South Korea Van Market Size, Share, and COVID-19 Impact Analysis, By Tonnage Capacity (Upto 2 Tons, 2 to 3 Tons, and 3 to 5.5 Tons), By Propulsion (Internal Combustion Engine (ICE), Hybrid, Electric, and Others), and South Korea Van Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationSouth Korea Van Market Insights Forecasts to 2035

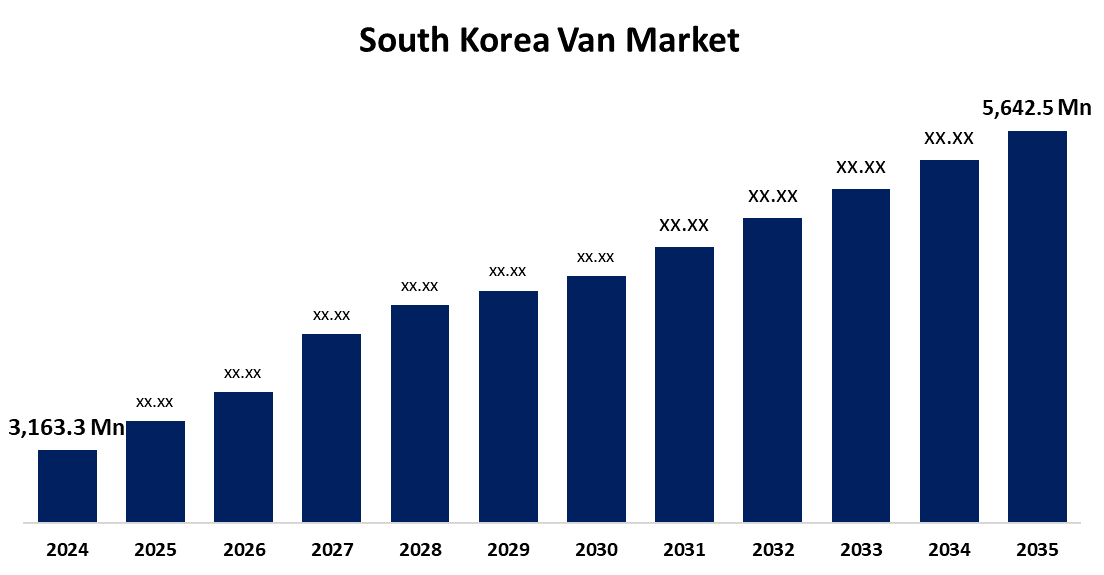

- The South Korea Van Market Size was Estimated at USD 3,163.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.40% from 2025 to 2035

- The South Korea Van Market Size is Expected to Reach USD 5,642.5 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the South Korea Van Market Size is Anticipated to reach USD 5,642.5 Million by 2035, Growing at a CAGR of 5.40% from 2025 to 2035. The demand for small, low-emission transportation options is rising as a result of growing metropolitan areas and smart infrastructure initiatives.

Market Overview

The South Korea van market refers to the industry sector devoted to the manufacture, distribution, and operation of light commercial vehicles (LCVs), mainly vans, used for the transportation of passengers and goods between urban and rural areas is known as the South Korean van market. Additionally, through a combination of financial incentives, regulatory requirements, and infrastructure development, the South Korean government is hastening the adoption of electric vans. Businesses can now buy multiple subsidized EVs at once thanks to loosened regulations, and buyers of electric vans under KRW 55–60 million can receive subsidies of up to KRW 6.5 million. Automakers are expanding their EV lineups in response to emissions targets and sales quotas; Hyundai's ST1 and KG Mobility's Torres EVX are emerging as flagship models. To further demonstrate its dedication to a low-emission commercial vehicle ecosystem, the government also plans to install 1.23 million EV chargers by 2030. Moreover, the demand for low-emission, networked vans that connect to urban mobility platforms is increased by South Korea's smart city initiatives, providing prospects for fleet services that are powered by technology.

Report Coverage

This research report categorizes the market for the South Korea van market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea van market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea van market.

South Korea Van Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3,163.3 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.40% |

| 2035 Value Projection: | USD 5,642.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Tonnage Capacity, By Propulsion and COVID-19 Impact Analysis. |

| Companies covered:: | Hyundai Motor Co., Kia Corporation, Renault Korea Motors and Other |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Demand for last-mile delivery vans has increased dramatically in South Korea due to the country's fast internet, high smartphone usage, and convenience-driven consumer base. as they can handle frequent short-distance trips, efficiently navigate crowded urban areas, and satisfy online shoppers' expectations for delivery speed, compact and mid-sized vans are particularly preferred.

Restraining Factors

To the cost of lithium-ion batteries, sophisticated electronics, and limited production economies of scale, electric vans are usually more expensive up front. The initial investment is difficult for many small businesses and fleet operators in South Korea due to budgetary constraints, even though they eventually offer lower operating costs. This is particularly true when ICE vans are still more reasonably priced and extensively supported by existing infrastructure.

Market Segmentation

The South Korea van market share is classified into tonnage capacity and propulsion.

- The upto 2 tons segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea van market is segmented by tonnage capacity into upto 2 tons, 2 to 3 tons, and 3 to 5.5 tons. Among these, the upto 2 tons segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Reflecting a high demand for small, fuel-efficient vans for small business operations, last-mile delivery, and urban logistics.

- The internal combustion engine segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea van market is segmented by propulsion into internal combustion engine (ICE), hybrid, electric, and others. Among these, the internal combustion engine segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Fleet operators find ICE vans to be more convenient due to a well-established network of filling stations and service facilities.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea van market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hyundai Motor Co.

- Kia Corporation

- Renault Korea Motors

- others

Recent Developments:

- In May 2024, KG Mobility, formerly known as SsangYong Motor Co., announced on Thursday that it had launched the Torres EVX Van, marking the debut of the first electric van model in South Korea

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea Van Market based on the below-mentioned segments:

South Korea Van Market, By Tonnage Capacity

- Upto 2 Tons

- 2 to 3 Tons

- 3 to 5.5 Tons

South Korea Van Market, By Propulsion

- Internal Combustion Engine (ICE)

- Hybrid

- Electric

- Others

Need help to buy this report?