Global Steel Wire Rod Market Size, Share, and COVID-19 Impact Analysis, By Type (Carbon Steel Wire Rod, Alloy Steel Wire Rod, and Stainless Steel Wire Rod), By Application (Construction, Automotive, Industrial, Agriculture, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Steel Wire Rod Market Insights Forecasts to 2035

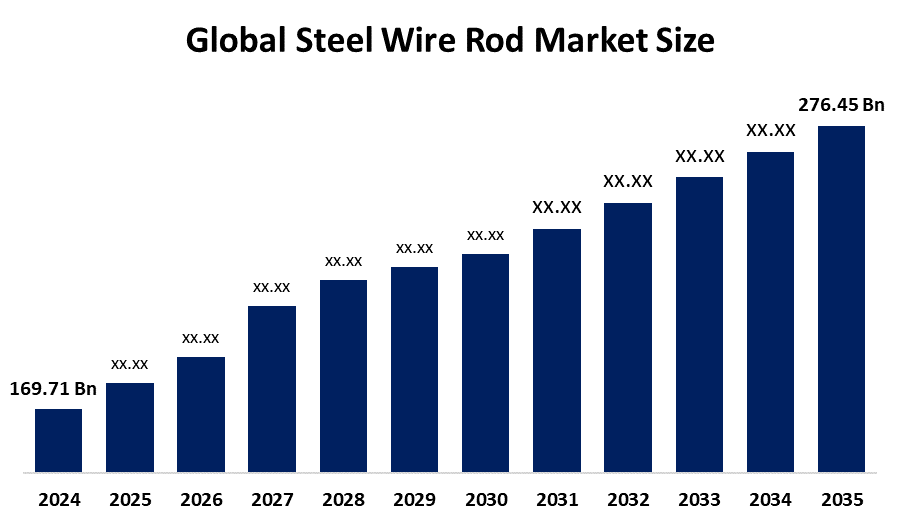

- The Global Steel Wire Rod Market Size Was Estimated at USD 169.71 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.54% from 2025 to 2035

- The Worldwide Steel Wire Rod Market Size is Expected to Reach USD 276.45 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global steel wire rod market size was worth around USD 169.71 billion in 2024 and is predicted to grow to around USD 276.45 billion by 2035 with a compound annual growth rate (CAGR) of 4.54% from 2025 to 2035. The steel wire rod market is expanding due to elevated construction activities, improved demand from the manufacturing and automotive industries, infrastructure building, and spreading industrialization. Besides, technological improvements in manufacturing and urbanization also augment market growth on a worldwide scale.

Market Overview

The Steel Wire rod Market Size refers to the manufacturing and supplying of steel wire rods, which are steel products half-finished and usually rolled into coils or wire coils. They are the raw material used in making various wire products such as nails, screws, wire mesh, springs, and components for cars. Steel wire rods have widespread uses in construction, automotive, manufacturing, infrastructure, and energy industries due to their high strength, durability, and flexibility. Market growth is mainly induced by high urbanization, construction activities, and rising demand from the automotive sector for lightweight, high-strength components. Rising industrialization in emerging markets also stimulates demand for steel wire rods, which drives overall market growth. Technological innovation in production processes, including advanced rolling processes and advanced alloy grades, has enhanced product quality and performance to meet varying industrial needs.

Growth opportunities are plentiful in emerging markets, notably in the Asia Pacific, with their burgeoning infrastructural growth and automobile manufacturing. In addition, growing emphasis on sustainable production practices and recycled steel use opens fresh opportunities for market growth. The adoption of digital technologies in manufacturing and supply chain management is likely to enhance production efficiency and lower costs, further enhancing market competitiveness. Leading market participants such as ArcelorMittal, Nippon Steel, Tata Steel, and POSCO are making capacity additions and technological upgrades to address growing demand. Strategic partnerships and mergers benefit the market, boosting product offerings and geographic presence. India's Domestically Manufactured Iron and Steel Products Policy 2025, which took effect on April 1, requires government agencies to give preference to locally produced steel. To shield the local industry from cheap imports, India also slapped a 12% interim safeguard duty on specific steel imports, favoring local producers with increasing import surges.

Report Coverage

This research report categorizes the steel wire rod market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the steel wire rod market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the steel wire rod market.

Global Steel Wire Rod Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 169.71 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.54% |

| 2035 Value Projection: | USD 276.45 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | ArcelorMittal, POSCO, HBIS Group, Gerdau, JFE Steel Corporation, Bekaert SA, EVRAZ, China Baowu Group, Emirates Steel, Tata Steel, Nippon Steel Corporation, Kobe Steel, Ltd., Ansteel Group Corporation, And Other Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The steel wire rod market is propelled by improving demand from primary industries like construction, automotive, and manufacturing, driven by swift urbanization and the building of infrastructure on a global scale. Increased industrialization in new markets also increases consumption further. Improvements in steel production technology improve product quality and economies of scale, favoring market growth. The growing application of steel wire rods in renewable energy and electrical uses also adds to growth. Government policies encouraging infrastructure activities and protectionist policies safeguarding home industries are also important factors. The move towards light, high-strength materials in car manufacturing is a critical driving force, guaranteeing steady demand for steel wire rods worldwide.

Restraining Factors

The steel wire rod market is constrained by volatile raw material prices, particularly iron ore and coal, whose rises in price jack up the cost of production. Carbon emission caps and environmental rules introduce compliance challenges. Moreover, competition from substituting materials such as aluminum and composites, financial uncertainty, and trade tensions inhibit growth and investment in the sector.

Market Segmentation

The steel wire rod market share is classified into type and application.

- The carbon steel wire rod segment dominated the market in 2024, approximately 60% and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the steel wire rod market is divided into carbon steel wire rod, alloy steel wire rod, and stainless steel wire rod. Among these, the carbon steel wire rod segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Carbon steel wire rods are extensively utilized for their affordability and applicability in construction and manufacturing industries with high tensile strength requirements. Demand for them is steady, thanks to global infrastructure growth and industrial development. As public and private construction projects continue to attract investment, carbon steel wire rods will continue to have a commanding share in the steel wire rod market.

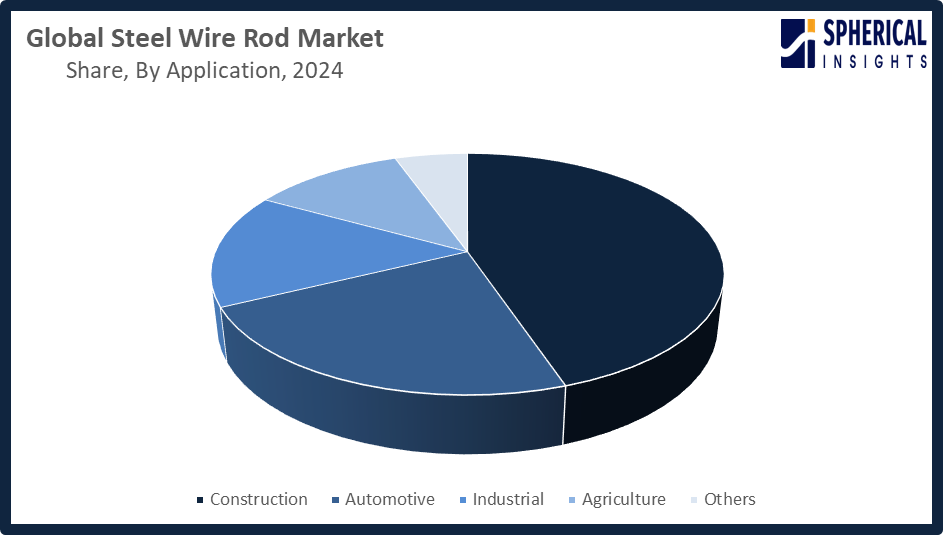

- The construction segment accounted for the largest share in 2024, approximately 45% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the steel wire rod market is divided into construction, automotive, industrial, agriculture, and others. Among these, the construction segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The construction industry is the largest consumer of steel wire rods, using them to rebar concrete, produce tools, and fabricate structural elements. Increasing worldwide infrastructure projects, coupled with expanding demand for skyscrapers and intelligent cities, are primary drivers for the rising application of steel wire rods in the construction industry, underpinning long-term market expansion in the next few years.

Get more details on this report -

Regional Segment Analysis of the Steel Wire Rod Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the steel wire rod market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the steel wire rod market over the predicted timeframe. Asia Pacific is expected to contribute the largest market share in the steel wire rod market owing to high industrialization, urbanization, and widespread infrastructure development in the region. China, India, and Japan are major contributors. China, the world's largest producer of steel, leads the demand through tremendous construction and manufacturing activities. India is developing its infrastructure with smart cities, highways, and housing schemes, increasing steel demand. Japan, which is famous for high-tech car production, needs high-quality steel wire rods. Government investments, increased automobile production, and increasing energy demand further fuel regional market growth.

North America is expected to grow at a rapid CAGR in the steel wire rod market during the forecast period. North America is rapidly growing in the steel wire rod market due to robust industrial growth, investment in infrastructure, and increasing demand from the automobile and construction industries. The United States is at the forefront of this growth, with higher expenditures on transportation, energy, and intelligent infrastructure initiatives. Advancements in manufacturing technologies create further demand along with a trend towards lightweight, high-strength materials in the auto sector. Supportive government policies and efforts to redevelop infrastructure also drive the region's market growth.

Europe's steel wire rod market expansion is supported by the modernization of infrastructure, automotive production, and green power initiatives. Germany takes the lead with robust industrial output and an emphasis on sustainable building. The region's drive toward electric cars and intelligent infrastructure boosts the demand for quality steel wire rods. Stringent environmental laws propel development toward long-lasting, environmentally friendly materials. Government programs promoting green technologies and infrastructure improvement again fuel market growth across Europe.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Steel Wire Rod market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ArcelorMittal

- POSCO

- HBIS Group

- Gerdau

- JFE Steel Corporation

- Bekaert SA

- EVRAZ

- China Baowu Group

- Emirates Steel

- Tata Steel

- Nippon Steel Corporation

- Kobe Steel, Ltd.

- Ansteel Group Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2025, Ansteel Group announced its first export of a large-scale stainless steel hot-rolling production line to Europe for the Eurasian Cooperation Project. Built by its subsidiary, the 7,000-ton, 350-meter-long line includes mills, downcoilers, and inspection systems, marking a major international engineering milestone.

- In February 2025, Bekaert announced the sale of its Steel Wire Solutions businesses in Costa Rica, Ecuador, and Venezuela to Grupo AG. This move aligns with Bekaert’s strategy to reduce exposure to volatile markets and focus on higher-growth, higher-margin opportunities.

- In November 2024, Posco Group shut down a steel wire rod mill in Pohang due to rising competition from Chinese producers. Steel wire rods are essential for automotive parts and construction, including suspension systems, engines, seats, and structural components.

- In May 2024, JFE Steel Corporation launched its new solutions-business brand, JFE Resolus, aimed at delivering advanced solutions beyond the steel industry. Leveraging decades of expertise in manufacturing and operational technologies, the brand targets a broad customer base with innovative, technology-driven offerings and services.

- In April 2024, Wire and Tube Fair, ArcelorMittal showcased innovations, including XCarb recycled steel made with high scrap content and 100% renewable electricity. Highlights included a new low-emission Free Cutting Steel and an advanced ultrasound control line in Dortmund, enhancing defect-free, customer-specific steel rod and wire production.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the steel wire rod market based on the below-mentioned segments:

Global Steel Wire Rod Market, By Type

- Carbon Steel Wire Rod

- Alloy Steel Wire Rod

- Stainless Steel Wire Rod

Global Steel Wire Rod Market, By Application

- Construction

- Automotive

- Industrial

- Agriculture

- Others

Global Steel Wire Rod Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?