South Korea Tablet Market Size, Share, and COVID-19 Impact Analysis, By Product (Detachable, Slate), By Operating System (Android, iOS, Windows), and South Korea Tablet Market Market Insights, Industry Trend, Forecasts to 2035.

Industry: Semiconductors & ElectronicsSouth Korea Tablet Market Insights Forecasts to 2035

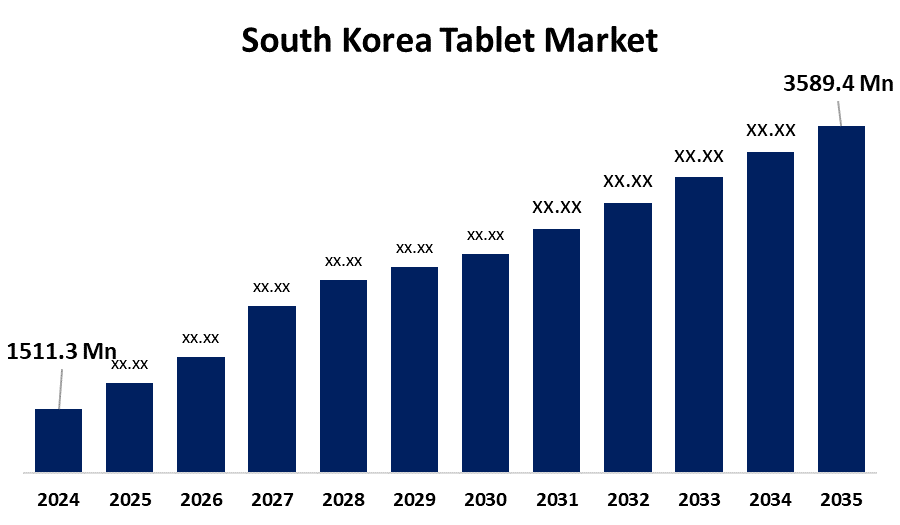

- The South Korea Tablet Market Size was estimated at USD 1511.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.18% from 2025 to 2035

- The South Korea Tablet Market Size is Expected to Reach USD 3589.4 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South Korea Tablet Market Size is anticipated to reach USD 3589.4 Million by 2035, growing at a CAGR of 8.18% from 2025 to 2035. Some of the major factors propelling the market are the continuous shift towards digital transformation, the growing remote working model, the expansion of e-commerce channels, the introduction of fifth-generation (5G) networks, the imposition of various government regulations, and the widespread use of products in the healthcare industry.

Market Overview

The sale and use of portable, touch-screen computing devices, such as e-readers, mini tablets, rugged tablets, and standard tablets, are all included in the South Korean tablet market. These gadgets are used in a number of industries, including business, entertainment, healthcare, and education. 2-in-1 convertible tablets and accessories such as keyboards, styluses, and cases are not included in the market. Additionally, the market is expanding due to ongoing innovations in processing power, battery life, and display quality. The market expansion is also being supported by South Korea's schools and universities' continuous transition to digital learning platforms. In addition, growing remote work models are driving the market's expansion by increasing demand for tablets and other portable computing devices. Additionally, the market is growing as such of the growing e-commerce channels, which make tablet purchases easier.

Report Coverage

This research report categorizes the market for the South Korea tablet market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea tablet market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea tablet market.

South Korea Tablet Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1511.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.18% |

| 2035 Value Projection: | USD 3589.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 205 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product (Detachable, Slate), By Operating System (Android, iOS, Windows) |

| Companies covered:: | Samsung Electronics, Bluebird Inc., TagHive Inc., Witek System Inc, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The launch of fifth-generation (5G) networks, which improve tablet performance, is having a favorable impact on market expansion. In addition, the market is expanding significantly due to the extensive use of the product in the healthcare industry for telemedicine and patient data management. Additionally, the market is expanding due to the growing use of the product as a smart home control center. Furthermore, the market is expanding favorably due to recent developments in augmented reality (AR) and virtual reality (VR) technologies, which make tablets more alluring for immersive experiences.

Restraining Factors

There is intense competition among many manufacturers in the tablet market, which results in price wars that reduce profit margins. Low-cost tablets from Chinese producers increase the pressure on prices, while major players like Apple and Samsung frequently reduce their prices to increase their market share.

Market Segmentation

The South Korea tablet market share is classified into product and operating system.

- The detachable segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea tablet market is segmented by product into detachable and slate. Among these, the detachable segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The detachable tablet's smooth mode switching meets the needs of contemporary users who demand flexibility from their digital tools. Detachable tablets are also more appealing to creative professionals and those looking for improved performance because they frequently have cutting-edge features like strong processors, stylus support, and high-resolution screens. The detachable tablet market is the largest product segment in the tablet industry because it is well-positioned to benefit from the ongoing shifts in consumer preferences toward remote work and flexible lifestyles.

- The android segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea tablet market is segmented by operating system into android, iOS, and window. Among these, the android segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Android tablets are made even more appealing by the availability of the Google Play Store, which offers a vast selection of apps. Additionally, Android's accessibility and low cost make it especially appealing in developing nations where consumers on a tight budget are looking for gadgets with lots of features. Because of its adaptability, accessibility, and broad use, Android is expected to maintain its position as the largest tablet market segment as it develops and adjusts to changing user needs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea tablet market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Samsung Electronics

- Bluebird Inc.

- TagHive Inc.

- Witek System Inc

- Others

Recent Developments:

- In April 2025, Samsung unveiled new iterations of its rugged tablets and smartphones, designed to withstand harsh conditions such as dirt, moisture, and impact. The Galaxy Tab Active5 Pro and Galaxy XCover7 Pro featured extended battery life, with the tablet introducing a dual hot-swap function that allowed users to replace the battery without powering down the device.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea tablet market based on the below-mentioned segments:

South Korea Tablet Market, By Product

- Detachable

- Slate

South Korea Tablet Market, By Operating System

- Android

- iOS

- Windows

Need help to buy this report?