Global Sterile Bioprocess Filtration Market Size, Share, and COVID-19 Impact Analysis, By Product (Membrane Filters, Depth Filters, Cartridge Filters, Capsule Filters, Filtration Accessories, and Others), By End User (Biopharmaceutical & Biotechnology Companies, CMOs & CROs, and Academic & Research Institutes), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Sterile Bioprocess Filtration Market Size Forecasts to 2033

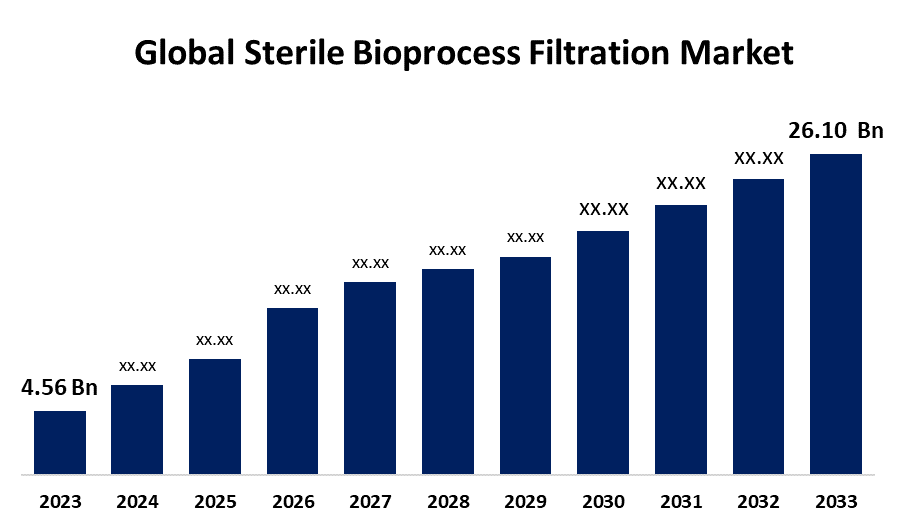

- The Global Sterile Bioprocess Filtration Market Size was estimated at USD 4.56 Billion in 2023

- The Global Sterile Bioprocess Filtration Market Size is Expected to Grow at a CAGR of around 19.06% from 2023 to 2033

- The Worldwide Sterile Bioprocess Filtration Market Size is Expected to Reach USD 26.10 Billion by 2033

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Sterile Bioprocess Filtration Market Size is expected to cross USD 26.10 Billion by 2033, Growing at a CAGR of 19.06% from 2023 to 2033. Growth in biopharmaceuticals, acceptance of single-use filtering, improvements in regulatory compliance, the rise of personalized medicine, technical breakthroughs, and higher investments in process efficiency and contamination control are all factors that offer opportunity in the sterile bioprocess filtration market.

Market Overview

The market for filtration technologies that guarantee sterility in the production of biopharmaceuticals is known as the sterile bioprocess filtration market. It includes aseptic filling systems, membrane filters, and cartridge filters that are used to eliminate impurities from cell treatments, biologics, and vaccines. Increased demand for biopharmaceuticals, stricter regulations, and improvements in filtering technology are the main drivers of growth. Ensuring contamination control, product safety, and process efficiency in the production of biopharmaceuticals is the primary focus of the sterile bioprocess filtration market. For Instance, in January 2023, Sartorius AG and U.S.-based RoosterBio Inc. inked a collaboration to supply purification solutions and set up comprehensive downstream production procedures for exosome-based treatments. Sartorius AG would supply a range of exosome filtration products as part of the partnership. The need for high-performance filtering systems is also driven by the focus on contaminant control, product safety, and process efficiency. Technology advancements, R&D expenditures, and the growing focus on individualized treatment all support sterile bioprocess filtration market expansion. The sterile bioprocess filtration market is driven by factors such as process efficiency, single-use technologies, regulatory compliance, growing demand for biologics, and technical advances.

Report Coverage

This research report categorizes the sterile bioprocess filtration market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the sterile bioprocess filtration market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the sterile bioprocess filtration market.

Global Sterile Bioprocess Filtration Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.56 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 19.06% |

| 2033 Value Projection: | USD 26.10 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 111 |

| Segments covered: | By Product, By End User, By Region and COVID-19 Impact Analysis |

| Companies covered:: | 3M Purification, Sartorius AG, Merck KGaA, Medela, Danaher, Cellab, Repligen Corporation, DrM, Dr. Muller AG, Thermo Fisher Scientific Inc., Meissner Filtration Products Incorporation, and Others key Vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

Growing demand for biopharmaceuticals, stricter regulations, and improvements in filtering technology are the main factors driving the sterile bioprocess filtration market. The growth of biologics manufacturing and the usage of single-use filtering devices both contribute to the market growth. The need for sterile bioprocess filtration is being driven by the growth of biologics manufacturing as biopharmaceutical firms invest in state-of-the-art production facilities to fulfil the increasing demand for recombinant proteins, cell and gene treatments, and monoclonal antibodies. Increased production of biologics and the usage of single-use filtering technologies accelerate industry growth.

Restraining Factors

High operating costs, complicated regulatory compliance, scarce raw material supply, technological limitations, scaling problems, and strict validation criteria are some of the obstacles facing the sterile bioprocess filtration market, which can restrict the adoption rates in the sterile bioprocess filtration market.

Market Segmentation

The sterile bioprocess filtration market share is classified into product and end user.

- The membrane filters segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the product, the sterile bioprocess filtration market is divided into membrane filters, depth filters, cartridge filters, capsule filters, filtration accessories, and others. Among these, the membrane filters segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. The primary driver of the membrane filters is the growing need for sterile filtering in the manufacture of biopharmaceuticals, namely in the fabrication of vaccines, monoclonal antibodies, and cell culture applications.

- The biopharmaceutical & biotechnology companies segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the end user, the sterile bioprocess filtration market is divided into biopharmaceutical & biotechnology companies, CMOs & CROs, and academic & research institutes. Among these, the biopharmaceutical & biotechnology companies segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. The widespread use of solvents in the synthesis, purification, and formulation of drugs is the reason for the pharmaceutical segment. The growing need for biologics, vaccines, and improved treatments is a factor in the growth of biopharmaceutical and biotechnology businesses. High-performance filtering technology adoption has been fueled by increased R&D expenditures as well as strict regulatory requirements for sterility assurance.

Regional Segment Analysis of the Sterile Bioprocess Filtration Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the sterile bioprocess filtration market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the sterile bioprocess filtration market over the predicted timeframe. North America's superior healthcare infrastructure, robust regulatory frameworks, and top biopharmaceutical producers are its main drivers. The FDA's stringent sterility regulations and the rising demand for single-use filtration systems also contribute to the market growth. High R&D expenditures, quick adoption of cutting-edge filtering technology, and rising biologics manufacturing all help the area. North America's leadership in the worldwide sterile bioprocess filtration market is cemented by major companies' ongoing investments in capacity expansions and technical developments.

Asia Pacific is expected to grow at the fastest CAGR growth of the sterile bioprocess filtration market during the forecast period. Growing biopharmaceutical output, more R&D spending, and developing healthcare infrastructure are the main drivers of the Asia Pacific region. Asia Pacific is also positioned as a critical market for innovations in sterile filtration and bioprocessing due to lower production costs and growing demand for biologics and biosimilars. The usage of single-use filtering technologies, the existence of new biotech companies, and growing government funding all contribute to the market's rapid growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the sterile bioprocess filtration market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 3M Purification

- Sartorius AG

- Merck KGaA

- Medela

- Danaher

- Cellab

- Repligen Corporation

- DrM, Dr. Muller AG

- Thermo Fisher Scientific Inc.

- Meissner Filtration Products Incorporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2025, the desktop portfolio of four bioprocessing Process Analytical Technology (PAT) devices from 908 Devices was purchased by Repligen Corporation. In the meanwhile, 908 Devices is concentrating on growing its line of portable devices for vital safety and health applications.

- In February 2025, solventum's purification and filtration business was signed by Thermo Fisher Scientific Inc. for about USD 4.1 billion. By enhancing its current tools and services for biopharmaceutical businesses, this strategic initiative seeks to increase Thermo Fisher's capabilities in the filtration section of bioprocessing.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the sterile bioprocess filtration market based on the below-mentioned segments:

Global Sterile Bioprocess Filtration Market, By Product

- Membrane Filters

- Depth Filters

- Cartridge Filters

- Capsule Filters

- Filtration Accessories

- Others

Global Sterile Bioprocess Filtration Market By End User

- Biopharmaceutical & Biotechnology Companies

- CMOs & CROs

- Academic & Research Institutes

Global Sterile Bioprocess Filtration Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?