South Korea Vacuum Gas Oil Market Size, Share, and COVID-19 Impact Analysis, By Type (Heavy Vacuum Gas Oil, Light Vacuum Gas Oil), By Application (Gasoline Production, Diesel Oil/Kerosene Production, and Others), and South Korea Vacuum Gas Oil Market Insights, Industry Trend, Forecasts to 2035

Industry: Energy & PowerSouth Korea Vacuum Gas Oil Market Insights Forecasts to 2035

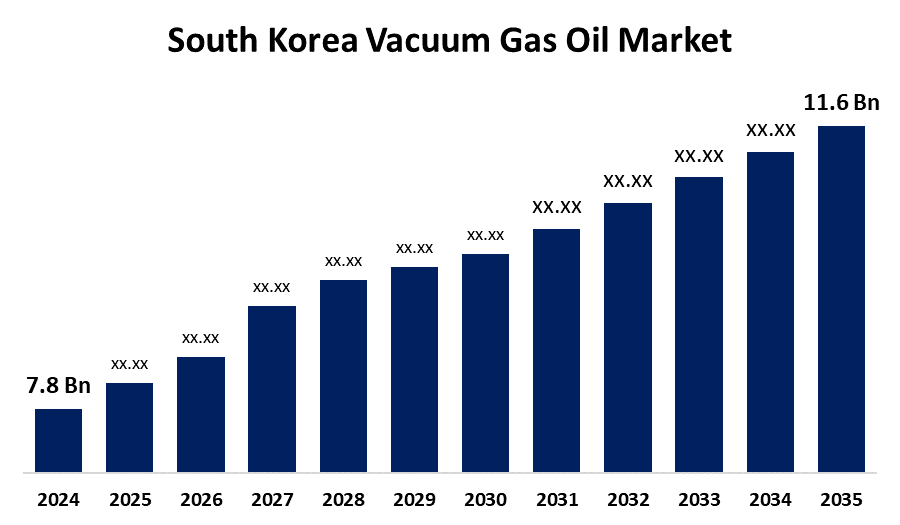

- The South Korea Vacuum Gas Oil Market Size Was Estimated at USD 7.8 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.67% from 2025 to 2035

- The South Korea Vacuum Gas Oil Market Size is Expected to Reach USD 11.6 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The South Korea Vacuum Gas Oil Market Size is anticipated to reach USD 11.6 Billion by 2035, growing at a CAGR of 3.67% from 2025 to 2035. The South Korea vacuum gas oil market is driven by strong refining capacity, rising fuel demand, and petrochemical integration, with key domestic players contributing to stable supply and technological advancement.

Market Overview

The South Korea vacuum gas oil market refers to the industry focused on the production, distribution, and utilization of vacuum gas oil, a heavy hydrocarbon feedstock obtained during the vacuum distillation of crude oil. VGO is primarily used in secondary conversion processes such as catalytic cracking and hydrocracking to produce lighter, high-value petroleum products like gasoline, diesel, and jet fuel. Moreover, South Korea's vacuum gas oil market is driven by rising demand for transportation fuels, expansion of refining capacity, and increasing investments in upgrading secondary processing units like hydrocrackers and FCCs. Strategic imports to optimize feedstock flexibility and compliance with cleaner fuel regulations also support growth. Integration of advanced refining technologies enhances efficiency, boosting overall VGO consumption. Furthermore, by implementing cutting-edge hydrocracking units, investing in residue upgrading technology, and maximising feedstock flexibility, top refiners like SK Innovation and S-Oil can spur growth. Enhancing VGO processing, yield efficiency, and environmental compliance through partnerships with catalyst inventors and the use of AI-based refinery optimisation tools will ultimately boost market competitiveness.

Report Coverage

This research report categorizes the market for South Korea vacuum gas oil market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea vacuum gas oil market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment South Korea vacuum gas oil market.

South Korea Vacuum Gas Oil Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 7.8 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 3.67% |

| 2035 Value Projection: | USD 11.6 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 236 |

| Tables, Charts & Figures: | 103 |

| Segments covered: | By Type and By Application |

| Companies covered:: | SK Innovation Co., Ltd., Hyundai Oilbank Co., Ltd., GS Caltex Corporation, S-Oil Corporation, Korea National Oil Corporation (KNOC), Hanwha TotalEnergies Petrochemical Co., Ltd., Daesan Petrochemical Complex, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

A major driver of South Korea’s vacuum gas oil (VGO) market is the increasing integration of AI and digital twin technologies in refinery operations, optimizing VGO yield and conversion rates. Additionally, rising marine fuel demand due to South Korea’s shipbuilding strength and IMO 2020 sulfur regulations is indirectly increasing desulfurized product needs, thus boosting VGO use. Strategic stockpiling for energy security also fuels sustained domestic VGO processing and trade activity. Moreover, a public-private joint promotion team has been formed by the South Korean government to spearhead the development of liquefied hydrogen transporters. By 2027, the world's largest demonstration ship will be built, establishing South Korea as a leader in the hydrogen transport sector, with an expenditure of 55.5 billion won made in 2025.

Restraining Factors

High dependency on crude oil imports, environmental regulations, fluctuating global oil prices, and growing adoption of cleaner energy alternatives are key restraining factors impacting South Korea's vacuum gas oil market growth.

Market Segmentation

The South Korea Vacuum Gas Oil Market share is classified into type and application.

- The heavy vacuum gas oil segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea vacuum gas oil market is segmented by type into heavy vacuum gas oil, light vacuum gas oil. Among these, the heavy vacuum gas oil segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its extensive use in fluid catalytic cracking (FCC) units for producing gasoline and diesel. Its higher yield potential and compatibility with refining processes make it more preferred by refineries, driving its dominant market position.

- The diesel oil/kerosene production segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea vacuum gas oil market is segmented by application into gasoline production, diesel oil/kerosene production, and others. Among these, the diesel oil/kerosene production segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This dominance is driven by strong domestic demand for transportation and industrial fuels. Additionally, South Korea's advanced refining infrastructure supports efficient VGO upgrading into middle distillates, enhancing the segment's overall market share and growth potential.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea vacuum gas oil market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SK Innovation Co., Ltd.

- Hyundai Oilbank Co., Ltd.

- GS Caltex Corporation

- S-Oil Corporation

- Korea National Oil Corporation (KNOC)

- Hanwha TotalEnergies Petrochemical Co., Ltd.

- Daesan Petrochemical Complex

- Others

Recent Development News:

- In January 2025, Co-founded by KOBC and the Ministry of Oceans and Fisheries, South Korea established a Won 1 trillion green marine fuel infrastructure fund, allocating Won 600 billion for facilities to store LNG, methanol, and ammonia, and Won 400 billion for the construction of four bunkering vessels.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea Vacuum Gas Oil Market based on the below-mentioned segments:

South Korea Vacuum Gas Oil Market, By Type

- Heavy Vacuum Gas Oil

- Light Vacuum Gas Oil

South Korea Vacuum Gas Oil Market, By Application

- Gasoline Production

- Diesel Oil/Kerosene Production

- Others

Need help to buy this report?