Global Straw Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Papers, Silicones, Metals, Plastics, Glass, Bamboo, and Others), By Length (<9 cms, 9-15 cms, 16 to 20 cms, and >20 cms), By Distribution Channel (Distributors, E-Retail, Manufacturers, and Retailers), By End-User (Institutional, Households, and Food Service), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Consumer GoodsGlobal Straw Market Insights Forecasts To 2033

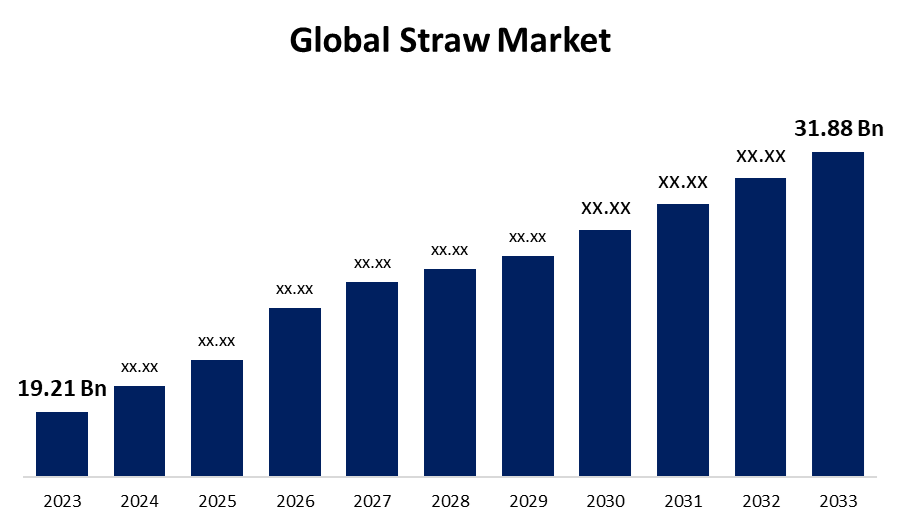

- The Global Straw Market Size was Estimated at USD 19.21 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 5.20% from 2023 to 2033

- The Worldwide Straw Market Size is Expected to Reach USD 31.88 Billion by 2033

- North America is predicted to Grow at the fastest CAGR throughout the projection period

Get more details on this report -

The Global Straw Market Size is predicted to Exceed USD 31.88 Billion by 2033, Growing at a CAGR of 5.20% from 2023 to 2033.

Market Overview

The straw market Size is a global industry producing, distributing, and selling various straws for drinking beverages, catering to diverse consumer needs and preferences. The use of drinking straws, particularly plastic ones, to suck liquid from a cup into the mouth is common throughout the world. They feature two ends: one narrower for the user's mouth and the other wider for the container. These straws are frequently used for drinks like milkshakes and sodas because they make it easier to drink without lifting the container. Straws are tubes used to suck beverages out of containers, and with the industrial age, mass production methods have been developed to mass produce straws by rolling elongated sheets of wax-coated paper into cylindrical, hollow tubes. Straws are made from a blend of plastic resin, colorants, and other additives. Polypropylene plastic is the preferred material for straw manufacturing due to its lightweight, fair abrasion resistance, good dimensional stability, and surface hardness. It has excellent chemical resistance at higher temperatures and good thermoplastic properties. Colorants can be added to the plastic to give the straws an aesthetically pleasing appearance. Additional materials are added to control the physical properties of the finished straw, such as plasticizers to prevent cracking, antioxidants to reduce harmful interactions between the plastic and oxygen in the air, ultraviolet light filters to shield the plastic from sunlight, and inert fillers to increase the bulk density of the plastic. The demand for straw in the retail and hospitality industries is rising as a result of consumers' increased spending on leisure and eating out due to higher disposable incomes. Quality and sustainability are the major priorities for consumers, are prepared to spend more for long-lasting, environmentally friendly straw choices. Plant-based substitutes and biodegradable polymers are examples of new materials that potentially satisfy this need. Businesses may take advantage of the expanding market for sustainable straws by investing in research and development for these materials, which will also help them comply with environmental regulations and improve their reputation. In cars, cafes, fast-food restaurants, lounges, and homes, straws made of paper, bamboo, stainless steel, or plastic are frequently used for drinking and moving liquids.

Report Coverage

This research report categorizes the global straw market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global straw market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global straw market.

Global Straw Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 19.21 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.20% |

| 2033 Value Projection: | USD 31.88 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product Type, By Length, By Distribution Channel, By End-User and By Region |

| Companies covered:: | Tetra Pak International SA, ConverPack Inc., Transcend Packaging, Absolute Custom Extrusions Inc., Koffie Straw, Eco-Products Inc., Stone Straw Limited, Pactiv Evergreen Inc., Klean Kanteen, Steelys Drinkware, Vegware Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors:

The market growth is driven by the consumers are increasingly concerned about the environmental impact of single-use plastics, particularly on marine ecosystems. Paper straws are seen as a sustainable alternative, as they are biodegradable and less harmful to the environment. This shift has led businesses to replace plastic straws with paper ones, aligning with consumer values and corporate social responsibility. The demand for paper straws has surged, driving market growth and encouraging eco-friendly packaging solutions. Straws provide a hygienic barrier, minimizing direct contact and contamination risk. They are individually wrapped, ensuring cleanliness throughout the supply chain. Straws also offer convenience, especially in fast-paced environments like restaurants and cafes. With growing concerns about hygiene and sanitation, the demand for straws as a hygiene solution has grown.

Restraining Factors

The straw market faces challenges environmental concerns, the cost of alternatives, consumer preferences, governmental pressure, and material supply issues, and more costly eco-friendly options like bamboo, paper, and metal are available, which may restrict the growth of the market.

Market Segmentation

The global straw market share is classified into product type, length, distribution channel, and end-user.

- The plastics segment dominated the global straw market in 2023 and is anticipated to grow at a significant CAGR throughout the forecast period.

Based on the product type, the global straw market is categorized into papers, silicones, metals, plastics, glass, bamboo, and others. Among these, the plastics segment dominated the global straw market in 2023 and is anticipated to grow at a significant CAGR throughout the forecast period. The segmental expansion is attributed to the affordability, cost-effectiveness, convenience, easy accessibility, light weight, portability, flexibility, and single use of the plastic straws reduces the risk of cross-contamination which maintains hygienic conditions.

- The 9-15 cms segment accounted for the largest market share in 2023 and is expected to grow at a significant CAGR throughout the projected timeframe.

Based on the length, the global straw market is categorized into <9 cms, 9-15 cms, 16 to 20 cms, and >20 cms. Among these, the 9-15 cms segment accounted for the largest market share in 2023 and is expected to grow at a significant CAGR throughout the projected timeframe. The straw's length, which is usually between 9 and 15 cm, is appropriate for the majority of drink containers and strikes the ideal balance between utility and convenience. It is long enough to reach the bottom of most cups without being overly huge, making it simple to handle and carry.

- The retailers segment held the largest market share in 2023 and is expected to grow at a significant CAGR throughout the projected timeframe.

Based on the distribution channel, the global straw market is categorized into distributors, e-retail, manufacturers, and retailers. Among these, the retailers segment held the largest market share in 2023 and is expected to grow at a significant CAGR throughout the projected timeframe. The sector expansion is attributed to the wide accessibility, product variety, consumer convenience, and promotional opportunities. Retailers can offer a variety of straw types, cater to urban and rural markets, and highlight eco-friendly options, aligning with sustainability trends and consumer preferences.

- The food service segment accounted for the largest market share in 2023 and is predicted to grow at a significant CAGR throughout the projected timeframe.

Based on the end-user, the global straw market is categorized into institutional, households, and food service. Among these, the food service segment accounted for the largest market share in 2023 and is predicted to grow at a significant CAGR throughout the projected timeframe. This is driven by the widespread consumption in fast-food restaurants, cafes, bars, and other establishments. As more companies switch to reusable and biodegradable straws, customization and sustainability initiatives are widespread. Eco-conscious consumers are catered to by innovations in straw materials, such as plant-based and compostable choices.

Regional Segment Analysis of the Global Straw Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

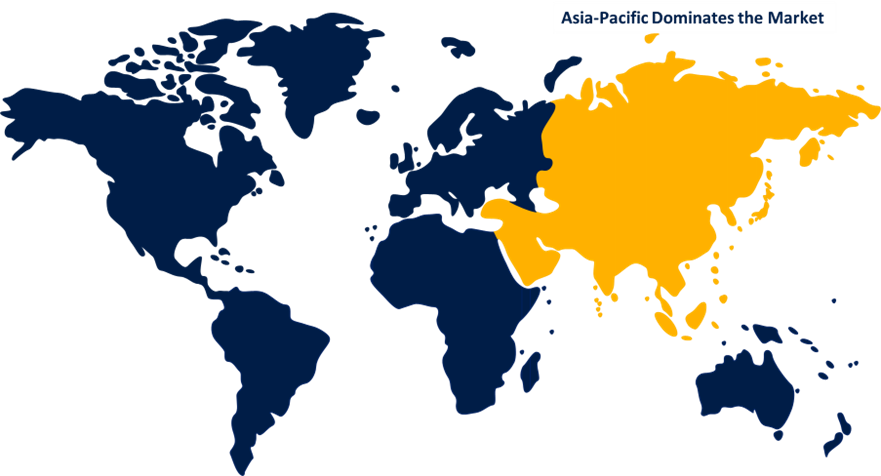

Asia Pacific is anticipated to hold the largest share of the global straw market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the global straw market over the predicted timeframe. The rise of the food service industry, urbanization, and stricter laws governing plastic waste are all contributing to the notable growth of the straw market in the Asia-Pacific region. Leading the way in the transition to reusable and biodegradable straws are nations like China, India, and Japan. Consumer preferences, regulatory support, technology developments, and an emphasis on sustainability are important trends. Companies are creating sophisticated designs with materials that are highly durable, such as silicone, glass, and bamboo. Heat-resistant silicone straws, reusable straws with storage cases, paper straws with FSC certification, and antibacterial coatings are all in high demand. Additionally, investments in plant-based product alternatives and biodegradable packaging materials are propelling regional market expansion. Additionally, the Asia-Pacific region's growing number of manufacturers of sustainable products is enhancing local production capabilities.

North America is anticipated to grow at the fastest CAGR throughout the projected timeframe. Government regulations, material innovation, the growth of food services, environmental consciousness, and business sustainability objectives are some of the drivers driving the North American straw market. Government restrictions on single-use plastics are pushing companies to utilize more environmentally friendly alternatives, while consumers are moving toward reusable and biodegradable straws. The industry is expanding owing to improvements in materials and production techniques, such as long-lasting and compostable choices. Additionally, the expansion of cafes and quick-service restaurants is increasing demand for straws. By investing in automated manufacturing options and smart product technology to enhance consumer experience, the United States and Canada are at the forefront of sustainable product material technology.

Europe is predicted to hold a significant share of the global straw market throughout the projected timeframe. The market for straw in Europe is changing quickly as a result of customer demand for sustainable alternatives and environmental laws. Straws made of silicone, paper, bamboo, metal, and glass are all available at the market. Governments are driving the use of eco-friendly straws by enforcing stringent laws against single-use plastics. The desire for reusable and biodegradable straws is being driven by growing environmental consciousness. Long-lasting, biodegradable materials are introduced by improvements in manufacturing techniques. Strong regulatory frameworks and consumer awareness have made Germany, France, and the UK market leaders.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global straw market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Tetra Pak International SA

- ConverPack Inc.

- Transcend Packaging

- Absolute Custom Extrusions Inc.

- Koffie Straw

- Eco-Products Inc.

- Stone Straw Limited

- Pactiv Evergreen Inc.

- Klean Kanteen

- Steelys Drinkware

- Vegware Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2025, TOUS les JOURS, a French-Asian bakery chain, introduced plant-based, biodegradable plastic straws in its U.S. locations. These straws are made from PHACT PHA biopolymer, developed by CJ Biomaterials, Inc., a leading manufacturer of polyhydroxyalkanoate (PHA) biopolymers. These straws offer durability and flexibility, preventing soggy beverages, making them a significant step towards sustainability.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global straw market based on the below-mentioned segments:

Global Straw Market, By Product Type

- Papers

- Silicones

- Metals

- Plastics

- Glass

- Bamboo

- Others

Global Straw Market, By Length

- <9 cms

- 9-15 cms

- 16-20 cms

- >20 cms

Global Straw Market, By Distribution Channel

- Distributors

- E-Retail

- Manufacturers

- Retailers

Global Straw Market, By End-User

- Institutional

- Households

- Food Service

Global Straw Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?