South Korea Smart Healthcare Market Size, Share, and COVID-19 Impact Analysis, By Product Type (RFID Kanban Systems, RFID Smart Cabinets, Electronic Health Records (EHR), Telemedicine, Mhealth, Smart Pills, and Smart Syringes), By End User (Hospitals, Homecare Settings, and Others), and South Korea Smart Healthcare Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareSouth Korea Smart Healthcare Market Insights Forecasts to 2035

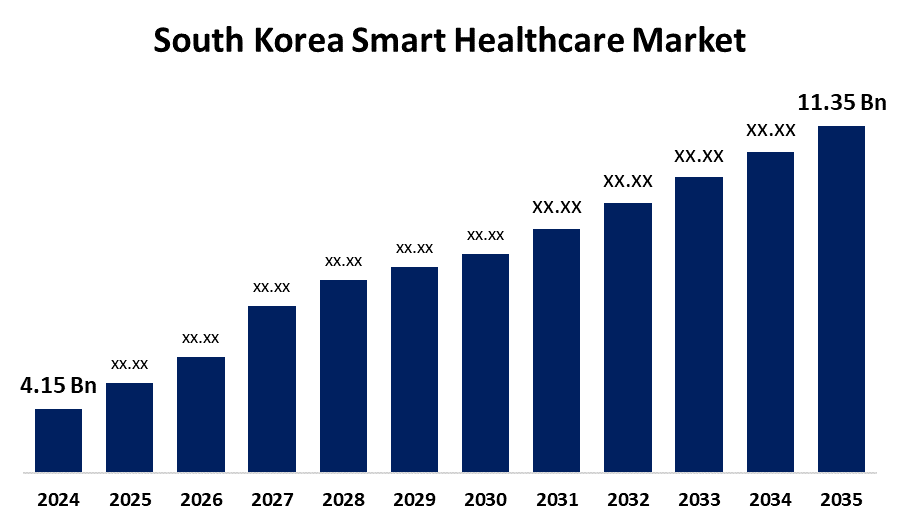

- The South Korea Smart Healthcare Market Size was Estimated at USD 4.15 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.58% from 2025 to 2035

- The South Korea Smart Healthcare Market Size is Expected to Reach USD 11.35 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The South Korea Smart Healthcare Market Size is anticipated to reach USD 11.35 Billion by 2035, growing at a CAGR of 9.58% from 2025 to 2035. Grow as a result of the government's robust support for digital health programs, the growing need for remote care, and the quick uptake of technologies like telemedicine, AI, and the Internet of Things. The need for intelligent, patient-centered healthcare solutions is further accelerated by an aging population and rising rates of chronic diseases.

Market Overview

The South Korea smart healthcare market refers to the ecosystem of digitally integrated healthcare solutions intended to improve medical outcomes, operational effectiveness, and patient care through cutting-edge technologies is referred to as the South Korean smart healthcare market. Additionally, the South Korean smart healthcare sector offers a number of opportunities, particularly in the fields of artificial intelligence (AI) and data analytics. By using AI in diagnostics and patient management systems, healthcare providers can increase service accuracy and speed up operations. Furthermore, there are opportunities to develop patient-specific treatments and personalized health solutions using genomic data. Preventative healthcare and remote monitoring are expected to become more important due to the demands of the aging population and their need for more easily accessible healthcare solutions. Moreover, South Koreans' increasing health consciousness promotes the use of smart health devices that monitor wellness and provide real-time feedback. The increasing demand for smart healthcare solutions has made South Korea a leader in this emerging market.

Report Coverage

This research report categorizes the market for the South Korea smart healthcare market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea smart healthcare market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea smart healthcare market.

South Korea Smart Healthcare Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.15 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 9.58% |

| 2035 Value Projection: | USD 11.35 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 216 |

| Tables, Charts & Figures: | 108 |

| Segments covered: | By Product Type and By End User |

| Companies covered:: | Lemon Healthcare Co., Ltd., Dr. Now Co., Ltd., iCOOP Co., Ltd., Wellysis Corp., Mezoo Co., Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

With the goal of improving the country's healthcare system, the South Korean government has put in place a number of funding programs and policies that encourage healthcare innovation. For example, a major investment in healthcare technology is emphasized in South Korea's Digital New Deal, which is a component of the country's larger economic recovery strategy. Further, the expansion of the South Korean smart healthcare market is supported by the significant budgets already allotted to digital healthcare under this strategic direction. Moreover, the Ministry of Health and Welfare projects that investments in digital health solutions will rise at an exponential rate, further propelling the market's expansion. In addition to emphasizing the value of healthcare innovation, this kind of government support fosters advantageous circumstances for public-private collaborations in the smart healthcare space.

Restraining Factors

The market for smart healthcare in South Korea is hampered by issues with data privacy, high startup costs, and complicated regulations. The widespread deployment and smooth integration of smart technologies are further hampered by slow adoption in smaller facilities and limited interoperability across systems.

Market Segmentation

The South Korea smart healthcare market share is classified into product type and end user.

- The electronic health records (EHR) segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea smart healthcare market is segmented by product type into RFID kanban systems, RFID smart cabinets, electronic health records (EHR), telemedicine, mhealth, smart pills, and smart syringes. Among these, the electronic health records (EHR) segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. With offering immediate access to medical histories, electronic health records (EHR) promote smooth data exchange and enhance patient care.

- The hospitals segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea smart healthcare market is segmented by end user into hospitals, homecare settings, and others. Among these, the hospitals segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. A significant part of this market is made up of hospitals, which offer a variety of cutting-edge technologies that improve patient care and operational effectiveness.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea smart healthcare market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lemon Healthcare Co., Ltd.

- Dr. Now Co., Ltd.

- iCOOP Co., Ltd.

- Wellysis Corp.

- Mezoo Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea Smart Healthcare Market based on the below-mentioned segments:

South Korea Smart Healthcare Market, By Product Type

- RFID kanban systems

- RFID smart cabinets

- electronic health records (EHR)

- telemedicine

- mhealth

- smart pills

- smart syringes

South Korea Smart Healthcare Market, By End User

- Hospitals

- homecare settings

- others

Need help to buy this report?