South Korean Life and Non-life Insurance Market Size, Share, and COVID-19 Impact Analysis, By Insurance Types (Life Insurance and Non-life insurance), By Distribution Channels (Banks, Agencies, Direct, and Others), and South Korean life and Non-life Insurance Market Insights Forecasts 2022 - 2032

Industry: Banking & FinancialSouth Korea Life and Non-life Insurance Market Insights Forecasts to 2032

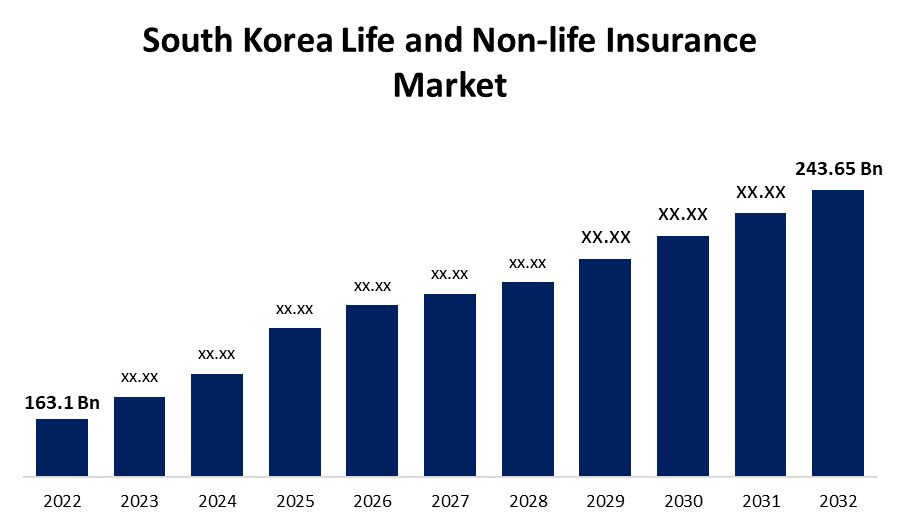

- The South Korean Life and Non-life Insurance Market Size was valued at USD 163.1 Billion in 2022.

- The Market Size is Growing at a CAGR of 4.10% from 2022 to 2032.

- The South Korean Life and Non-life Insurance Market Size is Expected to Reach 243.65 Billion by 2032.

Get more details on this report -

The South Korean Life and Non-life Insurance Market Size is Expected to Reach USD 243.65 Billion by 2032, at a CAGR of 4.10% during the forecast period 2022 to 2032.

Market Overview

An insurance policy is a contract in which an individual or entity receives financial protection or reimbursement from an insurance company. The company pooled its clients' risks to make payments to the insured more affordable. Insurance policies are used to protect against the risk of large and small financial losses caused by damage to the insured's property or liability for third-party damage or injury. There are numerous insurance policies to choose from, and almost anyone or any business can find an insurance company willing to insure them for a fee. Insurance is a method of protecting oneself from financial loss. It is a comprehensive method of forecasting and evaluating financial risks, with solutions to mitigate their impact. An insurer is a company that offers insurance and risk management tools like deductibles, contractual requirements, and premium credit incentives. Any type of insurance must have three components: a premium, a policy limit, and a deductible.

Report Coverage

This research report categorizes the market for South Korean life and non-life insurance market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korean life and non-life insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korean life and non-life insurance market.

South Korean Life and Non-life Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 163.1 Billion |

| Forecast Period: | 2020-2021 |

| Forecast Period CAGR 2020-2021 : | 4.10% |

| 2021 Value Projection: | USD 243.65 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Insurance, By Distribution. |

| Companies covered:: | DS Smith plc, Schoeller Allibert, Multipac Systems, reusable transport packaging, Schutz Gmbh & Co. Kgaa, IPL Plastics, Nefab Group, Monoflo International, Vetropack Holding, Cabka Group, UFP Technologies, Plasmix Private Limited, Myers Industries Inc., Menasha Corporation, Brambles Limited, and and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Increasing health awareness and a preference for preventative care are driving demand for health insurance, which is expected to propel market growth during the forecast period. Rising disposable income is expected to drive market expansion in the coming years. Vehicle insurance is required, and the country's expanding vehicle industry is expected to drive market growth in the coming years. Furthermore, the growing popularity of life insurance as a means of saving and investing, as well as the evolving determinants of tax benefits, are expected to provide lucrative opportunities for market participants.

Restraining Factors

New entrants may face challenges from current insurers' extensive distribution networks, and customer brand loyalty is expected to hamper market growth. Premium amounts for policies have risen as a result of high claim ratios, particularly in the health and automobile insurance sectors, making them less affordable to the middle-income group, which is expected to limit market growth.

Market Segment

- In 2022, the life insurance segment accounted for the largest revenue share over the forecast period.

Based on the insurance type, the South Korean life and non-life insurance market is segmented into life insurance and non-life insurance. Among these, the life insurance segment has the largest revenue share over the forecast period. A rapidly aging population and a strong demand for post-retirement protection products such as annuities and savings coverage, growing road accident rates, increased disposable income, and an increase in outbound tourism are driving the personal accident and health industry.

- In 2022, the direct segment accounted for the largest revenue share over the forecast period.

Based on distribution channels, the South Korean life and non-life insurance market is segmented into banks, agencies, direct, and others. Among these, the direct segment has the largest revenue share over the forecast period. People prefer to buy insurance plans through direct company distribution channels because the process is quick and easy.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korean Life and Non-life Insurance Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- National Health Insurance Service

- Samsung Fire & Marine Insurance Co. Ltd

- Hanwha Life Insurance Co. Ltd

- Hyundai Marine & Fire Insurance Co. Ltd

- Kyobo Life Insurance Co. Ltd

- Nonghyup Life Insurance Co. Ltd

- KB Insurance Co. Ltd

- Korean Reinsurance Company

- Meritz Fire & Marine Insurance Co. Ltd

- Mirae Asset Life Insurance Co. Ltd

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at regional, and country levels from 2021 to 2032. Spherical Insights has segmented the South Korean Life and Non-life Insurance Market based on the below-mentioned segments:

South Korea Life and Non-life Insurance Market, By Insurance Type

- Life Insurances

- Non-life insurances

South Korea Life and Non-life Insurance Market, By Distribution Channels

- Banks

- Agencies

- Direct

- Others

Need help to buy this report?