South Korea System-on-Module Market Size, Share, and COVID-19 Impact Analysis, By Type (ARM Architecture, X86 Architecture, and Power Architecture), By Application (Industrial automation, Medical, Entertainment, Transportation, Test and Measurement, and Others), and South Korea System-on-Module Market Insights, Industry Trend, Forecasts to 2035

Industry: Semiconductors & ElectronicsSouth Korea System-on-Module Market Insights Forecasts to 2035

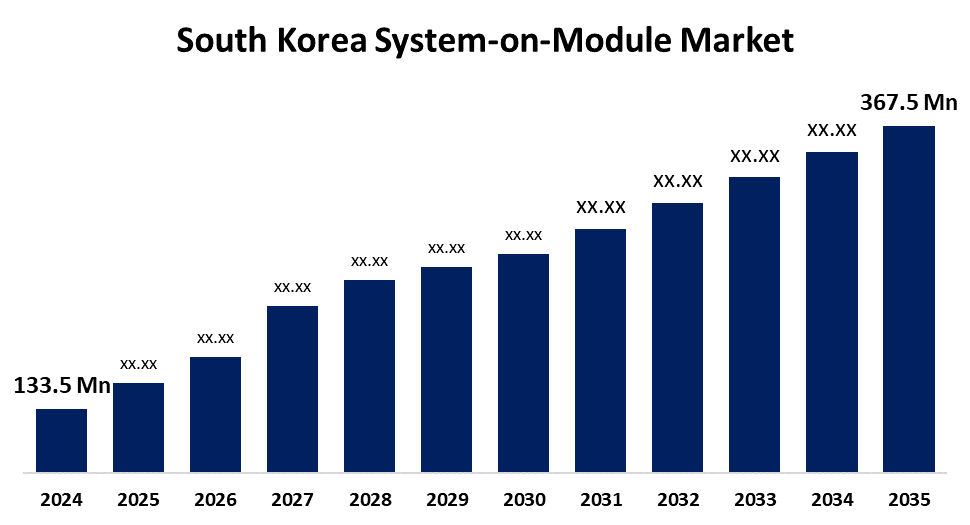

- The South Korea System-on-Module Market Size was estimated at USD 133.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.64% from 2025 to 2035

- The South Korea System-on-Module Market Size is Expected to Reach USD 367.5 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The South Korea System-on-Module Market Size is anticipated to Reach USD 367.5 Million by 2035, Growing at a CAGR of 9.64% from 2025 to 2035. The growing need for small, energy-efficient computing solutions in consumer electronics, medical devices, and industrial automation. The demand for scalable, high-performance embedded modules is being driven by government-backed smart factory initiatives, growing IoT adoption, and developments in edge computing and artificial intelligence.

Market Overview

The South Korea System-on-Module (SoM) Market Size refers to the industry centered on small, integrated computing solutions that integrate memory, processors, and connectivity features onto a single board is known as the South Korean system-on-module (SoM) market. These modules facilitate scalable embedded applications across multiple industries, expedite product development, and shorten time-to-market. Additionally, growing demands across multiple sectors and technological advancements are driving notable trends in the South Korean system-on-module (SoM) market. The growing use of IoT applications in the electronics and manufacturing sectors of South Korea is one of the main market drivers. By encouraging the integration of SoM designs that improve product features and efficiency, the nation's focus on smart factories is consistent with its goal to be a leader in Industry 4.0. Further, as businesses look for small and effective data processing solutions, the growing use of artificial intelligence (AI) and machine learning (ML) has increased interest in SoMs. Opportunities in consumer appliances, healthcare equipment, and new and developing automotive electronics are available in the South Korean System-on-Module (SoM) market. As the "Digital New Deal" initiative concentrates on the transformation of digital infrastructure, there will probably be a greater demand for the new SoM products that offer scalability and flexibility. This program encourages both new and established businesses to work on SoM technology innovations and supports the nation's drive for technological advancement. In South Korea, there has also been a discernible trend toward the miniaturization and enhanced functionality of SoMs.

Report Coverage

This research report categorizes the market for the South Korea system-on-module market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea system-on-module market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea system-on-module market.

South Korea System-on-Module Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 133.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 9.64% |

| 2035 Value Projection: | USD 367.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Samsung Electronics, LG Electronics, Hyundai Motor Company, SK Telecom, SolidRun, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for system-on-modules in South Korea is expanding rapidly due to the rising need for sophisticated electronics in a number of industries, including consumer electronics, telecommunications, and automotive applications. Major companies like Samsung Electronics and LG Electronics, which together accounted for more than 20% of global electronics sales in recent years, are based in South Korea, a technological leader in the world. This notable market penetration suggests that electronic products are constantly being pushed for innovation and integration.

Restraining Factors

The market for system-on-modules in South Korea is constrained by high development costs, integration complexity, and a lack of local knowledge of sophisticated embedded systems. Furthermore, supply chain interruptions and worldwide chip shortages impede prompt production and deployment in important industries.

Market Segmentation

The South Korea system-on-module market share is classified into type and application.

- The ARM architecture segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.s

The South Korea system-on-module market is segmented by type into type into ARM architecture, X86 architecture, and power architecture. Among these, the ARM architecture segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Since ARM architecture is popular in embedded systems and is well-known for its energy efficiency, it is crucial for Internet of Things applications and mobile devices.

- The industrial automation segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea system-on-module market is segmented by application into industrial automation, medical, entertainment, transportation, test and measurement, and others. Among these, the industrial automation segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. the drive for productivity and efficiency in manufacturing processes is driving an increase in industrial automation, which in turn is driving up demand for sophisticated embedded systems.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea system-on-module market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Samsung Electronics

- LG Electronics

- Hyundai Motor Company

- SK Telecom

- SolidRun

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea System-on-Module Market based on the below-mentioned segments:

South Korea System-on-Module Market, By Type

- ARM Architecture

- X86 Architecture

- Power Architecture

South Korea System-on-Module Market, By Application

- Industrial automation

- Medical

- Entertainment

- Transportation

- Test and Measurement,

- Others

Need help to buy this report?