South Korea Used Car Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (Hatchbacks, Sedans, and SUVs.), By Vendor Type (Organized, Unorganized), By fuel Type (Diesel, Petrol, Others), By Sale Channel (Franchised Dealers, Independent Dealers, Online, Others), and South Korea Used Car Market Insights Forecasts 2023 - 2033

Industry: Automotive & TransportationSouth Korea Used Car Market Size Insights Forecasts to 2033

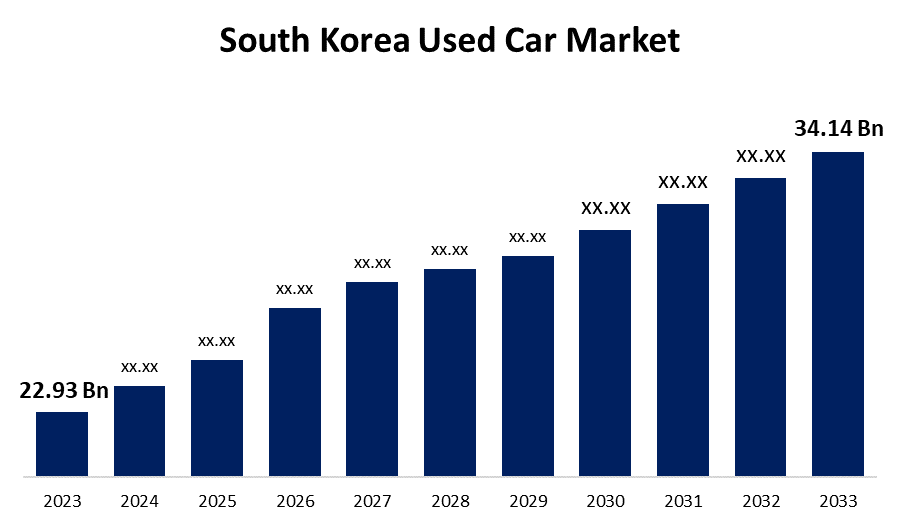

- The South Korea Used Car Market Size was valued at USD 22.93 Billion in 2023.

- The Market Size is Growing at a CAGR of 4.06% from 2022 to 2033.

- The South Korea Used Car Market Size is Expected to reach USD 34.14 Billion by 2033.

Get more details on this report -

The South Korea Used Car Market Size is expected to reach USD 34.14 Billion by 2032, at a CAGR of 4.06% during the forecast period 2023 to 2033.

Market Overview

A used car is also known as a second-hand car or a pre-owned vehicle. A used automobile is a previously owned vehicle by one or more retail owners. Used cars can be purchased from a variety of sources, including franchise and independent car dealerships, rental car companies, leasing agencies, auctions, and private party sales. Some car dealerships offer no-haggle pricing, certified pre-owned vehicles, and extended service contracts. Purchasing a used car is less expensive than purchasing a new car and has lower car insurance rates. People buy used cars to learn about car characteristics and to learn to drive. Three factors influence the price of a used car: the dealer or retailer price, the dealer or wholesale price, and the private party price. The internet's growth has increased the availability of information on used vehicle pricing and information that was previously available in trade journals, but there are now several sites where you can quickly discover the used car based on region. A used car has several advantages, including lower vehicle depreciation, lower car insurance rates, a vehicle warranty, and no hidden fees.

Report Coverage

This research report categorizes the market for South Korea used car market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea used car market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea used car market.

South Korea Used Car Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 22.93 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.06% |

| 2033 Value Projection: | USD 34.14 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Vehicle Type, By Fuel Type, By Sale Channel, By Vendor Type |

| Companies covered:: | Autowini Inc., Robert’s Used Car, KB Cha Cha Cha, K Car, Encar, Used Car Korea, Sena Trading, Car Vision, Be Forward, PicknBuy24, Han Sung Motor, Aj Sell Car, Pickplus, Hyundai Glovis, Corea-Auto, and other key vendors. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

The growth of the South Korean used car market is being driven by rising demand for luxury used cars, rising disposable income, and rising financial penetration. Furthermore, the increasing penetration of online platforms and improved after-sales services are providing opportunities for the market to grow. Some of the factors expected to drive market growth during the forecast period include automakers' increasing focus on setting up used car networks and customers' growing preference for used cars.

Restraining Factors

High financing costs for a used car may hinder market growth. The price of a used car is determined by the vehicle's freshness, quality, and the form of its pricing; for example, if it is a private party seller, the price may be higher than the normal buying price, which can have a negative impact on the market's growth.

Market Segment

- In 2023, the SUVs segment accounted for the largest revenue share over the forecast period.

Based on the vehicle type, the South Korea used car market is segmented into hatchbacks, sedans, and SUVs. Among these, the SUVs segment has the largest revenue share over the forecast period. SUV stands for sports utility vehicle and is often classified based on the size of the vehicle, such as full-size SUV, compact SUV, and sport coupe SUV. Higher ground clearance, easy access and exit, high engine power, off-road capability, improved visibility, and superior safety are the primary characteristics that drive market demand for SUVs. SUVs are also popular for their roominess, safety, and off-road capability, among other things.

- In 2023, the organized segment accounted for the largest revenue share over the forecast period.

Based on vendor type, the South Korea used car market is segmented into organized, unorganized. Among these, the organized segment has the largest revenue share over the forecast period. This is due to an increase in the number of franchised dealers in the market. The market's growth has been fueled by the entry of new players and the development of new retail models. Furthermore, organized vendors benefited from increased brand loyalty across all age groups.

- In 2023, The petrol segment accounted for the largest market share over the forecast period.

Based on fuel type, the South Korea used car market is segmented into diesel, petrol, and others. Among these, the petrol segment held the largest market share over the forecast period. A spark-ignited internal combustion engine powers a petrol car. It is intended to run on gasoline and other volatile fuels. The vast majority of automobiles on the road today are powered by gasoline. Furthermore, a large portion of petrol vehicles are used cars. When compared to diesel and other vehicles, the price of these fuel-type vehicles is reasonable. Low prices, less engine noise compared to diesel, and greater market availability are the factors driving the desire for petrol cars in the used car market.

- In 2023, the franchised dealers segment accounted for a significant revenue share over the forecast period.

Based on the sale channel, the South Korea used car market is segmented into franchised dealers, independent dealers, online, and others. Among these, the franchised dealer segment has a significant revenue share over the forecast period. A franchised dealer is a dealership that sells new and used vehicles to customers. Several factors, including vehicle accessibility, pre-owned certified vehicles, immediate vehicle delivery, and brand trust, are driving the growth of franchised dealers, particularly in the market. Negotiating prices, various product testing, the expansion of internet infrastructure, and post-sale services are also important used car market trends for franchised dealers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea used car market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Autowini Inc.

- Robert's Used Car

- KB Cha Cha Cha

- K Car

- Encar

- Used Car Korea

- Sena Trading

- Car Vision

- Be Forward

- PicknBuy24

- Han Sung Motor

- Aj Sell Car

- Pickplus

- Hyundai Glovis

- Corea-Auto

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2023, according to a report released by the Korean International Trade Association (KITA), South Korea's used vehicle exports to Russia will increase by 1,163% in 2022, as new car releases are prohibited due to the ongoing conflict in Ukraine. Furthermore, the association revealed that Russia contributed 4.9% of total overseas used car shipments from South Korea in 2022, with a unit shipment of 19,626 used vehicles.

- In January 2022, to diversify its business portfolio, Hyundai Glovis announced the launch of Autobell, a South Korean online platform for used car sales.

Market Segment

This study forecasts revenue at regional, and country levels from 2023 to 2033. Spherical Insights has segmented the South Korea Used Car Market based on the below-mentioned segments:

South Korea Used Car Market, By Vehicle Type

- Hatchbacks

- Sedans

- SUVs

South Korea Used Car Market, By Vendor Type

- Organized

- Unorganized

South Korea Used Car Market, By Fuel Type

- Diesel

- Petrol

- Others

South Korea Used Car Market, By Sale Channel

- Franchised Dealers

- Independent Dealers

- Online

- Others

Need help to buy this report?