South Korean Personal Loans Market Size, Share, and COVID-19 Impact Analysis, By Type (P2P Marketplace Lending and Balance Sheet Lending), By Age (Less Than 30, 30-50, and More Than 5), and South Korean Personal Loans Market Insights, Industry Trend, Forecasts to 2035

Industry: Banking & FinancialSouth Korean Personal Loans Market Insights Forecasts to 2035

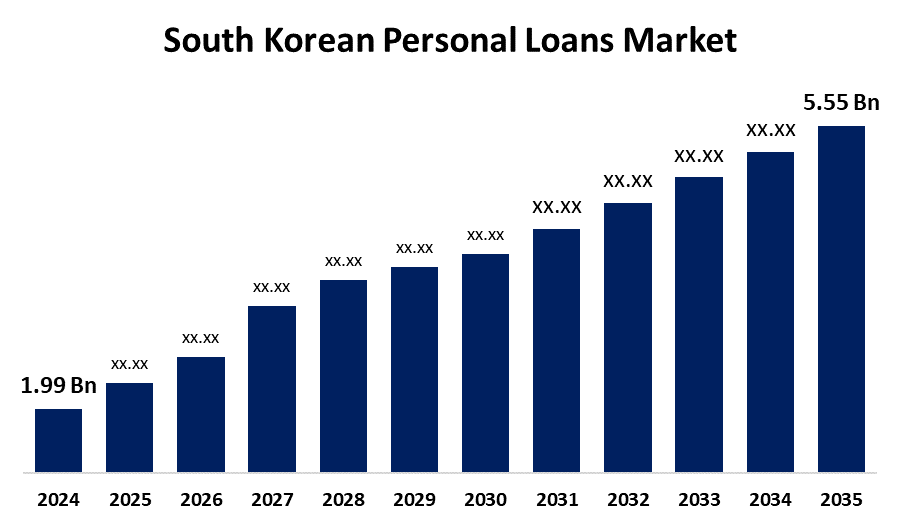

- The South Korean Personal Loans Market Size was Estimated at USD 1.99 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.77% from 2025 to 2035

- The South Korean Personal Loans Market Size is Expected to Reach USD 5.55 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The South Korean Personal Loans Market Size is anticipated to reach USD 5.55 Billion by 2035, growing at a CAGR of 9.77% from 2025 to 2035. By growing urban living expenses, the need for financial flexibility, and the quick uptake of digital lending platforms that provide tech-savvy consumers with quick, easy, and customized loan services.

Market Overview

The South Korean personal loan market is the financial ecosystem where consumers can borrow money, either secured or unsecured, from banks, fintech companies, or online lenders for personal purposes like debt consolidation, home improvement, healthcare, or education. Digital lending platforms, consumer desire for financial flexibility, and regulatory oversight aimed at encouraging responsible borrowing and financial inclusion all influence this market. Additionally, an increase in household debt suggests that consumers are depending more and more on personal loans to cover their expenses, which is driving the South Korean personal loan market. Notably, the government has recognized this trend and is implementing measures to support responsible lending practices and meet the financial needs of its citizens. Financial institutions are well-positioned to handle the market's rising demand for personal loans thanks to continuous changes in regulatory frameworks. In order to accommodate this expanding debt landscape, major banks such as Kookmin Bank and Shinhan Bank are also expanding their product lines to offer borrowers competitive loan products.

Report Coverage

This research report categorizes the market for the South Korean personal loans market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korean personal loans market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korean personal loans market.

South Korean Personal Loans Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.99 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 9.77% |

| 2035 Value Projection: | USD 5.55 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 191 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Type and By Age |

| Companies covered:: | Shinhan Bank, KB Kookmin Bank, NH Nonghyup Bank, KEB Hana Bank, Woori Bank, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing number of tech-savvy consumers who favor quick, easy, and less bureaucratic lending options is driving this trend, and fintech companies like Toss and Viva Republica are at the forefront of the market. A move toward mobile banking, along with improvements in technology and user experience, is driving a boom in digital lending options in the South Korean personal loan market. The Financial Services Commission (FSC) and other regulatory bodies are attempting to create precise rules in order to further validate and encourage the expansion of online lending.

Restraining Factors

The South Korean government has strengthened financial regulations to curb overlending in response to the increase in household debt. These include tighter credit assessments, debt-to-income (DTI) and loan-to-income (LTI) ceilings, and restrictions on unsecured personal loans. Given this, many borrowers have less access to credit, particularly those with modest incomes or little credit history.

Market Segmentation

The South Korean personal loans market share is classified into type and age.

- The balance sheet lending segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korean personal loans market is segmented by type into P2P marketplace lending, balance sheet lending. Among these, the balance sheet lending segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. In South Korea, balance sheet lending is still a mainstay of the personal loan market, and it is mostly backed by well-known financial institutions. This kind offers a more conventional method of borrowing and is funded by the lender's balance sheet.

- The 30-50 segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korean personal loans market is segmented by age into less than 30, 30–50, more than 50. Among these, the 30-50 segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Customers in the 30–50 age range usually use personal loans for significant life events like home purchases or family-related costs, which frequently results in a significant presence in overall borrowing activities.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korean personal loans market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Shinhan Bank

- KB Kookmin Bank

- NH Nonghyup Bank

- KEB Hana Bank

- Woori Bank

- Others

Recent Developments:

- In October 2024, Kakao Bank had expanded its offerings by launching new loan products aimed at providing more accessible credit options for consumers, particularly targeting younger borrowers and those with limited credit history. This initiative reflected the bank's commitment to enhancing financial inclusion and catering to the market's evolving needs

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korean Personal Loans Market based on the below-mentioned segments:

South Korean Personal Loans Market, By Type

- P2P Marketplace Lending

- Balance Sheet Lending

South Korean Personal Loans Market, By Age

- Less Than 30

- 30-50

- More Than 5

Need help to buy this report?