Global Sperm Bank Market Size, Share, and COVID-19 Impact Analysis, By Donor Type (Known Donor and Anonymous Donor), By Service (Sperm Storage, Semen Analysis, and Genetic Consultation), By Fertilization Techniques (Donor Insemination and In Vitro Fertilization), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032.

Industry: HealthcareGlobal Sperm Bank Market Insights Forecasts to 2032

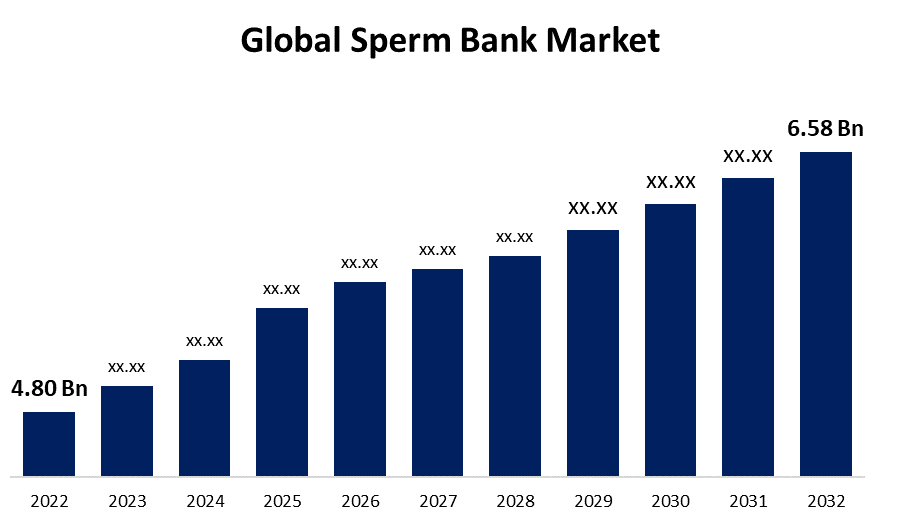

- The Global Sperm Bank Market Size was valued at USD 4.80 Billion in 2022.

- The Market Size is Growing at a CAGR of 3.2% from 2022 to 2032

- The Worldwide Sperm Bank Market Size is expected to reach USD 6.58 Billion by 2032

- Asia-Pacific is expected To Grow significant during the forecast period

Get more details on this report -

The Global Sperm Bank Market Size is expected to reach USD 6.58 Billion by 2032, at a CAGR of 3.2% during the forecast period 2022 to 2032.

Market Overview

A sperm bank, also known as a cryobank, is a specialized facility that collects, freezes, stores, and distributes sperm samples for use in assisted reproductive technologies. It serves as a vital resource for individuals and couples who wish to conceive but face fertility challenges, same-sex couples, and single individuals who desire to have a child. Donors undergo a thorough screening process, including medical and genetic tests, to ensure the quality and viability of the sperm. Once collected, the sperm samples are cryopreserved and stored in liquid nitrogen at extremely low temperatures, maintaining their viability for an extended period. Sperm banks offer a range of services, including the selection of donors based on physical characteristics, medical history, and personal preferences. The stored sperm can be used in various fertility treatments, such as intrauterine insemination (IUI) and in vitro fertilization (IVF), enabling individuals and couples to achieve their dreams of parenthood.

Report Coverage

This research report categorizes the market for sperm bank market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the sperm bank market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the sperm bank market.

Global Sperm Bank Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 4.80 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 3.2% |

| 2032 Value Projection: | USD 6.58 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Donor Type, By Service, By Fertilization Techniques, By Region. |

| Companies covered:: | Cryos International, New England Cryogenic Center, European Sperm Bank, Fairfax Cryobank, Inc., The London Sperm Bank, Indian Spermtech, ReproTech LLC, Xytex Corporation, Cryobank America LLC, and The Sperm Bank of California |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The sperm bank market is driven by several key factors, because the increasing prevalence of infertility and the growing acceptance of assisted reproductive technologies (ART) are significant drivers. As more couples and individuals face difficulties conceiving naturally, they turn to sperm banks for viable solutions. The changing societal norms and a shift toward inclusive family-building options, including same-sex couples and single individuals seeking parenthood, contribute to the market growth. Additionally, advancements in reproductive technologies and improved success rates of procedures like in vitro fertilization (IVF) have increased the demand for quality sperm samples. Moreover, the expanding global population, rising awareness about fertility treatments, and the growing availability of sperm banks worldwide are fueling market growth. Overall, supportive government policies, insurance coverage for fertility treatments, and the advent of online sperm banks have further propelled the market by increasing accessibility and convenience for consumers.

Restraining Factors

The sperm bank market also faces certain restraints. One major challenge is the stringent regulatory framework governing the operation of sperm banks, including guidelines for donor screening and testing. Compliance with these regulations can be time-consuming and costly. Additionally, ethical concerns surrounding the use of donor sperm and the potential for legal issues related to donor anonymity and rights pose challenges. Another limitation is the high cost associated with fertility treatments and the limited insurance coverage, making it unaffordable for some individuals or couples. Moreover, social stigmas and cultural barriers in certain regions may hinder the acceptance and utilization of sperm bank services, limiting market growth.

Market Segmentation

- In 2022, the known donor segment accounted for around 54.8% market share

On the basis of the donor type, the global sperm bank market is segmented into known donor and anonymous donor. The known donor segment has emerged as the largest market share holder in the sperm bank market. This can be attributed to several factors driving its popularity, because known donors offer a unique advantage of allowing individuals or couples to have more information and control over the selection process. This includes having access to detailed medical and genetic history, physical characteristics, and sometimes even personal interactions with the donor. The transparency and familiarity provided by known donors can in still greater confidence and peace of mind in the recipients. The increasing emphasis on creating a connection between the child and the donor has contributed to the growth of the known donor segment. Many individuals and couples prioritize the ability for future contact or potential relationships between the child and the donor. Additionally, the availability of various platforms and services that facilitate known donor arrangements, such as online directories or agencies specializing in connecting donors and recipients, have further fueled the growth of this segment. These platforms provide a convenient and streamlined process for matching recipients with known donors, expanding the market reach and accessibility. Moreover, cultural and personal preferences also play a role in the preference for known donors. Some individuals or couples may prioritize maintaining cultural or familial similarities with the donor, which can be better achieved through known donor arrangements. Overall, the known donor segment's largest market share reflects the growing demand for personalized and transparent options in the sperm bank market, driven by factors such as control, connection, and cultural preferences.

- In 2022, the donor insemination segment dominated with more than 72.4% market share

Based on the fertilization techniques, the global sperm bank market is segmented into donor insemination and in vitro fertilization. The donor insemination segment has emerged as a significant market share holder in the sperm bank market. The donor insemination is a widely recognized and established assisted reproductive technique. It involves the direct transfer of donor sperm into the reproductive tract of the recipient, typically through intrauterine insemination (IUI). This procedure has been used successfully for many years, making it a trusted and preferred option for individuals and couples seeking fertility assistance. Donor insemination offers a less invasive and more affordable alternative to more complex procedures like in vitro fertilization (IVF). It can be an effective solution for individuals or couples facing mild to moderate fertility challenges, without the need for extensive medical interventions. Additionally, donor insemination provides greater accessibility to parenthood for various groups, including single individuals, same-sex couples, and heterosexual couples facing male factor infertility. It offers the opportunity to conceive and experience pregnancy, fulfilling the desire for biological parenthood. Moreover, the increasing societal acceptance and legal recognition of donor insemination have contributed to its market dominance. Many countries and regions have established regulations and guidelines to ensure the safety, quality, and ethical aspects of donor insemination procedures, further enhancing its credibility and acceptance. Furthermore, advancements in reproductive technologies, such as sperm freezing and improved screening methods for donors, have enhanced the success rates of donor insemination, making it an attractive option for fertility treatments.

Overall, the donor insemination segment's major market share reflects its established position, accessibility, affordability, and proven success in helping individuals and couples achieve their dreams of parenthood.

Regional Segment Analysis of the Sperm Bank Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

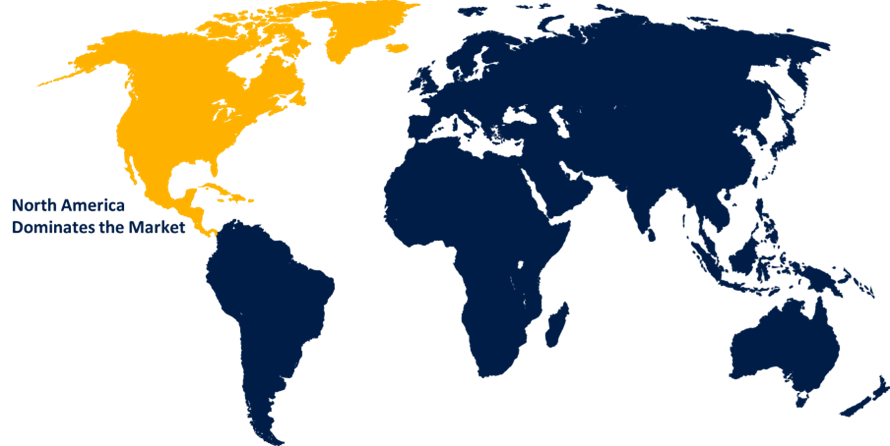

North America dominated the market with more than 35.6% revenue share in 2022.

Get more details on this report -

Based on region, North America's dominance in the sperm bank market can be attributed to the boast in advanced healthcare infrastructure and sophisticated reproductive technologies, which have facilitated the establishment of numerous well-equipped and reputable sperm banks. The high prevalence of infertility cases in North America has led to an increased demand for assisted reproductive services, driving the growth of the sperm bank industry. Additionally, the region's progressive social attitudes and legal frameworks have fostered a more accepting environment for individuals and couples seeking fertility treatments, including those using donor sperm. Furthermore, the presence of favorable government policies, insurance coverage for certain fertility treatments, and higher disposable incomes contribute to the region's ability to afford and access sperm bank services, solidifying North America's position as the largest market for sperm banks.

Recent Developments

- In March 2022, Ro, a direct-to-patient healthcare firm, has acquired Dadi, a fertility startup that specialises in sperm testing, analysis, and storage. Ro Sperm Kit, an improved and renamed solution powered by Dadi's proprietary collection, testing, and storage kit, was released as part of the purchase.

- In June 2022, Perwyn, a private equity firm, has announced the acquisition of European Sperm Bank from Axcel. As Perwyn strives to increase its presence in the European market, this deal constitutes a significant step in the fertility business. Perwyn's faith in European Sperm Bank's development potential, as well as its commitment to supporting and extending its activities in the field of assisted reproductive technologies, is reflected in the acquisition.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global sperm bank market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Cryos International

- New England Cryogenic Center

- European Sperm Bank

- Fairfax Cryobank, Inc.

- The London Sperm Bank

- Indian Spermtech

- ReproTech LLC

- Xytex Corporation

- Cryobank America LLC

- The Sperm Bank of California

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the global sperm bank market based on the below-mentioned segments:

Sperm Bank Market, By Donor Type

- Known Donor

- Anonymous Donor

Sperm Bank Market, By Service

- Sperm Storage

- Semen Analysis

- Genetic Consultation

Sperm Bank Market, By Fertilization Techniques

- Donor Insemination

- In Vitro Fertilization

Sperm Bank Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?