Global Space Insurance Market Size, Share, and COVID-19 Impact Analysis, By Type (Manufacturing, Pre-launch, Launch, On-orbit, De-orbit, Others), By Coverage (Third-Party Liability, In-Orbit Coverage, Payload Recovery, Salvage Debris Removal, Claims Assistance, Others), By Application (Commercial, Scientific Research, Military, Satellite Communication, Earth Observation, Others), By End-User (Government, Private Companies, Non-Profit Organizations, Research Institutions, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032.

Industry: Banking & FinancialGlobal Space Insurance Market Insights Forecasts to 2032

- The Global Space Insurance Market Size is expected to reach USD XX.XX Billion by 2032.

- The Worldwide Space Insurance Market is Growing at a CAGR of 16.7% from 2022 to 2032.

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Space Insurance Market Size is expected to reach USD XX.XX Billion by 2032, at a CAGR of 16.7% during the forecast period 2022 to 2032. As more nations and private organizations participate in space exploration activities and businesses, the demand for space insurance is expected to rise, making it a vital component of risk mitigation in the space industry.

Space insurance, commonly referred to as satellite insurance or space risk insurance, is a type of specialized insurance that insures likelihood connected with space-related activities such as launch, in-orbit operations, and other phases of spacecraft or satellite missions. Space insurance is an integral part of the governmental and corporate businesses that participate in space missions because it entails high costs, highly sophisticated equipment, and severe dangers. Insurance acts as a safety net, allowing entities to embark on risky space missions with security. Additionally, space insurance encourages private sector investment and engagement, which is becoming increasingly important as space commercialization accelerates. The overall expense of space insurance premiums is determined by a number of criteria, including the kind of vehicle, intended mission, launch vehicle, past performance of the operators, and contemporary space-related parameters. The space insurance industry is small and highly specialized, with just a few insurers operating globally. As the space sector expands and grows in diversity, it also affects the space insurance market, which now includes coverage for emerging industries like space exploration, space tourism, and asteroid extraction.

Report Coverage

This research report categorizes the Global Space Insurance Market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Global Space Insurance Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Global Space Insurance Market. Technological innovation and advancement will further optimize the performance of the product, enabling it to acquire a wider range of applications in the downstream market.

Global Space Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 16.7% |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 203 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Coverage, By Application, By End-User, By End-User, By Region, and COVID-19 Impact Analysis. |

| Companies covered:: | AXA XL, Swiss Re, SpaceCo, Lloyds of London, Marsh Inc., Allianz Global Corporate & Specialty (AGCS), Atrium Underwriting, AIG (American International Group), Zurich Insurance Group, Aon Space Insurance and other key venders. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Several factors have contributed to the space insurance market growth, including increased space operations, commercialization of space, regulatory constraints, and technological advancements. It's a rapidly evolving industry that necessitates an in-depth comprehension of space technology, risk management, and actuarial research. The space insurance market is predicted to continue growing as the space industry evolves and develops owing to increased commercialization, as well as space exploration, satellite deployment, and other space-related initiatives.

The increasing number of public and private space missions is pushing up the demand for space insurance. The demand for space insurance is growing as satellite launches increase and private companies enter the space sector. In addition, developments in aerospace technology enable greater complexity and demanding missions. However, these advancements introduce new hazards, increasing the need for specialized space insurance. Furthermore, as space tourism becomes a reality, the necessity for insurance coverage for space travelers and the spacecraft intended for suborbital missions opens up an exciting new sector for space insurance.

Restraining Factors

The space insurance market, on the other hand, can be unpredictable, with instances of demand being elevated and decreased. This instability, which is caused by the success or failure of space missions, might make it challenging for insurers to remain profitable. Furthermore, there are limited insurers with the competence and financial resources for covering space risks. This limited capacity may hinder the space insurance market's expansion.

Market Segmentation

By Type Insights

The launch segment is dominating the market with the largest revenue share over the forecast period.

On the basis of type, the global space insurance market is segmented into the manufacturing, pre-launch, launch, on-orbit, de-orbit, and others. Among these, the launch segment is dominating the market with the largest revenue share of 38.6% over the forecast period. The launch phase contains some of the most significant hazards in a space vehicle's life cycle, necessitating extensive insurance coverage. Because of the enormous expenses involved with a failed launch, insurance policies in this field attract premiums, which are accounting for a sizable share of the market. Launch insurance covers failures during the initial phase, such as a launch vehicle malfunction that results in the whole loss, partial failure, or misplacement of the spacecraft.

By Coverage Insights

The in-orbit coverage segment is witnessing significant CAGR growth over the forecast period.

On the basis of coverage, the global space insurance market is segmented into third-party liability, in-orbit coverage, payload recovery, salvage debris removal, claims assistance, and others. Among these, the in-orbit coverage is witnessing significant CAGR growth over the forecast period. This is due to the fact that the functional lifespan of a satellite in orbit is several years, during which time the satellite becomes vulnerable to a range of threats. In-orbit insurance covers these risks, shielding the spacecraft's owner from the financial consequences of a complete or partial malfunction of the spacecraft throughout its operating life in space. As a result, premiums for in-orbit coverage are relatively high, driving the demand for space insurance.

By Application Insights

The satellite communication segment is expected to hold the largest share of the Global Space Insurance Market during the forecast period.

Based on the application, the global space insurance market is classified into commercial, scientific research, military, satellite communication, earth observation, and others. Among these, the satellite communication segment is expected to hold the largest share of the space insurance market during the forecast period. Communication satellites account for a sizable proportion of all satellite launches and are an essential component of worldwide communication systems. The satellite communication section includes communication satellite insurance, which covers a number of different amenities such as broadcasting, telecommunications, and internet access. Because these satellites are vital infrastructure for numerous industries, insurance coverage is essential. As a result, they account for a sizable percentage of the market for space insurance.

By End-User Insights

The private companies segment accounted for the largest revenue share of more than 57.2% over the forecast period.

On the basis of end-user, the global space insurance market is segmented into government, private companies, non-profit organizations, research institutions, and others. Among these, the private company’s segment is dominating the market with the largest revenue share of 57.2% over the forecast period, driven by the growth of commercial space activities. Space firms such as SpaceX and Blue Origin, as well as numerous smaller enterprises that are exploring the space industry, are included in the private company segment. These businesses engage in a variety of activities, such as satellite communication services, launch services, and space exploration, all of which necessitate insurance coverage. Private company insurance can protect against risks such as production, launch, on-orbit operations, third-party liability, and many others. With the continued commercialization of space and increasing involvement in space operations among a diverse variety of organizations, this sector of the insurance market is likely to increase significantly throughout the forecast period.

Regional Insights

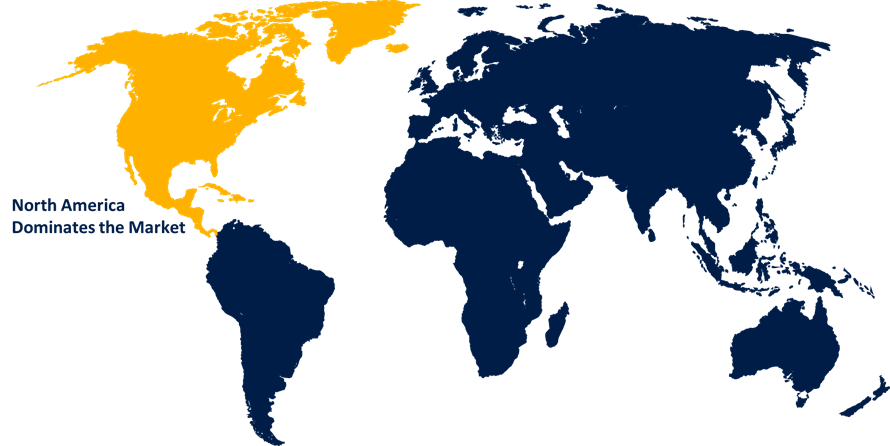

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

North America is dominating the market with more than 38.7% market share over the forecast period. North America has long been a strong player in the global space economy, with the United States at the vanguard, which has led to a substantial need for space insurance. The rise of private firms such as SpaceX, Blue Origin, and others, along with NASA's ongoing initiatives, have maintained the space insurance industry in this region competitive. With regard to the huge number of space missions and strong technological capabilities, there is still a high demand for space insurance in North America.

Asia Pacific, on the contrary, is expected to grow the fastest during the forecast period, with countries such as China, India, and Japan leading the space insurance market. These countries have successfully launched a greater number of satellites and have made significant investments in space technology and infrastructures. The growing amount of space missions, as well as the increased involvement of private enterprises in space operations, are likely to support the expansion of this region's space insurance market. The steadily rising investment in space-related activities by governments and private entities in Asia Pacific contributes to the growth of the regional space insurance market.

The Europe market is expected to register a substantial CAGR growth rate during the forecast period. European countries are actively involved in a wide range of space operations, ranging from scientific research expeditions to commercial satellite goods or services, all of which necessitate insurance coverage. The establishment of numerous major satellite manufacturers and operators in Europe boosts the demand for the space insurance market.

List of Key Market Players

- AXA XL

- Swiss Re

- SpaceCo

- Lloyds of London

- Marsh Inc.

- Allianz Global Corporate & Specialty (AGCS)

- Atrium Underwriting

- AIG (American International Group)

- Zurich Insurance Group

- Aon Space Insurance

- Others

Key Market Developments

- On April 2023, Tokio Marine Holdings, Inc. has formed a financing and commercial collaboration with Axelspace Holdings Inc., a startup in the space business sector, to create innovative space insurance products and services. Axelspace's data on the development and manufacturing of microsatellites will be analyzed by TMNF in order to produce new space insurance products specialized for microsatellites. Furthermore, TMNF will work with AxelLiner, an Axelspace service that will assist develop a digitalized space insurance platform to improve user experience during the insurance procurement process.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Space Insurance Market based on the below-mentioned segments:

Space Insurance Market, Type Analysis

- Manufacturing

- Pre-launch

- Launch

- On-orbit

- De-orbit

- Others

Space Insurance Market, Coverage Analysis

- Third-Party Liability

- In-Orbit Coverage

- Payload Recovery

- Salvage Debris Removal

- Claims Assistance

- Others

Space Insurance Market, Application Analysis

- Commercial

- Scientific Research

- Military

- Satellite Communication

- Earth Observation

- Others

Space Insurance Market, Application Analysis

- Government

- Private Companies

- Non-Profit Organizations

- Research Institutions

- Others

Space Insurance Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?