South Korea Trade Finance Market Size, Share, and COVID-19 Impact Analysis, By Finance Type (Structured Trade Finance, Supply Chain Finance, Traditional Trade Finance), By Offering (Letters of Credit, Bill of Lading, Export Factoring, Insurance, and Others), By Service Provider (Banks, Trade Finance Houses), By End-user (Small and Medium Sized Enterprises (SMEs), Large Enterprises), and South Korea Trade Finance Market Insights Forecasts 2023 - 2033

Industry: Banking & FinancialSouth Korea Trade Finance Market Size Insights Forecasts to 2033

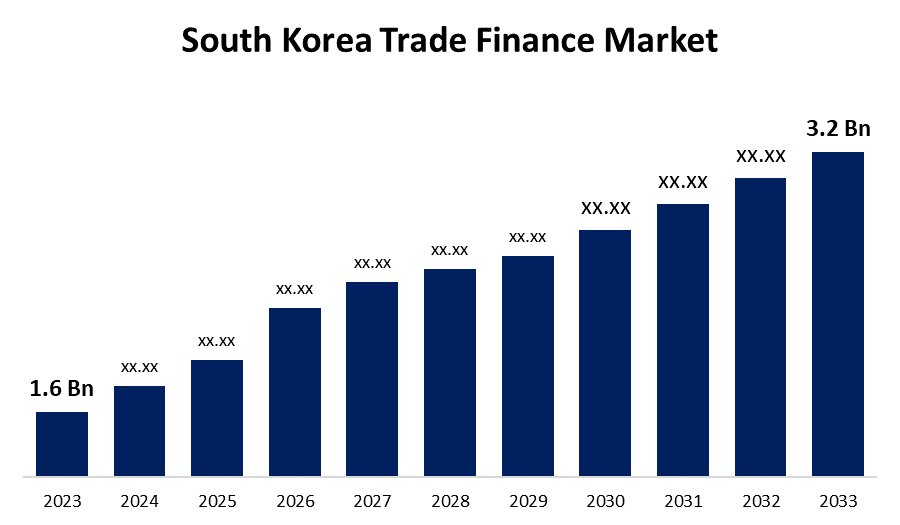

- The South Korea Trade Finance Market Size was valued at USD 1.6 Billion in 2023.

- The Market Size is Growing at a CAGR of 7.18% from 2023 to 2033.

- The South Korea Trade Finance Market Size is Expected to Reach USD 3.2 Billion by 2033.

Get more details on this report -

The South Korea Trade Finance Market Size is Expected to reach USD 3.2 Billion by 2033, at a CAGR of 7.18% during the Forecast period 2023 to 2033.

Market Overview

Trade finance is the financing of international trade flows by acting as an intermediary between importers and exporters to reduce transaction risks and improve business working capital efficiency. It is concerned with activities related to domestic and international trade financing. Issuing letters of credit (LCs), receivables and invoice finance, credit agency, export finance, bank guarantees, and insurance are all examples of trade finance. Traders, buyers, sellers, manufacturers, importers, and exporters use it to simplify financing and deal with cash, credit, investments, and other assets for trade purposes. The main advantage of trade finance is that it makes it simple to arrange short-term financing. The major factors driving the trade finance market growth are an increase in the need for safety and security in trading activities, an increase in the adoption of trade finance by SMEs in the country, increased competition, and new trade agreements.

Report Coverage

This research report categorizes the market for the South Korean trade finance market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea trade finance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea trade finance market.

South Korea Trade Finance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.6 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 7.18% |

| 023 – 2033 Value Projection: | USD 3.2 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Finance, By Offering, By Service Provider, By End-user, and COVID-19 Impact Analysis |

| Companies covered:: | Bank of America, Bank of New York Mellon, Citibank, HSBC, Woori Bank, Hana Bank, Nonghyup Bank, Shinhan Bank, BNP Paribas, KB Kookmin Bank, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

During the forecast period, the integration of blockchain technology in trade finance is expected to provide a lucrative trade finance market opportunity. The importers segment gained a significant trade finance market share during the forecast period due to an increase in market abuse and irregularities in trading activities in companies, which resulted in the generation of a massive volume of unstructured data, driving demand for trade finance in this sector. However, the trader’s segment is expected to grow at the fastest rate during the trade finance market forecast period. Rise in multiple communication channels, trading technologies, regulatory compliances, and managing an individual's wealth accounts are expected to emerge as growth opportunities for trade finance traders. The dynamic and ever-changing regulatory environment plays an important role in driving the trade finance market. Governments and international organizations are enacting new regulations and standards affecting cross-border trade in response to financial crises and shifting geopolitical landscapes.

Market Segment

- In 2023, the supply chain finance segment accounted for the largest revenue share over the forecast period.

Based on the finance type, the South Korea trade finance market is segmented into structured trade finance, supply chain finance, and traditional trade finance. Among these, the supply chain finance segment has the largest revenue share over the forecast period. Supply chain finance (SCF) refers to financing solutions that maximize working capital throughout the supply chain. SCF enables businesses to extend payment terms to suppliers while also providing early payment options to suppliers in need of liquidity. This market is growing in popularity due to its ability to improve efficiency, lower costs, and mitigate risks in complex and South Korean supply chains. It is especially advantageous for SMEs because it increases their access to affordable financing, thereby supporting business growth and strengthening supplier relationships.

- The letters of credit segment is witnessing significant CAGR growth over the forecast period.

Based on offering, the South Korea trade finance market is segmented into letters of credit, bills of lading, export factoring, insurance, and others. Among these, the letters of credit segment is witnessing significant CAGR growth over the forecast period. Letters of credit accounted for a significant share of the market because they provide a secure method for international trade transactions by guaranteeing payment to the seller upon presentation of compliant shipping documents. They provide a high level of risk mitigation, especially for parties new to trade relationships or dealing with volatile trading environments. They are classified as revocable or irrevocable, with irrevocable letters of credit being the most commonly used due to their binding nature.

- The banks segment is witnessing rapid CAGR growth over the forecast period.

Based on the service provider, the South Korea trade finance market is segmented into banks, and trade finance houses. Among these, the banks segment is witnessing rapid CAGR growth over the forecast period. Banks provide a variety of trade finance services, such as letters of credit, trade credit insurance, and export financing. Banks have a well-established presence and extensive networks, making them the first choice for many international businesses. They play a multifaceted role because they not only provide financing but also provide expertise in navigating complex trade regulations and compliance issues. Banks are trusted partners in trade transactions for both buyers and sellers, leveraging their financial strength and reputation to facilitate secure and efficient South Korean trade.

- In 2023, the large enterprises segment accounted for the largest revenue share over the forecast period.

Based on the end-user, the South Korea trade finance market is segmented into small and medium-sized enterprises (SMEs), and large enterprises. Among these, the large enterprises segment has the largest revenue share over the forecast period. Large corporations engage in extensive international trade activities, frequently managing complex supply chains and high transaction volumes. Trade finance is an important tool for large enterprises to optimize working capital, mitigate risks, and ensure the smooth flow of goods and services across borders. They typically have established relationships with major banks and financial institutions, giving them access to a variety of trade finance solutions, such as letters of credit, export financing, and trade credit insurance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea trade finance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bank of America

- Bank of New York Mellon

- Citibank

- HSBC

- Woori Bank

- Hana Bank

- Nonghyup Bank

- Shinhan Bank

- BNP Paribas

- KB Kookmin Bank

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2022, Shinhan Bank of Korea introduced S-TBML to increase its competitiveness in the global trade finance market. Shinhan Bank in South Korea has implemented a large data-driven anti-money laundering (AML) system to identify questionable trade transactions and boost its competitiveness in the global trade financing market.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the South Korean Trade Finance Market based on the below-mentioned segments:

South Korea Trade Finance Market, By Finance Type

- Structured Trade Finance

- Supply Chain Finance

- Traditional Trade Finance

South Korea Trade Finance Market, By Offering

- Letters of Credit

- Bill of Lading

- Export Factoring

- Insurance

- Others

South Korea Trade Finance Market, By Service Provider

- Banks

- Trade Finance Houses

South Korea Trade Finance Market, By End-user

- Small and Medium Sized Enterprises (SMEs)

- Large Enterprises

Need help to buy this report?