South Korea Specialty Insurance Market Size, Share, and COVID-19 Impact Analysis, By Type (Marine, Aviation and Transport (MAT) (marine insurance and aviation insurance)), Political Risk and Credit Insurance, Entertainment Insurance, Art Insurance, Livestock and Aquaculture Insurance, and Others), By Distribution Channel (Brokers, Non-Brokers), and South Korea Specialty Insurance Market Insights, Industry Trend, Forecasts to 2035

Industry: Banking & FinancialSouth Korea Specialty Insurance Market Insights Forecasts to 2035

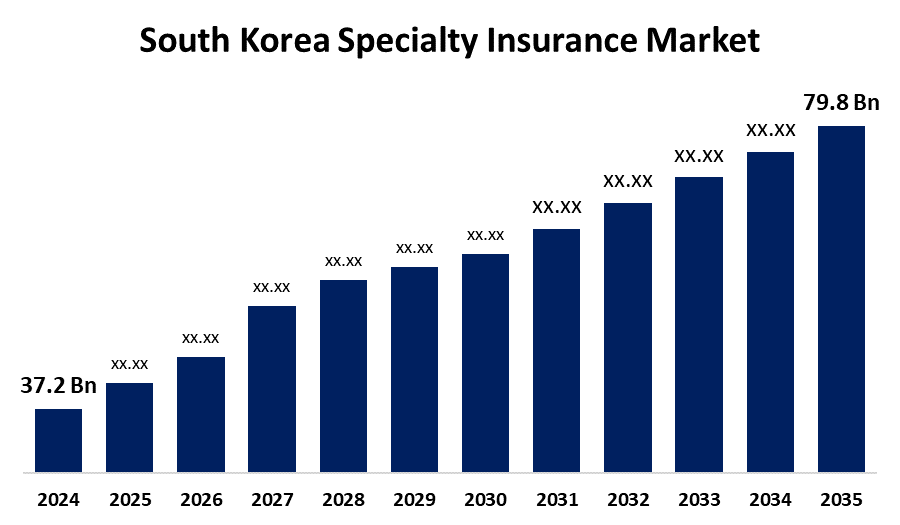

- The South Korea Specialty Insurance Market Size was Estimated at USD 37.2 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.18% from 2025 to 2035

- The South Korea Specialty Insurance Market Size is Expected to Reach USD 79.8 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The South Korea Specialty Insurance Market Size is anticipated to reach USD 79.8 Billion by 2035, growing at a CAGR of 7.18% from 2025 to 2035. Some of the main factors propelling the market are the rising need to reduce financial risk in organizations, the growing demand for cyber insurance to protect against cyberattacks and data breaches, and the rise in natural disasters.

Market Overview

The specialty insurance market in South Korea is a subset of the insurance sector that offers specialized coverage for particular, frequently complicated risks that are not normally covered by regular insurance plans. These specialized products provide protection against niche exposures and are made to meet the specific needs of both individuals and businesses. Additionally, the dynamic economic activity of the nation and the growing awareness of the particular risks connected to different industries are the main factors propelling the South Korean market. The need for specialized insurance solutions that address particular risk exposures, like supply chain disruptions, cyber threats, and specialized project financings, is growing as South Korean companies invest in cutting-edge technologies and grow internationally. Furthermore, South Korea's regulatory landscape is changing to facilitate the growth of the specialty insurance industry and promote the launch of new goods and services.

Report Coverage

This research report categorizes the market for the South Korea specialty insurance market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea specialty insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea specialty insurance market.

South Korea Specialty Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 37.2 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 7.18% |

| 2035 Value Projection: | USD 79.8 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 256 |

| Tables, Charts & Figures: | 96 |

| Segments covered: | By Type and By Distribution Channel |

| Companies covered:: | Samsung Fire & Marine Insurance, Hyundai Marine & Fire Insurance, KB Insurance, Meritz Fire & Marine Insurance, Dongbu Insurance, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The natural disasters are becoming more frequent in the nation, which is helping the market expand. Furthermore, the construction industry's increasing use of specialty insurance to cover project-related risks is bolstering the South Korean market's expansion. In addition, the market is being positively impacted by the growing demand for specialty medical malpractice and healthcare liability insurance brought on by improvements in healthcare technology as well as the growing use of specialty insurance by individuals because it offers peace of mind. Additionally, the growing demand for specialized insurance for risks associated with technology, like product innovation and intellectual property, is providing the nation's industry investors with profitable growth prospects. Additionally, this is because specialty insurance plans offer specialized protection, their growing use is driving market expansion in South

Restraining Factors

The low penetration rates result from a sizable section of the populace being unaware of the insurance products that are available. Additionally, there are still many complaints about solicitation tactics and claim payments, which contribute to the low level of consumer trust in the insurance sector.

Market Segmentation

The South Korea Specialty Insurance Market share is classified into type and distribution channel.

- The marine, aviation and transport (MAT) segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea specialty insurance market is segmented by type into marine, aviation and transport (MAT) (marine insurance and aviation insurance), political risk and credit insurance, entertainment insurance, art insurance, livestock and aquaculture insurance, and others. Among these, the marine, aviation and transport (MAT) segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. An essential part of the nation's trade and transportation sectors, this segment addresses risks associated with shipping, aviation, and logistics.

- The brokers segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period

The South Korea specialty insurance market is segmented by distribution channel into brokers and non-brokers. Among these, the brokers segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Brokers are essential in helping customers find specialized insurance products by providing individualized risk analysis and advisory services. They dominate the market because of their proficiency in handling complicated insurance requirements.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea specialty insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Samsung Fire & Marine Insurance

- Hyundai Marine & Fire Insurance

- KB Insurance

- Meritz Fire & Marine Insurance

- Dongbu Insurance

- Others

Recent Developments:

- In May 2025, Samsung Fire & Marine Insurance (SFMI) partnered with Cyberwrite to enhance its cyber insurance capabilities. Cyberwrite was selected following a global assessment by Samsung Financial C-Lab Outside for its expertise in AI-driven real-time cyber underwriting analytics, broker enablement solutions, and advanced cyber catastrophe modeling.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea Specialty Insurance Market based on the below-mentioned segments:

South Korea Specialty Insurance Market, By Type

- Marine, Aviation and Transport (MAT)

- Marine Insurance

- Aviation Insurance

- Political Risk and Credit Insurance

- Entertainment Insurance

- Art Insurance

- Livestock and Aquaculture Insurance

- Others

South Korea Specialty Insurance Market, By Distribution Channel

- Brokers

- Non-Brokers

Need help to buy this report?