Spain Herbicides Market Size, Share, and COVID-19 Impact Analysis, By Type (Cereals & Grains, Fruits & Vegetables, Oilseeds & Pulses, and Others), By Application (Fertigation, Foliar, Soil, and Others), and Spain Herbicides Market Insights, Industry Trend, Forecasts to 2033.

Industry: AgricultureSpain Herbicides Market Insights Forecasts to 2033

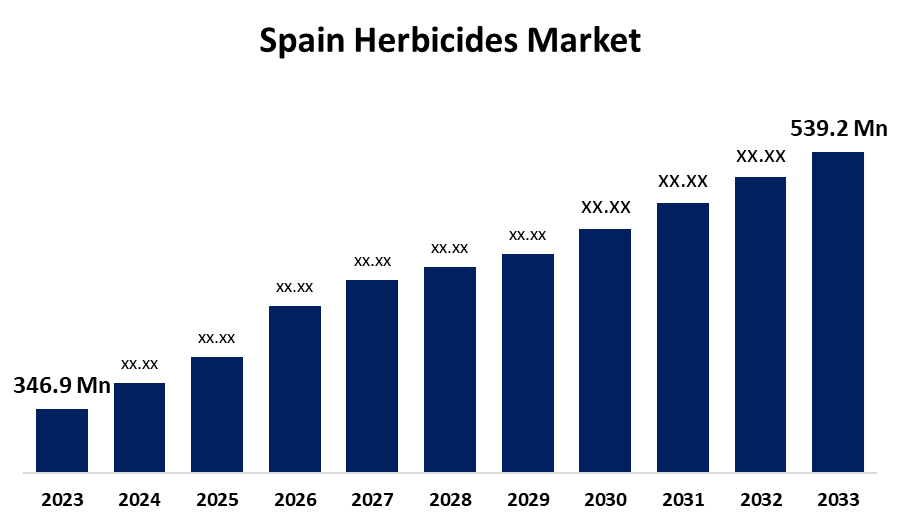

- The Spain Herbicides Market Size was valued at USD 346.9 Million in 2023.

- The Market is Growing at a CAGR of 4.51% from 2023 to 2033

- The Spain Herbicides Market Size is Expected to Reach USD 539.2 Million by 2033

Get more details on this report -

The Spain Herbicides Market is Anticipated to Reach USD 539.2 Million by 2033, growing at a CAGR of 4.51% from 2023 to 2033

Market Overview

Herbicides are substances utilized to regulate or control unwanted plant life. The application of herbicides is most common in row-crop farming, where they are used before or during planting to optimize crop productivity by minimizing other vegetation. They may also be applied to crops in the fall to enhance the harvest. In forest management, herbicides are employed to prepare cleared areas for replanting. Although the total volume and coverage area are greater, the frequency of application is significantly lower compared to farming. Spain is among the countries most impacted by herbicide-resistant weeds, holding the top position in Europe and fifth globally. Some of the most prevalent weed species in Spain include Conyza, Lolium, Bassia scoparia, and Salsola kali. In 2022, Spain recorded sales of approximately 12.2 million tons of active ingredients for herbicides, haulm destructors, and moss killers, with sales reaching a peak of over 20 million tons in 2020. In Spanish olive groves, herbicides are frequently utilized to control weeds, with nearly 90% of olive groves in mountainous areas employing herbicides and no-tillage practices.

Report Coverage

This research report categorizes the market for the Spain herbicides based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Spain herbicides market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Spain herbicides market.

Spain Herbicides Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 346.9 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.51% |

| 2033 Value Projection: | USD 539.2 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application |

| Companies covered:: | ALFREDO INESTA, S.L., Aspe Agrobiológico S.L, Emsa Tecnologia Quimica S.A., Distribuciones Agrícolas Herrero, S.L., Chemo Ibérica Madrid, And Other Key Players |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

The increasing necessity to produce more food to satisfy the needs of a growing population is a significant factor propelling herbicide use in Spain. A lack of agricultural labor makes herbicides a more appealing choice for weed control, as they demand less manual labor. Herbicides allow farmers to effectively manage weeds, resulting in enhanced crop yields and greater profitability. The introduction of new, targeted herbicides with better effectiveness and lesser environmental impact is contributing to market expansion. Variable weather patterns can escalate weed pressure, which necessitates more efficient herbicide solutions. Spain's export market often demands high-quality products, which further amplifies the necessity for effective weed management through herbicides.

Restraining Factors

The main restraining factors for the Spain herbicides market are strict environmental regulations, growing concerns about the health risks associated with herbicide use, increasing pressure for sustainable farming practices, and a push towards integrated pest management (IPM) strategies which aim to minimize reliance on chemical herbicides; all of which are enforced by the Spanish government and the European Union's regulations on pesticide usage.

Market Segmentation

The Spain herbicides market share is classified into type and application.

- The cereals & grains segment is expected to hold the largest market share through the forecast period.

The Spain herbicides market is segmented by type into cereals & grains, fruits & vegetables, oilseeds & pulses, and others. Among these, the cereals & grains segment is expected to hold the largest market share through the forecast period. This segment features key crops like corn, rice, and wheat, which are fundamental to worldwide food production. The need for herbicides in this sector is driven by the requirement for effective weed control to guarantee high yields and quality in these vital crops. Within the cereals and grains industry, herbicides are essential for enabling crops such as corn and wheat to flourish without competing with weeds. As the global population increases, so does the demand for food, leading farmers to incorporate herbicides as a main strategy for weed management. This movement is further bolstered by the emergence of herbicide-resistant crop varieties, allowing for the safe use of particular herbicides that do not damage the crops.

- The soil segment is expected to dominate the Spain herbicides market during the forecast period.

Based on the application, the Spain herbicides market is divided into fertigation, foliar, soil, and others. Among these, the soil segment is expected to dominate the Spain herbicides market during the forecast period. The soil application method is a prevalent technique in the market, particularly effective for managing weeds before they appear. This method entails integrating herbicides into the soil, where they can engage with the weed root systems. By applying these chemicals before emergence, farmers can establish a protective barrier that prevents weed germination and growth. This technique proves especially advantageous in row-crop farming, where preserving crop health and maximizing yields are crucial. Soil application methods can vary, including broadcasting, banding, or mixing the herbicide into the soil during tillage.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Spain herbicides market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ALFREDO INESTA, S.L.

- Aspe Agrobiológico S.L

- Emsa Tecnologia Quimica S.A.

- Distribuciones Agrícolas Herrero, S.L.

- Chemo Ibérica Madrid

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2024, Corteva has introduced its new herbicide for maize, Hector ALS, combining inhibitors (HRAC Group 2, Nicosulfuron + Rimsulfuron) and synthetic auxin (HRAC Group 4, Decamba), renowned for its extensive range of control and high selectivity, making Hector a perfect choice for corn growers in Spain.

Market Segment

This study forecasts revenue at Spain, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Spain Herbicides Market based on the below-mentioned segments:

Spain Herbicides Market, By Type

- Cereals & Grains

- Fruits & Vegetables

- Oilseeds & Pulses

- Others

Spain Herbicides Market, By Application

- Fertigation

- Foliar

- Soil

- Others

Need help to buy this report?