Spain Diabetes Devices Market Size, Share, and COVID-19 Impact Analysis, By Type (Blood Glucose Monitoring Devices and Insulin Delivery Devices), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Diabetes Clinics/Centers, Online Pharmacies, and Others), By End-use (Hospitals, Diagnostic Centers, and Homecare), and Spain Diabetes Devices Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareSpain Diabetes Devices Market Insights Forecasts to 2033

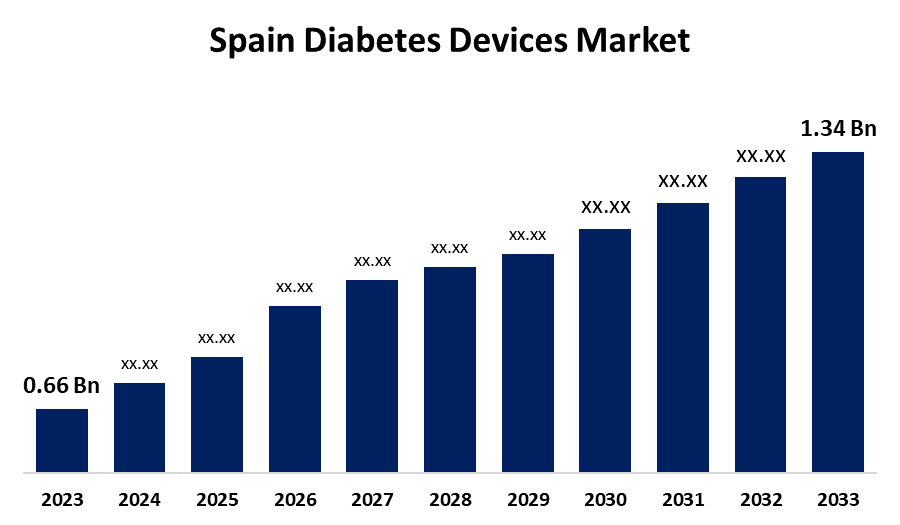

- The Spain Diabetes Devices Market Size was valued at USD 0.66 Billion in 2023.

- The Spain Diabetes Devices Market is growing at a CAGR of 7.34% from 2023 to 2033

- The Spain Diabetes Devices Market Size is expected to reach USD 1.34 Billion by 2033

Get more details on this report -

The Spain Diabetes Devices Market Size is Anticipated to exceed USD 1.34 Billion By 2033, Growing at a CAGR of 7.34% from 2023 to 2033. The increasing prevalence of diabetes, awareness about effective diabetes management strategies, and technological advancements are driving the growth of the diabetes devices market in the Spain.

Market Overview

The diabetes devices market refers to the products and services used for managing and treating diabetes. The devices include glucose monitoring systems, insulin delivery systems, and related accessories. The shift towards advanced digital solutions, enhancing patient engagement, and improving health outcomes are several factors that are escalating the market growth for diabetes devices. The upsurging need for accurate blood glucose monitoring and use of insulin delivery devices, along with the rise in obesity rates, are significantly driving the market demand for diabetes devices. Digital solutions and continuous glucose monitoring, along with the growing prevalence of diabetes and technological advancements, are expected to bolster the market growth opportunities.

Report Coverage

This research report categorizes the market for the Spain diabetes devices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Spain diabetes devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Spain diabetes devices market.

Spain Diabetes Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 0.66 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.34% |

| 2033 Value Projection: | USD 1.34 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 198 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Type, By Distribution Channel, By End-use and COVID-19 Impact Analysis |

| Companies covered:: | Becton and Dickenson, Medtronic, Insulet, Tandem, Ypsomed, Novo Nordisk, Sanofi, Eli Lilly, Abbottt, Roche, Lifescan (Johnson &Johnson), Dexcom, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing prevalence of diabetes is responsible for propelling the diabetes devices market. It was estimated that a total of 2,956,121 people were diagnosed with diabetes in Spain, representing 6.66% of the population of the above-mentioned age assigned to primary care in the Spanish National Health System. The increasing emphasis on promoting healthy lifestyles, early detection of prediabetes and diabetes, and optimization of treatment adherence are several factors that are escalating the market. Further, the technological advancements in glucose monitoring and artificial pancreas systems for shaping diabetes care are promoting the market growth.

Restraining Factors

The increased cost of devices, limited reimbursement policies, and the need for robust regulatory approvals are challenging the diabetes devices market.

Market Segmentation

The Spain diabetes devices market share is classified into type, distribution channel, and end-use.

- The insulin delivery devices segment dominated the market with the largest revenue market share in 2023 and is anticipated to witness the fastest CAGR growth during the forecast period.

The Spain diabetes devices market is segmented by type into blood glucose monitoring devices and insulin delivery devices. Among these, the insulin delivery devices segment dominated the market with the largest revenue market share in 2023 and is anticipated to witness the fastest CAGR growth during the forecast period. The segment includes syringes, pens, and pumps. Further, smart pens and artificial pancreas systems are emerging technologies. The rising incidence of diabetes, technological advancements, and awareness about diabetes management are propelling the market in the insulin delivery devices segment.

- The hospital pharmacies segment dominated the market with the largest revenue share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

The Spain diabetes devices market is segmented by distribution channel into hospital pharmacies, retail pharmacies, diabetes clinics/centers, online pharmacies, and others. Among these, the hospital pharmacies segment dominated the market with the largest revenue share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. In the hospital pharmacies segment, pharmaceutical products are purchased directly by the hospitals from different pharmaceutical companies, used for either outpatients or inpatients. The increased footfall and product availability are significantly propelling the market growth in the hospital pharmacies segment.

- The hospitals segment dominated the market with the largest revenue share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

The Spain diabetes devices market is segmented by end-use into hospitals, diagnostic centers, and homecare. Among these, the hospitals segment dominated the market with the largest revenue share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Diabetes devices, including blood glucose meters, CGMs, insulin pumps, and smart insulin pens, are used in hospitals to enhance diabetes management and patient outcomes. The increasing hospital admissions and emphasis on enhancing diabetes care in medical facilities are responsible for driving the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Spain diabetes devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Becton and Dickenson

- Medtronic

- Insulet

- Tandem

- Ypsomed

- Novo Nordisk

- Sanofi

- Eli Lilly

- Abbottt

- Roche

- Lifescan (Johnson &Johnson)

- Dexcom

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2024, Dexcom Inc., a global leader in real-time continuous glucose monitoring (CGM) for people with diabetes, announced the launch of its latest CGM system, Dexcom ONE+.

- In June 2022, Senseonics Holdings, Inc., a medical technology company focused on the development and manufacturing of long-term, implantable continuous glucose monitoring (CGM) systems for people with diabetes, announced that it has received CE market approval for the next-generation Eversense E3 CGM System, the longest-lasting system available, with exceptional accuracy.

Market Segment

This study forecasts revenue at Spain, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Spain diabetes devices market based on the below-mentioned segments:

Spain Diabetes Devices Market, By Type

- Blood Glucose Monitoring Devices

- Insulin Delivery Devices

Spain Diabetes Devices Market, By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Diabetes Clinics/Centers

- Online Pharmacies

- Others

Spain Diabetes Devices Market, By End-use

- Hospitals

- Diagnostic Centers

- Homecare

Need help to buy this report?