South Korea Unidirectional Tapes Market Size, Share, and COVID-19 Impact Analysis, By Product (Thermoplastic and Thermoset), By Fiber (Carbon, Glass, and Other Fiber), By End Use (Aerospace & Defense and Automotive), and South Korea Unidirectional Tapes Market Insights, Industry Trend, Forecasts to 2035

Industry: Advanced MaterialsSouth Korea Unidirectional Tapes Market Insights Forecasts to 2035

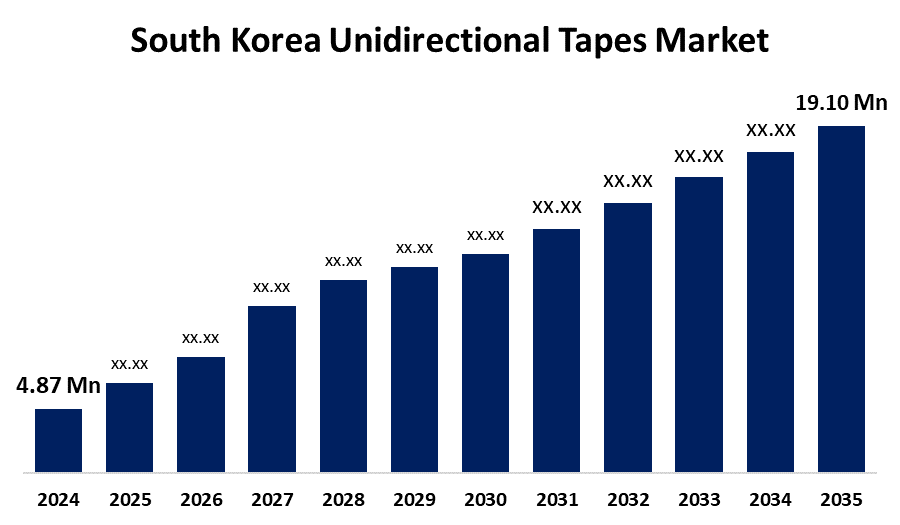

- The South Korea Unidirectional Tapes Market Size Was Estimated at USD 4.87 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 13.23% from 2025 to 2035

- The South Korea Unidirectional Tapes Market Size is Expected to Reach USD 19.10 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the South Korea Unidirectional Tapes Market Size is Anticipated to Reach USD 19.10 Million by 2035, Growing at a CAGR of 13.23% from 2025 to 2035. The demand for unidirectional tapes is anticipated to be driven by the expanding need for lightweight components in the automotive and aerospace industries.

Market Overview

The unidirectional tapes market refers to high-performance composite materials consisting of continuous fibers aligned in a single direction, typically embedded in a thermoplastic or thermoset resin. These tapes offer exceptional strength-to-weight ratios, stiffness, and design flexibility, making them ideal for aerospace, automotive, and sports equipment applications. Lightweight construction, corrosion resistance, and enhanced structural performance. Expanding electric vehicle production, renewable energy, and advanced manufacturing sectors. In South Korea, government initiatives supporting carbon neutrality, smart mobility, and materials innovation are fostering growth. Policies promoting lightweight materials in transportation and defense, along with investments in carbon fiber technology and advanced composites R&D, are helping domestic firms expand their capabilities and compete globally in the evolving unidirectional tapes market.

Report Coverage

This research report categorizes the market for South Korea unidirectional tapes market based on various segments and regions forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea unidirectional tapes market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment South Korea unidirectional tapes market.

South Korea Unidirectional Tapes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.87 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 13.23% |

| 2035 Value Projection: | USD 19.10 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 120 |

| Tables, Charts & Figures: | 135 |

| Segments covered: | By Product, By Fiber, By End Use and COVID-19 Impact Analysis. |

| Companies covered:: | Kolon Industries, Hyosung Chemical, Kumho Petrochemical, Korea Engineering Kwang Myung Fastener Co., Ltd., Daehyunst Co., Ltd., and |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

High-strength materials across aerospace, automotive, and defense sectors. Growing focus on fuel efficiency and emission reduction encourages the use of composites in structural components. Technological advancements in fiber-reinforced thermoplastics and automated tape laying processes further boost adoption. Additionally, the surge in electric vehicle production and renewable energy projects increases the need for durable, high-performance materials.

Restraining Factors

High production costs driven by expensive raw materials like carbon fiber and advanced manufacturing limit adoption, especially among SMEs. Complex fabrication processes require specialized equipment and precise quality control, raising barriers to entry. Regulatory certification in aerospace and automotive adds time and expense, slowing innovation.

Market Segmentation

The South Korea unidirectional tapes market share is classified into product, fiber, and end use.

- The thermoplastic segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea unidirectional tapes market is segmented by product into thermoplastic and thermoset. Among these, the thermoplastic segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period. Its superior recyclability, impact resistance, and ease of processing. These properties make thermoplastic tapes ideal for aerospace, automotive, and sports industries.

- The carbon segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea unidirectional tapes market is segmented by fiber into carbon, glass, and other fiber. Among these, the carbon segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. its high strength-to-weight ratio, stiffness, and thermal resistance. These characteristics make it ideal for aerospace, automotive, and defense applications.

- The aerospace & defense segment dominated the share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea unidirectional tapes market is segmented by end use into aerospace & defense and automotive. Among these, the aerospace & defense segment dominated the share in 2024 and is expected to grow at a significant CAGR during the forecast period. due to increasing demand for lightweight, high-strength materials in aircraft manufacturing. These tapes enhance fuel efficiency, structural integrity, and performance. Ongoing defense modernization and rising aircraft production further drive segment growth during the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea unidirectional tapes market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Kolon Industries

- Hyosung Chemical

- Kumho Petrochemical

- Korea Engineering Plastics (KEP)

- Hansol (Tapex)

- DSO Co., Ltd.

- Kwang Myung Fastener Co., Ltd.

- Daehyunst Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea unidirectional tapes market based on the below-mentioned segments:

South Korea Unidirectional Tapes Market, By Product

- Thermoplastic

- Thermoset

South Korea Unidirectional Tapes Market, By Fiber

- Carbon

- Glass

- Other Fiber

South Korea Unidirectional Tapes Market, By End Use

- Aerospace & Defense

- Automotive

Need help to buy this report?