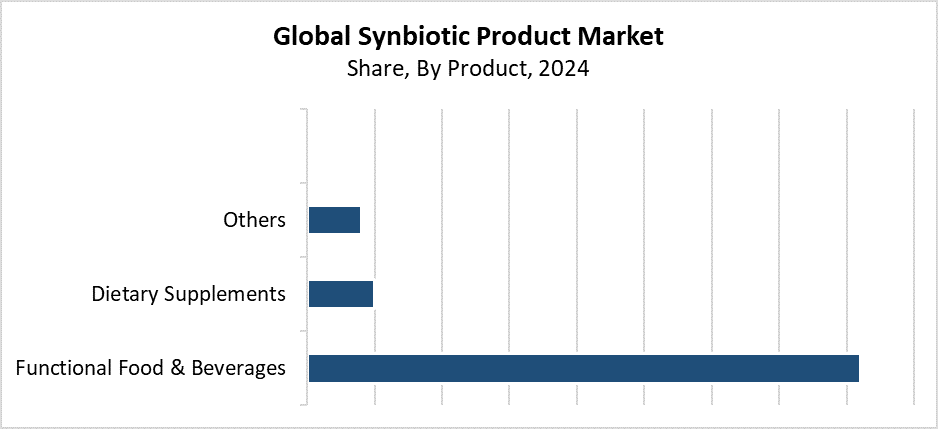

- In 2024, the functional food and beverages segment held the highest revenue share of 82.1% and dominated the global market by product.

- With the biggest revenue share in 2024, the offline segment led the worldwide market by distribution channel.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 1.01 Billion

- 2035 Projected Market Size: USD 2.48 Billion

- CAGR (2025-2035): 8.51%

- Europe: Largest market in 2024

The market for synbiotic products focuses on items which enhance gut health and overall wellness through the combination of probiotics and prebiotics. These items find increasing usage as animal feed components, and they also appear in beverages, functional foods, and dietary supplements. The market growth depends on three major factors, which include preventive healthcare solutions made from natural products and the connection between gut microbiota and the immune system. Rising consumer knowledge about digestive wellness. The market experiences growth because of the increasing number of elderly people who want to improve their health outcomes and the growing number of digestive disorders that stem from modern lifestyle choices. Urban residents who adopt better eating habits, and their demand for natural plant-based items with transparent labelling, support market growth.

The development of next-generation synbiotic products with enhanced stability, targeted delivery systems, and extended shelf life depends heavily on technological progress. Scientists have achieved commercial success with synbiotics through their development of advanced fermentation and microencapsulation techniques. The government provides backing to gut health, nutrition, and preventative care. This results in faster product development and market entry. The programs offer financial support to microbiome research initiatives while backing regulatory development for probiotics and functional foods. Public health programs which show the advantages of maintaining a healthy gut microbiome will help people understand and accept these benefits.

Product Insights

Get more details on this report -

The functional food and beverages segment led the synbiotic product market with the largest revenue share of 82.1% in 2024. The market dominance exists because customers seek fast, nutritious food options which support their immune system and digestive wellness. The market sees rising demand for products which combine flavour with health advantages through items like yoghurt, fermented beverages, breakfast cereals, and nutrition bars. The market receives additional support through plant-based and clean-label diets, which people choose for their health benefits and natural food preferences. The products exist in various retail locations, which include supermarkets, health stores, and online shopping platforms. The market dominance of synbiotics through functional foods and beverages exists because of continuous product development and marketing strategies that promote gut health.

The dietary supplements segment of the synbiotic product market is expected to grow at the fastest CAGR during the forecast period. The market growth results from consumers becoming more aware of their health and their increasing need for preventive medical solutions. People consume synbiotic supplements through capsules and pills, and powder forms to support their gut health, immune system, and total body wellness. People who lead busy lives choose supplements because they offer quick convenience, exact portion control, and long-lasting storage. The ageing population, together with increasing digestive disorders, leads to higher market demand. E-commerce platforms, together with health-focused retail channels, have expanded their reach. This results in higher product availability and sales growth. The market expansion will speed up because personalised nutrition and formulation innovation continue to develop.

Distribution Channel Insights

The offline segment held the largest market share and led the synbiotic product market during 2024. The market dominance exists because synbiotic products reach consumers through multiple channels, which include pharmacies, supermarkets, speciality food stores, and health and wellness outlets. Customers prefer to buy functional foods and health supplements through offline channels because they want to see products in person and receive face-to-face guidance, and check product authenticity. The combination of in-store promotions with brand awareness and professional advice at pharmacies helps to build customer trust. This leads to increased purchasing. The offline segment gained worldwide market leadership because of distribution networks that became established and synbiotic products, which became more accessible at major retail chains.

The online segment of the synbiotic product market is expected to grow at the fastest CAGR over the forecasted period because of increasing internet access, retail digital transformation, and changing consumer buying behaviour. People now choose to purchase health and wellness items, including functional foods and synbiotic pills, through online platforms because of the convenience they provide. E-commerce websites, together with brand-owned portals and health-focused platforms, boost sales through their extensive product selection, affordable prices, convenient home delivery, and customer feedback systems. The combination of subscription models with influencer endorsements and social media marketing strategies leads to higher customer loyalty rates and intensified customer involvement. The market shows rapid growth because consumers want personalised health solutions. Online shopping makes specialised products from around the world widely accessible.

Regional Insights

North America held a substantial market share in the global synbiotic product market during 2024 because functional foods and dietary supplements experienced high market demand, while consumers developed a better understanding of gut health. The region's established healthcare system and growing emphasis on preventive care have made synbiotic products widely available for use. The market growth has been driven by strong research and development activities, multiple leading market players, and continuous product launches. The market has grown because of two major elements. These include rising digestive disorders and customer preference for natural and clean-label products. The North American market holds the leading position in global market share because synbiotic products have expanded their distribution through supermarkets, health stores, and online marketplaces.

Europe Synbiotic Product Market Trends

Get more details on this report -

Europe led the global synbiotic products market with the largest revenue share of 34.5% in 2024. The market holds its dominant position because functional food and supplement businesses grow while people learn more about their digestive and gut health needs. The rising health awareness, along with the growing demand for plant-based, organic, and clean-label products, has made Germany, France, and the UK leading consumers of synbiotic products. The European Union enforces strict rules which protect both product safety and quality standards. This builds stronger trust among consumers. The combination of essential industry players and continuous innovation, and strong offline and online retail networks has enabled Europe to maintain its leadership position. Public health initiatives, together with microbiome research funding, play a major role in determining the success of market growth.

Asia Pacific Synbiotic Product Market Trends

The Asia Pacific synbiotic product market is expected to grow at a significant CAGR throughout the forecast period because people have more money to spend and they want functional foods and dietary supplements, while becoming more aware of their health. The demand for synbiotic products continues to grow because people in China, India, Japan, and South Korea want to improve their gut health and stop illnesses before they start. The area provides substantial market potential because it contains a large population, together with increasing urban growth and changing food consumption patterns. The government backs wellness and nutrition programs, which promote the use of probiotic and prebiotic products. It also provides straightforward medical information to the public. The Asia Pacific region experiences improved product availability and customer accessibility because e-commerce platforms now accept foreign health brands.

Key Synbiotic Product Companies:

The following are the leading companies in the synbiotic product market. These companies collectively hold the largest market share and dictate industry trends.

- Daflorn Ltd

- NUtech Ventures

- Probiotical S.p.A

- Yakult Honsha Co. Ltd

- Sabinsa

- Pfizer Inc.

- Synbiotic Health

- Danone

- United Naturals

- Asmara (NU3x)

- Others

Recent Developments

- In October 2024, Saya Suka's unique Synbiotic Water was introduced at SIAL Paris, coinciding with the increased focus on gut health and the relationship between the gut and the brain worldwide. This innovative drink blends probiotics and prebiotics to improve immune system performance, promote mental health, and improve digestion.

- In May 2024, during the Vitafoods Europe trade show in Geneva, Clasado Biosciences, a UK functional ingredients research and development company, displayed its novel functional beverage that contains probiotics and prebiotics.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the synbiotic product market based on the below-mentioned segments:

Global Synbiotic Product Market, By Product

- Functional Food & Beverages

- Dietary Supplements

- Others

Global Synbiotic Product Market, By Distribution Channel

- Offline

- Online

Global Synbiotic Product Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?