South Korea Smart Factory Market Size, Share, and COVID-19 Impact Analysis, By Component (Wired Connectivity, Wireless Connectivity), By End User (Electronics & Semiconductor, Aerospace & Defense, Automotive, Oil & Gas, Chemicals, Healthcare & Pharmaceuticals Others), and South Korea Smart Factory Market Insights Forecasts to 2033

Industry: Electronics, ICT & MediaSouth Korea Smart Factory Market Size Insights Forecasts to 2033

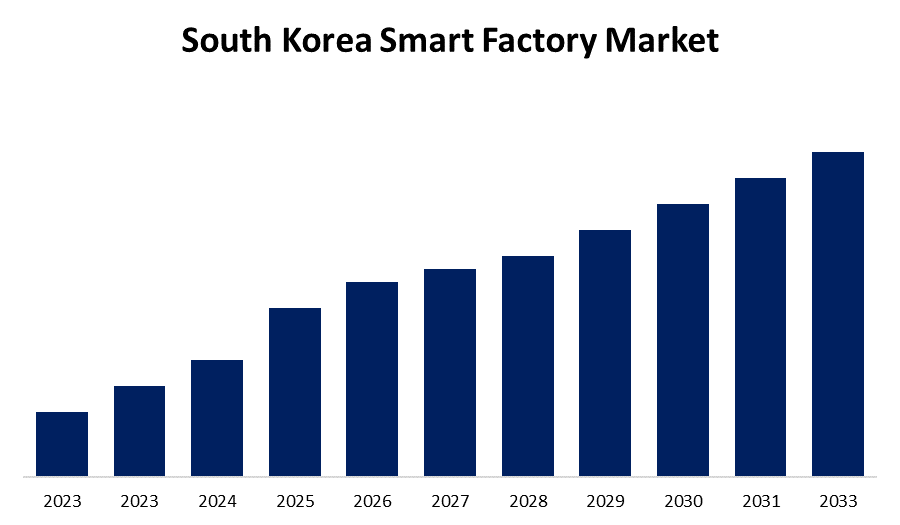

- The Market Size is Growing at a CAGR of 7.6% from 2023 to 2033.

- The South Korea Smart Factory Market Size is Expected to Hold a Significant Share by 2033.

Get more details on this report -

The South Korea Smart Factory Market Size is expected to hold a significant share by 2033, at a CAGR of 7.6% during the forecast period 2023 to 2033.

Market Overview

A South Korea smart factory is described as a highly digitalized and networked environment in which machines and equipment can improve processes through automation and self-optimization. Smart factories are part of the present industrial revolution's technology change known as Industry 4.0. The advantages extend beyond physical goods production to services such as planning, supply chain logistics, and even product development. Furthermore, in line with this, the incorporation of fifth-generation (5G) technology is increasing the operating efficiency of smart factories. Within smart manufacturing environments, 5G provides faster and more reliable communication. This improved connectivity allows for real-time data transmission as well as remote monitoring and management of industrial processes. Apart from that, growing alliances between companies and academic institutions are providing a healthy market picture. Collaborative research projects, knowledge exchange, and talent development programs encourage innovation and the development of innovative smart manufacturing solutions. Moreover, South Korea's government is launching several phases to create a favorable environment for the adoption of smart manufacturing technologies. They are also providing incentives, R&D funds, and policy frameworks to encourage enterprises to invest in smart manufacturing.

Report Coverage

This research report categorizes the market for South Korea smart factory market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea smart factory market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the South Korea smart factory market.

South Korea Smart Factory Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.6% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Component, By End User, and COVID-19 Impact Analysis |

| Companies covered:: | SK Telecom, KT, Samsung Electronics, Posco, LG, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

One of the key reasons driving market expansion is the increased inclination of South Korea for customized and personalized items. Smart manufacturing allows for increased flexibility and adaptability in manufacturing processes, making it easier for businesses in the country to satisfy changing consumer expectations. A robust digital environment, comprising improved telecommunications infrastructure and a high level of internet access, is also helping industry expansion.

Restraining Factors

High software system costs, the sensitivity of cyber-physical system security threats, a lack of standardization and interoperability, and a shortage of trained labor are significant barriers that are expected to hamper the market throughout the projected period. Furthermore, considering the substantial capital investments required for transformations, numerous organizations are having issues implementing innovative technologies.

Market Segment

- In 2023, the wired connectivity segment accounted for the largest revenue share over the forecast period.

Based on the component, the South Korea smart factory market is segmented into wired connectivity, and wireless connectivity. Among these, the wired connectivity segment has the largest revenue share over the forecast period. This trend is expected to continue as the shift to virtual work emphasizes the importance of dependable, secure, scalable, and adaptable off-premises technology services. Furthermore, wired connectivity witnessed tremendous market growth as a result of the significant benefits of automated manufacturing processes, such as uncomplicated monitoring, waste minimization, and output speed.

- In 2023, the automotive segment accounted for the largest revenue share over the forecast period.

On the basis of end user, the South Korea smart factory market is segmented into electronics & semiconductor, aerospace & defense, automotive, oil & gas, chemicals, healthcare & pharmaceuticals and others. Among these, the automotive segment has the largest revenue share over the forecast period. a result of the industry's widespread use of automated devices. Rising electric vehicle development and implementation of industrial robotics for automobile assembly and manufacture are significant drivers for the automotive market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea smart factory market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SK Telecom

- KT

- Samsung Electronics

- Posco

- LG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- On May 2022, Attabotics, the world's first 3D robotics supply chain system for modern commerce, and SYNUS Tech, a logistics automation firm, announced an exclusive agreement to provide integrated logistics system warehousing solutions to South Korean markets.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the South Korea smart factory market based on the below-mentioned segments:

South Korea Smart Factory Market, By Component

- Industrial Sensors

- Industrial Robots

- Industrial 3D Printers

- Machine Vision Systems

South Korea Smart Factory Market, By End User

- Electronics & Semiconductor

- Aerospace & Defense

- Automotive

- Oil & Gas

- Chemicals

- Healthcare & Pharmaceutical

- Others

Need help to buy this report?