South Korea Weight Loss Market Size, Share, and COVID-19 Impact Analysis, By Function (Diet (Supplements, Meals, Beverages), Equipment Type (Fitness Equipment (Cardiovascular Equipment, Strength Training Equipment, Others),Surgical Equipment (Minimally Invasive/ Bariatric Equipment, Non-Invasive Equipment), Service(Fitness Centers and Health Clubs, Consulting Service, Surgical Clinics, Online Weight Loss Programs, Others )), By Gender (Men, Women), and South Korea Weight Loss Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareSouth Korea Weight Loss Market Insights Forecasts to 2035

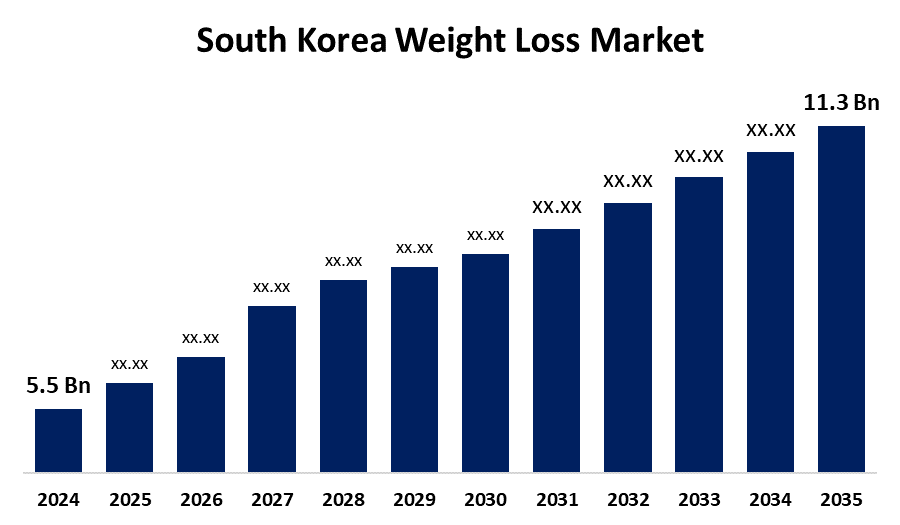

- The South Korea Weight Loss Market Size was Estimated at USD 5.5 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.76% from 2025 to 2035

- The South Korea Weight Loss Market Size is Expected to Reach USD 11.3 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the South Korea Weight Loss Market Size is Anticipated to Reach USD 11.3 Billion by 2035, Growing at a CAGR of 6.76% from 2025 to 2035. Increasing awareness of health and wellness, the proliferation of gyms, fitness studios, and wellness centers, and the growing demand for meal replacement shakes, bars, and snacks are some of the major factors propelling the market.

Market Overview

The weight loss market in South Korea includes a wide range of goods, services, and medical procedures meant to assist people in controlling their weight, lowering body fat, and reaching their desired aesthetic or health-related objectives. This market is distinguished by a combination of cutting-edge medical treatments and digital health tools with more conventional strategies like diet and exercise. Moreover, Weight loss products and services are becoming more popular as people try to meet different beauty standards due to the growing cultural emphasis on physical appearance. In addition, the country's market is being positively impacted by the increasing use of wearable fitness trackers and health monitoring devices, which allow users to keep an eye on their daily calorie intake, physical activity, and even sleep patterns. Additionally, a more comprehensive approach to health is being provided by the growing number of fitness studios, gyms, and wellness centers. The need for combined fitness and weight loss programs is being fueled by this. Additionally, the nation's market is expanding due to the growing popularity of meal replacement shakes, bars, and snacks that offer people on the go portion-controlled, nutritionally balanced options.

Report Coverage

This research report categorizes the market for the South Korea weight loss market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea weight loss market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea weight loss market.

South Korea Weight Loss Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5.5 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 6.76% |

| 2035 Value Projection: | USD 11.3 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 150 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Function, Equipment Type, By Gender and COVID-19 Impact Analysis. |

| Companies covered:: | Korean Novo Nordisk Pharmaceuticals, Eli Lilly Korea, NutriVille Korea, BodyFit Korea, SlimTech Korea and Others. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

A promising market outlook is being provided by the expanding range of weight loss options, such as dietary supplements and surgical procedures. Users can select strategies that fit their objectives, lifestyles, and financial constraints thanks to the availability of these options. In addition, a wider range of people can now purchase weight loss products thanks to the growing number of e-commerce platforms. These platforms make it simple for people to peruse a large selection of dietary products, equipment, and supplements for weight loss online. The market is expanding as a result of the growing trend towards sustainable weight loss strategies that prioritize long-term health over temporary solutions. This includes establishing long-term, sustainable exercise and nutrition regimens.

Restraining Factors

Factors like exorbitant prices and inadequate insurance coverage limit the availability of efficient weight loss treatments. For a sizable segment of the population, this restriction impacts their access to treatments like medication and bariatric procedures.

Market Segmentation

The South Korea weight loss market share is classified into function and gender.

- The diet segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea weight loss market is segmented by function into diet, equipment type, and service. Among these, the diet segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This market is dominated by the strong demand for protein shakes, meal replacements, and weight-loss supplements brought on by changing lifestyles and growing health consciousness.

- The women segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea weight loss market is segmented by gender into men and women. Among these, men and women. Among these, the women segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The demand for weight-management strategies, such as exercise regimens, dietary supplements, and surgical procedures, is typically higher among women. This segment's dominance is a result of cultural influences, beauty standards, and growing health consciousness.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea weight loss market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Korean Novo Nordisk Pharmaceuticals

- Eli Lilly Korea

- NutriVille Korea

- BodyFit Korea

- SlimTech Korea

- Others

Recent Developments:

- In October 2024, Korean Novo Nordisk Pharmaceuticals launched the obesity treatment drug Wegovy on Oct. 15, marking a significant milestone 18 months after receiving approval from the Ministry of Food and Drug Safety (MFDS) in April last year. The drug, developed by Danish pharmaceutical giant Novo Nordisk, had already made waves internationally, being touted as the "dream obesity drug" and credited by celebrities like Tesla CEO Elon Musk and model Kim Kardashian for their weight loss success.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea Weight Loss Market based on the below-mentioned segments:

South Korea Weight Loss Market, By Function

- Diet

- Supplements

- Meals

- Beverages

- Equipment Type

- Fitness Equipmen

- Cardiovascular Equipment

- Strength Training Equipment

- Others

- Surgical Equipment

- Minimally Invasive/ Bariatric Equipment

- Non-Invasive Equipment

- Service

- Fitness Centers and Health Clubs

- Consulting Service

- Surgical Clinics

- Online Weight Loss Programs

- Others

South Korea Weight Loss Market, By Gender

- Men

- Women

Need help to buy this report?