South Korea Virtual Cards Market Size, Share, and COVID-19 Impact Analysis, By Card Type (Debit Card and Credit Card), By Product Type (B2B Virtual Cards and B2C Remote Payment Virtual Cards), By Application (Business Use and Consumer Use), and South Korea Virtual Cards Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologySouth Korea Virtual Cards Market Insights Forecasts to 2035

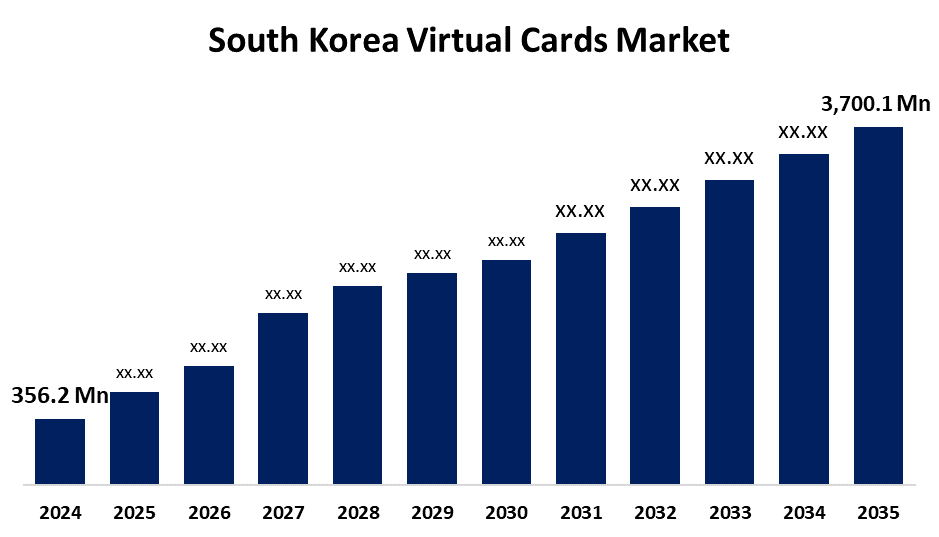

- The South Korea Virtual Cards Market Size Was Estimated at USD 356.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 23.71% from 2025 to 2035

- The South Korea Virtual Cards Market Size is Expected to Reach USD 3,700.1 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the South Korea Virtual Cards Market Size is Anticipated to Reach USD 3,700.1 Million by 2035, Growing at a CAGR of 23.71% from 2025 to 2035. It is anticipated that the increasing volume of digital transactions can drive demand for different kinds of virtual cards, which will support market expansion.

Market Overview

The financial ecosystem surrounding digital payment methods that serve as alternatives to actual credit or debit cards is included in the virtual card market. These cards, which are only available digitally, are used for online purchases and provide more ease and security than conventional payment options. Revenues from the issuing and use of these digital cards for e-commerce, subscription services, and business-to-business transactions are included in the market. When it comes to security, virtual credit cards are better than physical ones. They are made to create distinct card numbers for transactions, frequently with a one-time use limit or time limit. Since the information is rendered invalid following the transaction, this greatly lowers the chance of fraud. Virtual cards are more secure against fraud and data breaches because they provide distinct card numbers for every transaction, hiding the real card information. By doing away with manual procedures and lowering administrative expenses, virtual cards streamline the payment process for both customers and businesses. To improve the simplicity and security of payments, governments are pushing businesses to create and use virtual card solutions.

Report Coverage

This research report categorizes the market for South Korea virtual cards market based on various segments and regions forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea virtual cards market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment South Korea virtual cards market.

South Korea Virtual Cards Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 356.2 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 23.71% |

| 2035 Value Projection: | USD 3,700.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 150 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Card Type, By Product Type and COVID-19 Impact Analysis |

| Companies covered:: | G & T Corporation, G-Medcos International, SK Marketing & Company, SHINSONG PAPER TECH IND, LTD, Hansol Paper, Sindoh, Neu-chem Co., Ltd, J K International Co, K M Chart Co., Ltd, Commart Co., Ltd, Donghwa Ind Co., Ltd, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The surge in e-commerce and digital payments is fueling demand for secure and efficient online transactions. Enhanced security features such as one-time-use numbers, tokenization, and spending limits address fraud concerns and encourage wider adoption. The rise of subscription-based services, instant card issuance, cost savings from eliminating physical cards, and integration with mobile wallets streamline payment processes, further propelling market growth.

Restraining Factors

The virtual cards market is constrained by limited merchant acceptance, particularly in brick-and-mortar environments, due to infrastructure gaps and outdated POS systems. Low consumer awareness and unfamiliarity with virtual card usage further hinder adoption. Regulatory and compliance challenges across jurisdictions such as AML, KYC, and data protection standards add complexity and cost.

Market Segmentation

The South Korea virtual cards market share is classified into card type, product type, and application.

- The debit card segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea virtual cards market is segmented by card type into debit card and credit card. Among these, the debit card segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period. The demand for virtual debit cards is anticipated to be fuelled by the increasing number of net banking customers.

- The B2B virtual cards segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea virtual cards market is segmented by product type into B2B virtual cards and B2C remote payment virtual cards. Among these, the B2B virtual cards segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The demand for business-to-business (B2B) transactions has increased due to the growing imports and exports of products and services worldwide. This is anticipated to fuel the demand for B2B virtual cards. Instead of depending on outdated techniques like paper checks, businesses are incorporating virtual cards into their business-to-business (B2B) payment processes to enhance cash flow, boost security, and make Accounts Payable (AP) automation easier.

- The business use segment dominated the share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea virtual cards market is segmented by application into business use and consumer use. Among these, the business use segment dominated the share in 2024 and is expected to grow at a significant CAGR during the forecast period. Businesses pay suppliers and merchants online using virtual cards. Due to their inability to be lost or stolen, these cards offer a higher level of protection than conventional credit and debit cards. Additionally, the likelihood of fraud is decreased because these cards can only be used once or for a restricted number of transactions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea virtual cards market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

• G & T Corporation

• G-Medcos International

• SK Marketing & Company

• SHINSONG PAPER TECH IND, LTD

• Hansol Paper

• Sindoh

• Neu-chem Co., Ltd

• J K International Co

• K M Chart Co., Ltd

• Commart Co., Ltd

• Donghwa Ind Co., Ltd

• Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea virtual cards market based on the below-mentioned segments:

South Korea Virtual Cards Market, By Card Type

- Debit Card

- Credit Card

South Korea Virtual Cards Market, By Product Type

- B2B Virtual Cardsa

- B2C Remote Payment Virtual cards

South Korea Virtual Cards Market, By Application

- Business Use

- Consumer Use

Need help to buy this report?