Spain Genomics Market Size, Share, and COVID-19 Impact Analysis, By Application (Functional Genomics, Epigenomics, Pathway Analysis, Biomarker Discovery, and Others), By Deliverables (Products and Services), By End-use (Clinical Research, Academic & Government Institutes, Hospitals & Clinics, Pharmaceutical & Biotechnology Companies, and Others), and Spain Genomics Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareSpain Genomics Market Insights Forecasts to 2035

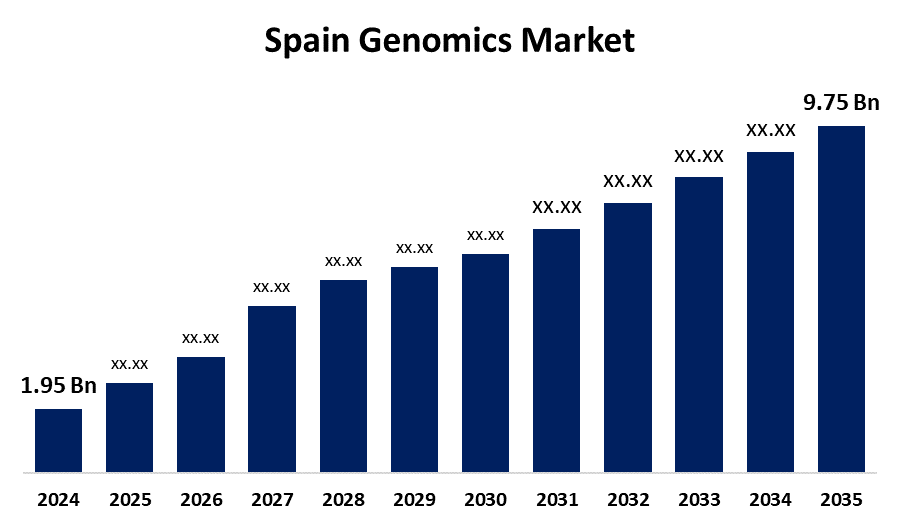

- The Spain Genomics Market Size was estimated at USD 1.95 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 15.76% from 2025 to 2035

- The Spain Genomics Market Size is Expected to Reach USD 9.75 Billion by 2035

Get more details on this report -

The Spain Genomics Market Size is anticipated to reach USD 9.75 Billion by 2035, growing at a CAGR of 15.76% from 2025 to 2035. An increasing prevalence of inherited & viral diseases, focus on personalized medicine, technological advancements, and favourable government initiatives & funding are driving the genomics market in the Spain.

Market Overview

The genomics market refers to the study and application of an organism’s genome, including its structure, function, and mapping. Genomics is an interdisciplinary field of molecular biology emphasizing the structure, function, evolution, mapping, and editing of genomes. An increasing prevalence of viral and inherited disorders that drive demand for genomic sequencing, as well as the application of NGS in chronic diseases such as cancer for identifying genetic mutations, are responsible for driving the genomics market. Furthermore, the adoption of personalized medicine for enhancing patient outcomes leads to an escalation of the market growth. The use of genomics in precision medicine provides individualized therapy, especially in the oncology sector, which is bolstering the market growth opportunities.

Report Coverage

This research report categorizes the market for the Spain genomics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Spain genomics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Spain genomics market.

Spain Genomics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.95 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 15.76% |

| 2035 Value Projection: | USD 9.75 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Application (Functional Genomics, Epigenomics, Pathway Analysis, Biomarker Discovery, and Others), By Deliverables (Products and Services), By End-use (Clinical Research, Academic & Government Institutes, Hospitals & Clinics, Pharmaceutical & Biotechnology Companies, and Others) |

| Companies covered:: | Illumina, Oryzon Genomics, BGI Genomics, Thermo Fisher Scientific, 10x Genomics, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing prevalence of inherited & viral diseases, owing to factors such as an aging population, Covid 19 pandemic impact, and demand for genetic testing for rare diseases, is driving the genomics market. The growing emphasis on personalized medicine, tailoring healthcare as per an individual’s genetic makeup propelling the market growth. Technological advancements transforming genomics, enabling faster, more accurate, and cost-effective analysis of genetic information, are driving the market growth. In addition, favorable government initiatives and funding contribute to driving market growth. For instance, Morant announced that Spain would contribute to the creation of Europe's largest DNA catalogue, which would help prevent diseases.

Restraining Factors

The increased instrument cost and the demand for specialized personnel are challenging the market. Further, the data storage challenges and regulatory hurdles are hampering the market growth.

Market Segmentation

The Spain genomics market share is classified into application, deliverables, and end-use.

- The functional genomics segment dominated the market with the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Spain genomics market is segmented by application into functional genomics, epigenomics, pathway analysis, biomarker discovery, and others. Among these, the functional genomics segment dominated the market with the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. It includes the study of gene and their products (RNA and protein) function and their interaction affecting various biological processes.

- The products segment dominated the genomics market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Spain genomics market is segmented by deliverables into products and services. Among these, the products segment dominated the genomics market in 2024 and is expected to grow at a significant CAGR during the forecast period. It encompasses a wide range of tools and reagents used in the study of genes and genomes, including sequencing reagents, library preparation kits, instruments, and software.

- The pharmaceutical & biotechnology companies segment dominated the market with the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Spain genomics market is segmented by end-use into clinical research, academic & government institutes, hospitals & clinics, pharmaceutical & biotechnology companies, and others. Among these, the pharmaceutical & biotechnology companies segment dominated the market with the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Advancements in drug discovery, development, and precision medicine are driving the market growth in the pharmaceutical & biotechnology companies segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Spain genomics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Illumina

- Oryzon Genomics

- BGI Genomics

- Thermo Fisher Scientific

- 10x Genomics

- Others

Recent Developments:

- In February 2024, REVEAL GENOMICS, S.L., a pioneering biotechnology start-up based in Barcelona that is poised to transform precision oncology with its biomarker innovations, has announced the start of the DEFINITIVE study, led by FRCB-IDIBAPS, representing the first prospective trial for HER2DX®.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Spain, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Spain Genomics Market based on the below-mentioned segments:

Spain Genomics Market, By Application

- Functional Genomics

- Epigenomics

- Pathway Analysis

- Biomarker Discovery

- Others

Spain Genomics Market, By Deliverables

- Products

- Services

Spain Genomics Market, By End-use

- Clinical Research

- Academic & Government Institutes

- Hospitals & Clinics

- Pharmaceutical & Biotechnology Companies

- Others

Need help to buy this report?