South Korea Transcatheter Devices Market Size, Share, and COVID-19 Impact Analysis, By Product (Transcatheter Embolization & Occlusion Devices, and Transcatheter Replacement Devices), By Application (Cardiovascular and Oncology), and South Korea Transcatheter Devices Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsSouth Korea Transcatheter Devices Market Insights Forecasts to 2035

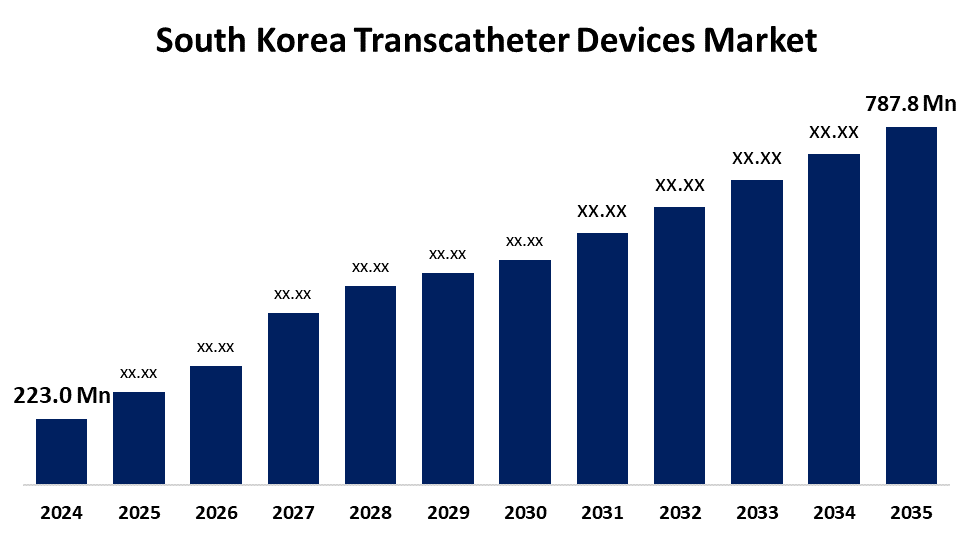

- The South Korea Transcatheter Devices Market Size Was Estimated at USD 223.0 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 12.16% from 2025 to 2035

- The South Korea Transcatheter Devices Market Size is Expected to Reach USD 787.8 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the South Korea Transcatheter Devices Market Size is Anticipated to reach USD 787.8 Million by 2035, Growing at a CAGR of 12.16% from 2025 to 2035. Market's expansion is the rising demand for minimally invasive procedures and surgeries, or MIS. Comparing these procedures to invasive ones like open heart operations, the patient has less trauma and recovers more quickly. MIS improves patient outcomes and economic feasibility from both a local and macro level by reducing the need for hospital stays.

Market Overview

The market for medical devices used in minimally invasive treatments, mainly in the cardiovascular and other therapeutic domains, is included in the transcatheter devices market. Stents, valves, and embolization devices are among the less invasive alternatives to open operations that are administered through catheters to treat a variety of ailments. The rising incidence of chronic illnesses, improvements in minimally invasive technology, and consumers' increased desire for operations with lower risks and quicker recovery times are some of the reasons propelling the industry. Smaller incisions are made during transcatheter operations, which lessens post-operative pain and bodily stress. Compared to open surgery, the risk of infection is reduced with smaller incisions and less tissue manipulation. For patients and healthcare providers looking for lower risks and quicker recovery, transcatheter devices present a less intrusive option to open-heart surgery. By promoting domestic production of medical devices, especially those used in transcatheter treatments, these programs lessen dependency on imports and increase device accessibility.

Report Coverage

This research report categorizes the market for South Korea transcatheter devices market based on various segments and regions forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea transcatheter devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment South Korea transcatheter devices market.

South Korea Transcatheter Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 223.0 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 12.16% |

| 2035 Value Projection: | USD 787.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 150 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Product, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | Samsung Medison, JW Medical Corporation, Medtronic Plc, BIOTRONIK Korea Co., Ltd., Boston Scientific Corporation, Abbott Laboratories, Terumo Corp, GE Healthcare, Canon Medical Systems Asia Pte. Ltd and Other. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing prevalence of cardiovascular diseases, growing preference for minimally invasive procedures, and advancements in device technology. Aging populations and rising healthcare expenditures further boost demand. Technological innovations, such as improved catheter design and imaging guidance, enhance procedural success rates. Additionally, expanding applications in oncology and structural heart interventions support market growth.

Restraining Factors

High device and procedural costs restrict access, especially in emerging regions with limited reimbursement. Strict regulatory pathways and lengthy clinical trials can delay product launches and increase development expenses. Risks such as device failures, thrombosis, and anatomical variability may result in complications, affecting clinician and patient confidence

Market Segmentation

The South Korea transcatheter devices market share is classified into product and application.

- The transcatheter embolization & occlusion devices segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea transcatheter devices market is segmented by product into transcatheter embolization & occlusion devices, and transcatheter replacement devices. Among these, the transcatheter embolization & occlusion devices segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period. A less invasive option to conventional surgical valve replacements is provided by transcatheter replacement devices. Patients and healthcare professionals find these operations appealing due to their faster recovery times, shorter hospital stays, and decreased incidence of complications. It is anticipated that ongoing technical developments and a rise in product releases by industry participants will sustain market expansion.

- The cardiovascular segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea transcatheter devices market is segmented by application into cardiovascular and oncology. Among these, the cardiovascular segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The rising prevalence of heart diseases, the aging population, and the increased adoption of minimally invasive procedures. Advancements in transcatheter technologies, such as TAVR and mitral valve repair, further drive demand. Growing awareness and improved healthcare infrastructure also contribute to its strong growth in South Korea.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea transcatheter devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Samsung Medison

- JW Medical Corporation

- Medtronic Plc

- BIOTRONIK Korea Co., Ltd.

- Boston Scientific Corporation

- Abbott Laboratories

- Terumo Corp

- GE Healthcare

- Canon Medical Systems Asia Pte. Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea transcatheter devices market based on the below-mentioned segments:

South Korea Transcatheter Devices Market, By Product

- Transcatheter Embolization & Occlusion Devices

- Transcatheter Replacement Devices

South Korea Transcatheter Devices Market, By Application

- Cardiovascular

- Oncology

Need help to buy this report?