South Korea Thermal Paper Market Size, Share, and COVID-19 Impact Analysis, By Width (57mm and 80mm), By Application (POS, Tags & Label, Lottery & Gaming, Ticketing, and Medical), By Technology (Direct Transfer and Thermal Transfer), and South Korea Thermal Paper Market Insights, Industry Trend, Forecasts to 2035

Industry: Advanced MaterialsSouth Korea Thermal Paper Market Insights Forecasts to 2035

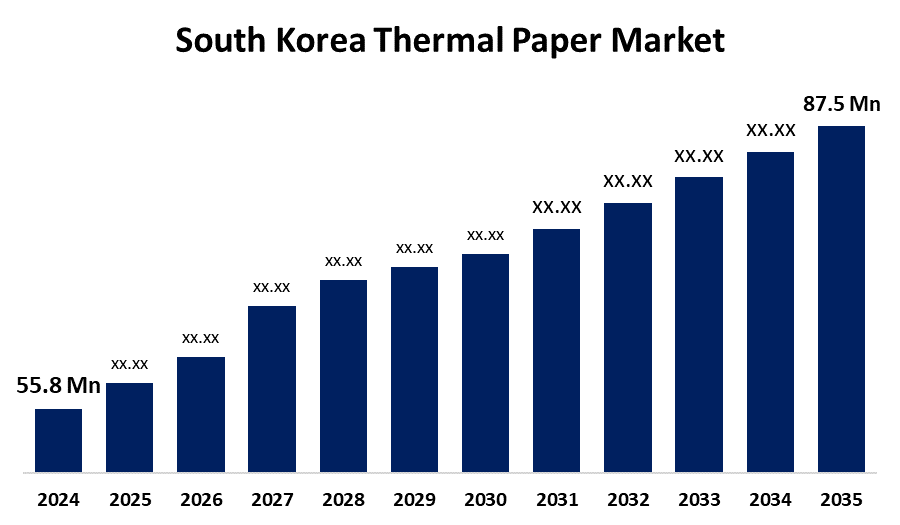

- The South Korea Thermal Paper Market Size Was Estimated at USD 55.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.17% from 2025 to 2035

- The South Korea Thermal Paper Market Size is Expected to Reach USD 87.5 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the South Korea Thermal Paper Market Size is Anticipated to Reach USD 87.5 Million by 2035, Growing at a CAGR of 4.17% from 2025 to 2035. The market's growth is the retail and e-commerce industries' explosive rise. Thermal paper is widely used for labels, tags, and point-of-sale (POS) receipts. Shipping labels and tracking tags, which are mostly composed of thermal paper, are in more demand as online purchasing grows. Thermal paper is used by retail establishments and logistics companies because it is economical, dependable, and effective at producing fast printouts, which increases consumer demand.

Market Overview

Thermal printers for receipts, labels, and tickets, thermal paper is a specialty kind of paper coated with a heat-sensitive chemical that changes color when heated. It is renowned for using only heat from a thermal printer to create images instead of ink or toner. Thermal paper doesn't require ink cartridges or ribbons, printing costs are reduced overall. Because thermal printers have fewer moving components, they require less maintenance and cost less. The need for thermal paper for invoicing, packing slips, and shipping labels is being driven by the expansion of e-commerce. Another significant user of thermal paper for tickets is the gaming and lottery sectors. Governments are promoting cashless transactions, which increases the usage of point-of-sale (POS) systems and, in turn, thermal paper for receipts. The need for thermal paper is further increased by the need for dependable labeling and tagging solutions for logistics brought on by the expansion of e-commerce.

Report Coverage

This research report categorizes the market for South Korea thermal paper market based on various segments and regions forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea thermal paper market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment South Korea thermal paper market.

South Korea Thermal Paper Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 55.8 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 4.17% |

| 2035 Value Projection: | USD 87.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 130 |

| Tables, Charts & Figures: | 142 |

| Segments covered: | By Width, By Technology and COVID-19 Impact Analysis. |

| Companies covered:: | Sindoh Neu-chem Co., Ltd. J. K. International Co. K. M. Chart Co., Ltd. Commart Co., Ltd. Donghwa Ind Co., Ltd. G & T Corporation G-Medcos International SK Marketing & Company SHINSONG PAPER TECH IND., LTD |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The surge in retail and e-commerce activity has increased the demand for POS receipts, shipping labels, and barcode tags, which are essential to these sectors. Technological advancements in thermal printing such as improved speed, resolution, and energy efficiency enhance operational efficiency and print quality. The healthcare industry's reliance on thermal paper for diagnostic prints, prescriptions, and patient records further drives market growth. Additionally, growing environmental awareness has fueled demand for BPA-free, eco-friendly alternatives, appealing to sustainability-focused markets.

Restraining Factors

The use of endocrine-disrupting chemicals such as BPA and BPS in coatings raises significant health and environmental concerns, prompting regulatory restrictions (e.g., EU bans) and increasing demand for more expensive BPA-free alternatives. Volatility in raw material prices particularly phenolic compounds and wood pulp leads to unstable production costs. The growing adoption of digitalization and e-receipts reduces demand, while limited recyclability and durability issues further hinder market growth.

Market Segmentation

The South Korea thermal paper market share is classified into width, application, and technology.

- The 57mm segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea thermal paper market is segmented by width into 57mm and 80mm. Among these, the 57mm segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period. The growing popularity of portable and small printers for tasks including on-the-go invoicing, ticketing, and creating delivery receipts is propelling the 57mm thermal paper market. Because they are convenient and work with 57mm thermal rolls, delivery workers, parking attendants, and small merchants frequently utilize these portable printers.

- The POS segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea thermal paper market is segmented by application into POS, tags & label, lottery & gaming, ticketing, and medical. Among these, the POS segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Cutting-edge technologies like touchscreens and wireless connectivity, point-of-sale (POS) systems have become more widely used in a variety of businesses. These systems minimize customer service delays by printing quickly and efficiently using thermal paper.

- The direct transfer segment dominated the share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea thermal paper market is segmented by technology into direct transfer and thermal transfer. Among these, the direct transfer segment dominated the share in 2024 and is expected to grow at a significant CAGR during the forecast period. In supply chain management and logistics, direct thermal technology is frequently used to print inventory, warehouse, and shipping labels. Its capacity to produce sharp, long-lasting prints that are appropriate for temporary use fits very well with the logistics sector's rapid speed.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea thermal paper market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

• Hansol Paper

• Sindoh

• Neu-chem Co., Ltd.

• J. K. International Co.

• K. M. Chart Co., Ltd.

• Commart Co., Ltd.

• Donghwa Ind Co., Ltd.

• G & T Corporation

• G-Medcos International

• SK Marketing & Company

• SHINSONG PAPER TECH IND., LTD

• Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea thermal paper market based on the below-mentioned segments:

South Korea Thermal Paper Market, By Pet Width

- 57mm

- 80mm

South Korea Thermal Paper Market, By Application

- POS

- Tags & Label

- Lottery & Gaming

- Ticketing

- Medical

South Korea Thermal Paper Market, By Technology

- Direct Transfer

- Thermal Transfer

Need help to buy this report?