Spain Orthopedic Devices Market Size, Share, and COVID-19 Impact Analysis, By Product (Joint Replacement/Orthopedic Implants, Trauma, Sports Medicine, Orthobiologics, and Others), By End-use (Hospitals and Outpatient Facilities), and Spain Orthopedic Devices Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareSpain Orthopedic Devices Market Insights Forecasts to 2033

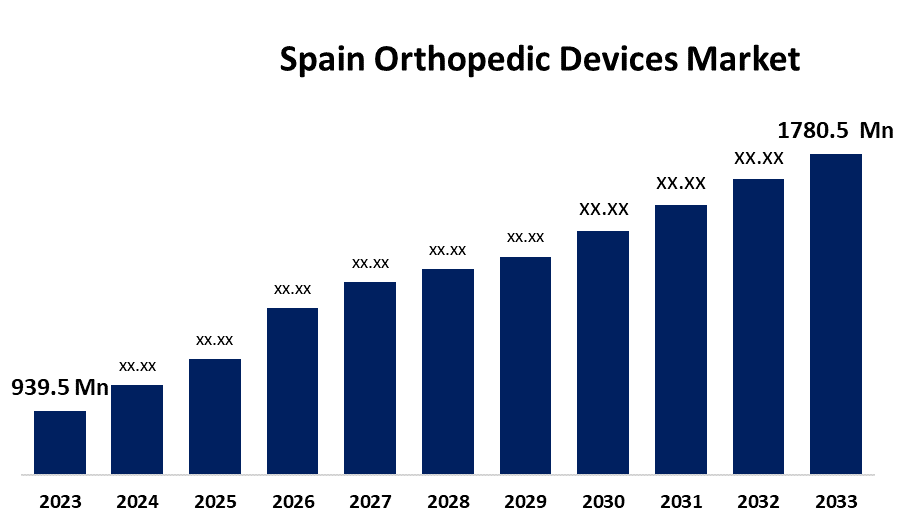

- The Spain Orthopedic Devices Market Size was valued at USD 939.5 Million in 2023.

- The Spain Orthopedic Devices Market Size is Growing at a CAGR of 6.60% from 2023 to 2033

- The Spain Orthopedic Devices Market Size is expected to reach USD 1780.5 Million by 2033

Get more details on this report -

The Spain Orthopedic Devices Market is anticipated to exceed USD 1780.5 Million by 2033, Growing at a CAGR of 6.60% from 2023 to 2033. The Growing aging population, sports participation & related injuries, technological advancements, and government initiatives promoting healthcare accessibility are driving the growth of the orthopedic devices market in the Spain.

Market Overview

The orthopedic devices market refers to the industry of medical equipment and accessories used for treating and managing musculoskeletal disorders. Orthopedic devices are medical tools and implants designed for treating or managing musculoskeletal issues, like fractures, dislocations, and joint replacements caused due to trauma, congenital conditions, and degenerative disease. They support or replace muscles, cartilage, joints, or bones, as well as the rehabilitation process post-surgery. Prevalence of musculoskeletal disorders, technological advancements, and an aging population are several factors that drive the orthopaedic devices market expansion. Furthermore, the new product launches and demand for orthopaedic implants with the increased accessibility in healthcare in emerging economies are promoting the market growth. The shift towards outpatient care and advancement in robotic-assisted orthopaedic surgeries, with the increasing number of hospitals, is creating growth opportunities for the orthopedic devices market.

Report Coverage

This research report categorizes the market for the Spain orthopedic devices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Spain orthopedic devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Spain orthopedic devices market.

Spain Orthopedic Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 939.5 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.60% |

| 2033 Value Projection: | USD 1780.5 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 127 |

| Segments covered: | By Product, By End-use and COVID-19 Impact Analysis |

| Companies covered:: | Smith and Nephew, Johnson and Johnson, DePuy Synthes, Orthofix, Conmed, Stryker, Zimmer Biomet, B. Braun Melsungen, and Others Key Vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The increasing cases of age-related orthopaedic conditions, such as osteoporosis and osteoarthritis, driving demand for devices and implants for treating these conditions leads to drive the market demand. The increasing rate of participation in sports, including cycling, tennis, handball, rugby, and other water sports, is contributing to driving the market demand as orthopaedic devices play a crucial role in managing sports injuries, offering support, protection, and facilitating recovery. Advancements, including 3D printed implants and wearable technology, which revolutionize sports injury treatment and prevention, significantly promote the market growth. Further, the government's promotion of the accessibility of orthopaedic devices through its comprehensive public healthcare system is responsible for driving the orthopedic devices market.

Restraining Factors

The dearth of skilled orthopaedic surgeons and increased cost of orthopaedic surgical treatments are restraining the orthopaedic devices market.

Market Segmentation

The Spain orthopedic devices market share is classified into product and end-use.

- The joint replacement/orthopedic implants segment dominated the market with the largest revenue share in 2023 and is anticipated to grow at a significant CAGR during the projected period.

The Spain orthopedic devices market is segmented by product into joint replacement/orthopedic implants, trauma, sports medicine, orthobiologics, and others. Among these, the joint replacement/orthopedic implants segment dominated the market with the largest revenue share in 2023 and is anticipated to grow at a significant CAGR during the projected period. Orthopedic implants are medical devices designed to replace or support damaged bones, joints, or cartilage, restoring function to a damaged joint. The growing adoption of robotic-assisted joint replacement surgeries is driving the market growth in the joint replacement/orthopaedic implants segment.

- The hospitals segment dominated the market with the largest revenue share in 2023 and is anticipated to grow at a significant CAGR during the projected period.

The Spain orthopedic devices market is segmented by end-use into hospitals and outpatient facilities. Among these, the hospitals segment dominated the market with the largest revenue share in 2023 and is anticipated to grow at a significant CAGR during the projected period. Orthopaedic devices are used for the diagnosis, treatment, and rehabilitation of musculoskeletal conditions in hospitals. The presence of significant infrastructure and availability of various treatment solutions, along with the growing number of hospital admissions significantly driving the market in the hospitals segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Spain orthopedic devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Smith and Nephew

- Johnson and Johnson

- DePuy Synthes

- Orthofix

- Conmed

- Stryker

- Zimmer Biomet

- B. Braun Melsungen

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Spain, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Spain orthopedic devices market based on the below-mentioned segments:

Spain Orthopedic Devices Market, By Product

- Joint Replacement/Orthopedic Implants

- Trauma

- Sports Medicine

- Orthobiologics

- Others

Spain Orthopedic Devices Market, By End-use

- Hospitals

- Outpatient Facilities

Need help to buy this report?