Spain Medical Device Contract Manufacturing Market Size, Share, and COVID-19 Impact Analysis, By Product (Class I, Class II, and Class III), By Services (Accessories Manufacturing, Assembly Manufacturing, Component Manufacturing, Device Manufacturing, and Others), By Therapeutic Area (Cardiovascular Devices, Orthopedic Devices, Ophthalmic Devices, Diagnostic Devices, Respiratory Devices, and Others), By End-use (Original Equipment Manufacturers (OEMs), Pharmaceutical & Biopharmaceutical Companies, and Others), and Spain Medical Device Contract Manufacturing Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareSpain Medical Device Contract Manufacturing Market Insights Forecasts to 2033

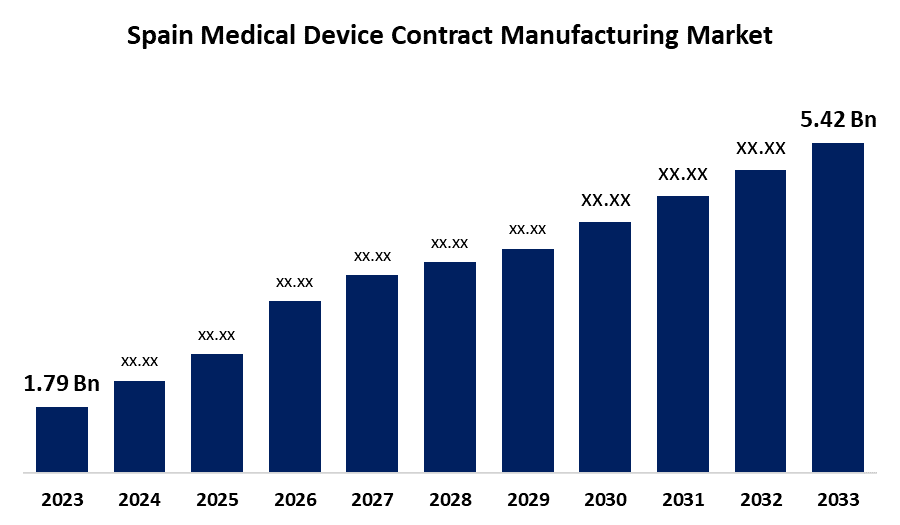

- The Spain Medical Device Contract Manufacturing Market Size was valued at USD 1.79 Billion in 2023.

- The Spain Medical Device Contract Manufacturing Market is Growing at a CAGR of 11.72% from 2023 to 2033

- The Spain Medical Device Contract Manufacturing Market Size is Expected to reach USD 5.42 Billion by 2033

Get more details on this report -

The Spain Medical Device Contract Manufacturing Market is anticipated to exceed USD 5.42 Billion by 2033, growing at a CAGR of 11.72% from 2023 to 2033. The increasing prevalence of chronic diseases & aging population, advancement in manufacturing technologies, and the emergence of Industry 4.0 are driving the growth of the medical device contract manufacturing market in the Spain.

Market Overview

The medical device contract manufacturing market refers to the industry in which companies outsource the production of medical devices or components to specialized firms. Medical device contract manufacturing is a process where a company specializing in medical device production (a CMO, or contract manufacturer) manufactures medical devices or components for another company, often the OEM (original equipment manufacturer), which owns the product design and idea. The emergence of Industry 4.0, including the integration of automation, robotics, and data analytics in MDCM, enhances production efficiency, precision, and consistency. Market innovation involves the additive manufacturing (3D printing) technology, which allows the creation of complex and customized medical devices. Furthermore, an increasing disposable income as well as allocation of resources towards improving healthcare accessibility and affordability, involving subsidies for medical devices or promotion of local manufacturing, is creating lucrative market growth opportunities.

Report Coverage

This research report categorizes the market for the Spain medical device contract manufacturing market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Spain medical device contract manufacturing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Spain medical device contract manufacturing market.

Spain Medical Device Contract Manufacturing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | at USD 1.79 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 11.72% |

| 2033 Value Projection: | USD 5.42 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 150 |

| Segments covered: | By Product, By Services, By Therapeutic, By End-use and COVID-19 Impact Analysis. |

| Companies covered:: | Flex, Ltd., Jabil Inc., Gerresheimer Zaragoza S.L.U, Nipro Medical Spain SL, Celestica, TE Connectivity Spain, S.L.U., Eurofins Scientific Spain, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

The increasing demand for medical devices for monitoring and treating chronic diseases leads to a surge in the outsourcing of devices. Thus, the increasing prevalence of chronic diseases with the growing aging population is driving the market demand. The advancement in manufacturing technologies for more personalized, efficient, and cost-effective solutions is propelling the market growth. Further, the emergence of industry 4.0 technologies into medical device contract manufacturing, emphasizing automation, robotics, and data analytics for enhancing production efficiency, precision, and consistency in MDCM, is promoting the market growth.

Restraining Factors

The regulatory complexity and increased cost of innovation are responsible for restraining the medical device contract manufacturing market. Further, intellectual property theft is negatively affecting the market growth.

Market Segmentation

The Spain medical device contract manufacturing market share is classified into product, services, therapeutic area, and end-use.

- The class II segment dominated the market with the largest revenue share in 2023 and is anticipated to witness significant CAGR growth during the forecast period.

The Spain medical device contract manufacturing market is segmented by product into class I, class II, and class III. Among these, the class II segment dominated the market with the largest revenue share in 2023 and is anticipated to witness significant CAGR growth during the forecast period. Class II medical devices, such as syringes, blood pressure cuffs, and certain diagnostic tools, pose a moderate to high risk to patients and users, requiring additional regulatory controls compared to Class I devices. The increasing prevalence of chronic disease, along with growing technological advancements, is driving the market in the class II segment.

- The accessories manufacturing segment held the largest revenue share in 2023 and is anticipated to witness significant CAGR growth during the forecast period.

The Spain medical device contract manufacturing market is segmented by services into accessories manufacturing, assembly manufacturing, component manufacturing, device manufacturing, and others. Among these, the accessories manufacturing segment held the largest revenue share in 2023 and is anticipated to witness significant CAGR growth during the forecast period. The segment involves the production of items complement and enhancing the functionality of the main medical devices. The rising demand for medical device components supporting device performance is propelling the market in the accessories manufacturing segment.

- The cardiovascular devices segment accounted for the largest market share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

The Spain medical device contract manufacturing market is segmented by therapeutic area into cardiovascular devices, orthopedic devices, ophthalmic devices, diagnostic devices, respiratory devices, and others. Among these, the cardiovascular devices segment accounted for the largest market share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The rising prevalence of cardiovascular diseases, including angina pectoris, myocardial infarction, hypertensive heart disease, rheumatic heart disease, and congenital heart disease, is fueling the market demand in the cardiovascular devices segment.

- The original equipment manufacturers (OEMs) segment held the largest revenue share in 2023 and is anticipated to witness significant CAGR growth during the forecast period.

The Spain medical device contract manufacturing market is segmented by end-use into original equipment manufacturers (OEMs), pharmaceutical & biopharmaceutical companies, and others. Among these, the original equipment manufacturers (OEMs) segment held the largest revenue share in 2023 and is anticipated to witness significant CAGR growth during the forecast period. It involves the production of components or products, which then rebrands and resells those components or products under its brand. The specialized service provided by OEMs, including device designs and manufacturing, contributes to propelling the market in the original equipment manufacturers (OEMs) segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Spain medical device contract manufacturing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Flex, Ltd.

- Jabil Inc.

- Gerresheimer Zaragoza S.L.U

- Nipro Medical Spain SL

- Celestica

- TE Connectivity Spain, S.L.U.

- Eurofins Scientific Spain

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2024, Esteve is to invest 100 million euros in the construction of a new plant at its industrial centre in Celra (Girona). This unit would allow the company’s production capacity to increase globally by up to 15% in the future.

Market Segment

This study forecasts revenue at Spain, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Spain medical device contract manufacturing market based on the below-mentioned segments:

Spain Medical Device Contract Manufacturing Market, By Product

- Class I

- Class II

- Class III

Spain Medical Device Contract Manufacturing Market, By Services

- Accessories Manufacturing

- Assembly Manufacturing

- Component Manufacturing

- Device Manufacturing

- Others

Spain Medical Device Contract Manufacturing Market, By Therapeutic Area

- Cardiovascular Devices

- Orthopedic Devices

- Ophthalmic Devices

- Diagnostic Devices

- Respiratory Devices

- Others

Spain Medical Device Contract Manufacturing Market, By End-use

- Original Equipment Manufacturers (OEMs)

- Pharmaceutical & Biopharmaceutical Companies

- Others

Need help to buy this report?