South Korea Sun Care Cosmetics Market Size, Share, and COVID-19 Impact Analysis, By Type (Conventional and Organic), By Product (SPF Sunscreen, SPF Foundation, SPF BB Creams, SPF Spray, SPF Lotion, and others), and South Korea Sun Care Cosmetics Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsSouth Korea Sun Care Cosmetics Market Insights Forecasts to 2035

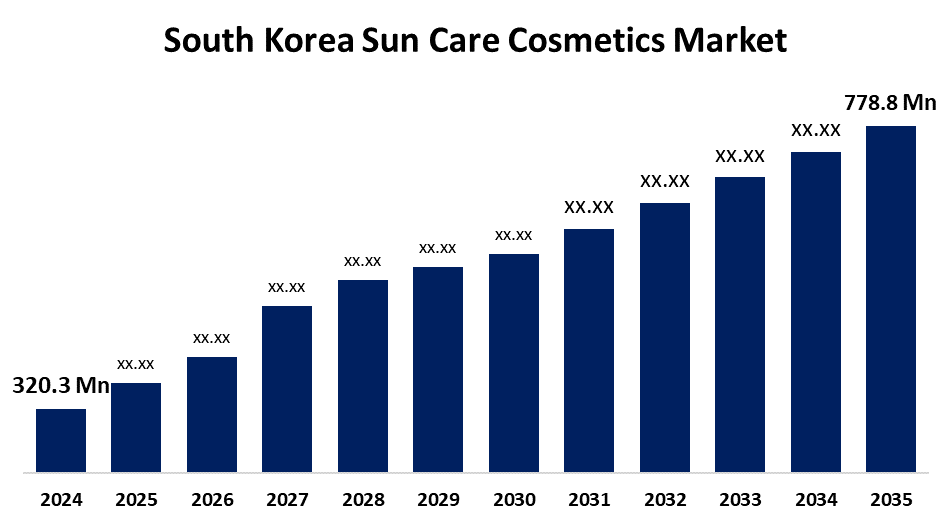

- The South Korea Sun Care Cosmetics Market Size was Estimated at USD 320.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.41% from 2025 to 2035

- The South Korea Sun Care Cosmetics Market Size is Expected to Reach USD 778.8 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the South Korea Sun Care Cosmetics Market Size is Anticipated to Reach USD 778.8 Million by 2035, Growing at a CAGR of 8.41% from 2025 to 2035. Growing demand for multipurpose SPF products and technological advancements like hybrid UV filters, which are being fueled by the global appeal of K-beauty and a culture that prioritizes skincare.

Market Overview

The market for sun care cosmetics in South Korea is the area of the personal care and cosmetics sector dedicated to goods that shield the skin from ultraviolet (UV) rays. Additionally, In South Korea, younger consumers are favoring non-greasy, lightweight sun care products like gels, sun sticks, and cushion compacts because they are convenient to carry, apply quickly, and are comfortable for everyday use. In fast-paced, urban lifestyles, these textures are perfect for frequent reapplication throughout the day because they absorb smoothly without leaving a white cast. Moreover, Innovation in multifunctional formulations is being driven by South Korea's growing preference for all-in-one sun care products. Nowadays, consumers look for sunscreens that serve as moisturizers, primers, tone-up creams, or anti-aging treatments in addition to UV protection. This way, they can streamline their skincare regimens without sacrificing effectiveness or skin benefits.

Report Coverage

This research report categorizes the market for the South Korea sun care cosmetics market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea sun care cosmetics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea sun care cosmetics market.

South Korea Sun Care Cosmetics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 320.3 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 8.41% |

| 2035 Value Projection: | USD 778.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Type, By Product and COVID-19 Impact Analysis. |

| Companies covered:: | Amorepacific Corporation, LG Household & Health Care, ABLE C&C Co., Ltd., Gowoonsesang Cosmetics Co., Nature Republic Co., Ltd and Others. |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

South Korean consumers are showing a growing preference for multipurpose sun care products that offer skincare benefits like moisturizing, priming, or tone correction along with SPF. This demand is pushing manufacturers to create hybrid formulations that simplify routines and improve convenience, particularly for hectic urban lifestyles, by providing broad-spectrum UV protection along with additional skincare or cosmetic benefits.

Restraining Factors

With so many national and international brands, the market is extremely competitive, making it challenging for new players to stand out and for established ones to stay visible.

Market Segmentation

The South Korea sun care cosmetics market share is classified into type and product.

- The conventional segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea sun care cosmetics market is segmented by type into conventional and organic. Among these, the conventional segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Mostly as a result of its increased brand availability and product variety in both mass and premium categories. These goods are usually more affordable, which makes a wider range of customers able to purchase them. Furthermore, well-known formulations with a track record of effectiveness have gradually gained the trust of consumers. But the organic market is expanding steadily due to rising demand for eco-friendly and clean beauty products, particularly from younger, ingredient-conscious consumers looking for sustainable skincare products.

- The SPF foundation segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea sun care cosmetics market is segmented by product into SPF sunscreen, SPF foundation, SPF BB creams, SPF spray, SPF lotion, and others. Among these, the SPF foundation segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Since its dual purpose of providing both cosmetic coverage and sun protection, which fits in with the nation's inclination for simplified skincare regimens. Its everyday wearability particularly among urban consumers and working professionals as well as ongoing innovation in breathable, lightweight textures that suit a range of skin tones are additional factors contributing to its popularity.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea sun care cosmetics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amorepacific Corporation

- LG Household & Health Care

- ABLE C&C Co., Ltd.

- Gowoonsesang Cosmetics Co.

- Nature Republic Co., Ltd.

- Others

Recent Developments:

- In February 2025, Kolmar Korea, a leading cosmetics original design manufacturer, announced that it had successfully developed the world’s first stabilization technology that seamlessly integrated mineral and chemical UV filters into a single hybrid sunscreen.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea Sun Care Cosmetics Market based on the below-mentioned segments:

South Korea Sun Care Cosmetics Market, By Type

- Conventional

- Organic

South Korea Sun Care Cosmetics Market, By Product

- SPF Sunscreen

- SPF Foundation

- SPF BB Creams

- SPF Spray

- SPF Lotion

- others

Need help to buy this report?