Spain Medical Devices Market Size, Share, and COVID-19 Impact Analysis, By Type (Orthopedic Devices, Cardiovascular Devices, Diagnostic Imaging Devices, In-vitro Diagnostics (IVD), Minimally Invasive Surgery Devices, Wound Management, Diabetes Care Devices, Ophthalmic Devices, Dental Devices, Nephrology Devices, General Surgery, and Others), By End-User (Hospitals & ASCs, Clinics, and Others), and Spain Medical Devices Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareSpain Medical Devices Market Insights Forecasts to 2033

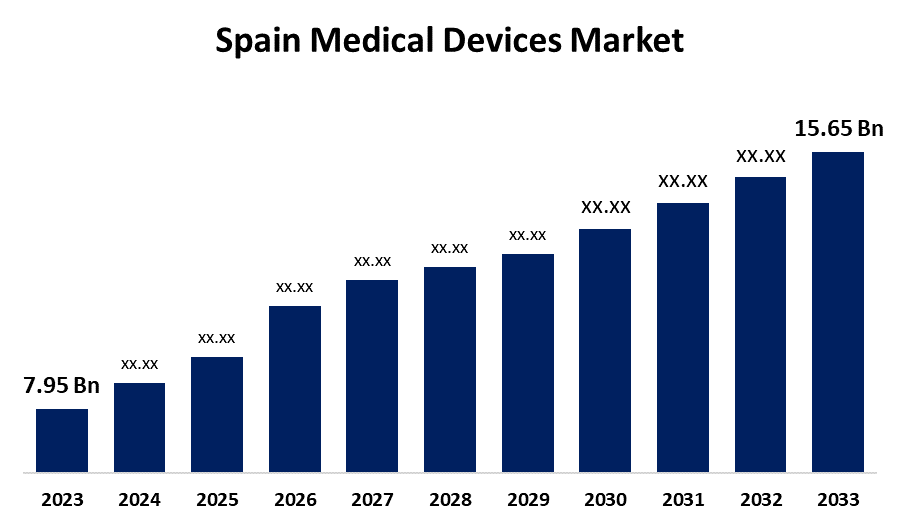

- The Spain Medical Devices Market Size was valued at USD 7.95 Billion in 2023.

- The Spain Medical Devices Market Size is growing at a CAGR of 7.01% from 2023 to 2033

- The Spain Medical Devices Market Size is expected to reach USD 15.65 Billion by 2033

Get more details on this report -

The Spain Medical Devices Market Size is anticipated to exceed USD 15.65 Billion by 2033, growing at a CAGR of 7.01% from 2023 to 2033. The growing aging population, technological advancements in medical devices, increased healthcare expenditure, and prevalence of chronic diseases are driving the growth of the medical devices market in the Spain.

Market Overview

The medical devices market is the industry of instruments and machines used in the prevention, diagnosis, and treatment of diseases. Medical devices are any instrument, apparatus, implement, machine, appliance, reagent for in vitro use, software, material, or other similar or related article, intended for medical purposes, used by individuals or healthcare professionals. Patients suffering from acute and chronic diseases, coupled with awareness about treatment options, are significantly contributing to driving the medical devices market demand. Further, the number of surgical procedures as well as inpatient admissions also contributes to propelling the market growth. There is an upsurging trend towards wearable devices in the medical devices market. Investments in R&D activities for the development and introduction of advanced products are creating lucrative market opportunities for medical devices.

Report Coverage

This research report categorizes the market for the Spain medical devices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Spain medical devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Spain medical devices market.

Spain Medical Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 7.95 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.01% |

| 2033 Value Projection: | USD 15.65 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type (Orthopedic Devices, Cardiovascular Devices, Diagnostic Imaging Devices, In-vitro Diagnostics (IVD), Minimally Invasive Surgery Devices, Wound Management, Diabetes Care Devices, Ophthalmic Devices, Dental Devices, Nephrology Devices, General Surgery, and Others), By End-User (Hospitals & ASCs, Clinics, and Others) |

| Companies covered:: | Medtronic, Bayer, Terumo Corporation, Stryker Corporation, Philips, Johnson and Johnson, Boston Scientific, Siemens Healthineers, Smith and Nephew, Fresenius Medical Care, Zimmer Biomet, GE Healthcare, Abbott Laboratories, Canon Medical Systems, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing aging population, driving the need for medical devices, including home dialysis machines, glucose monitoring systems, and respiratory therapy devices for the comfort of one’s home, is propelling the medical devices market. Technological advancements in medical devices, including telemedicine, wearables, robotics, 3D printing, and AI for improving patient care and outcomes leads to drive the market growth. The increasing country’s healthcare expenditure contributes to driving the medical devices market growth. In addition, the prevalence of chronic diseases significantly contributes to driving the market demand for medical devices.

Restraining Factors

The regulatory hurdles and increased cost of medical devices, along with the lack of accessibility of novel devices which limit their adoption, thereby restraining the medical devices market.

Market Segmentation

The Spain medical devices market share is classified into type and end-user.

- The in-vitro diagnostics (IVD) segment dominated the market with the largest market share in 2023 and is anticipated to grow at a significant CAGR during the projected period.

The Spain medical devices market is segmented by type into orthopedic devices, cardiovascular devices, diagnostic imaging devices, in-vitro diagnostics (IVD), minimally invasive surgery devices, wound management, diabetes care devices, ophthalmic devices, dental devices, nephrology devices, general surgery, and others. Among these, the in-vitro diagnostics (IVD) segment dominated the market with the largest market share in 2023 and is anticipated to grow at a significant CAGR during the projected period. A non-invasive diagnostic procedure used for evaluating various stages and diagnosis, screening, and detecting diseases, by conducting tests on biological samples, such as blood or tissue. The rising prevalence of infectious diseases, as well as growing R&D activities, are contributing to driving the market in the in-vitro diagnostics (IVD) segment.

- The hospitals & ASCs segment dominated the market with the largest share of the medical devices market in 2023 and is anticipated to grow at a significant CAGR during the projected period.

The Spain medical devices market is segmented by end-user into hospitals & ASCs, clinics, and others. Among these, the hospitals & ASCs segment dominated the market with the largest share of the medical devices market in 2023 and is anticipated to grow at a significant CAGR during the projected period. The segment offers a convenient and cost-effective alternative, attracting an increasing number of patients seeking outpatient care. Thus, the inclination towards outpatient care led to the adoption of strategies to cater to the specific needs of ASCs. The emergence of multispecialty and community hospitals is driving the market in the hospitals & ASCs segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Spain medical devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Medtronic

- Bayer

- Terumo Corporation

- Stryker Corporation

- Philips

- Johnson and Johnson

- Boston Scientific

- Siemens Healthineers

- Smith and Nephew

- Fresenius Medical Care

- Zimmer Biomet

- GE Healthcare

- Abbott Laboratories

- Canon Medical Systems

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Spain, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Spain medical devices market based on the below-mentioned segments:

Spain Medical Devices Market, By Type

- Orthopedic Devices

- Cardiovascular Devices

- Diagnostic Imaging Devices

- In-vitro Diagnostics (IVD)

- Minimally Invasive Surgery Devices

- Wound Management

- Diabetes Care Devices

- Ophthalmic Devices

- Dental Devices

- Nephrology Devices

- General Surgery

- Others

Spain Medical Devices Market, By End-User

- Hospitals & ASCs

- Clinics

- Others

Need help to buy this report?