South Korea Saccharin Market Size, Share, and COVID-19 Impact Analysis, By Product (Sodium Saccharin, Calcium Saccharin, and Insoluble Saccharin), By Application (Food & Beverage, Pharmaceuticals, Tabletop Sweetener, and Others), and South Korea Saccharin Market Insights, Industry Trend, Forecasts to 2035.

Industry: Consumer GoodsSouth Korea Saccharin Market Insights Forecasts to 2035

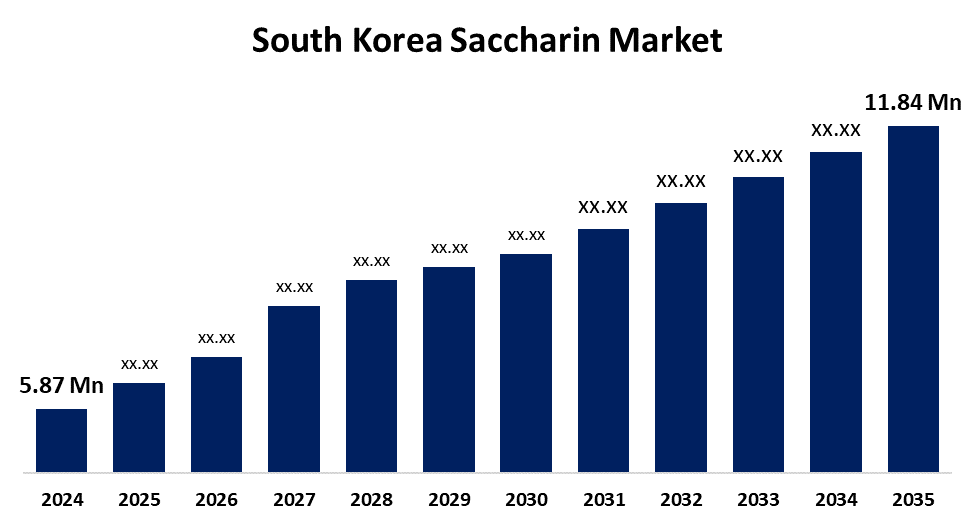

- The South Korea Saccharin Market Size Was Estimated at USD 5.87 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.59% from 2025 to 2035

- The South Korea Saccharin Market Size is Expected to Reach USD 11.84 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South Korea Saccharin Market Size is anticipated to reach USD 11.84 Million by 2035, growing at a CAGR of 6.59% from 2025 to 2035. The growing health consciousness and incidence of lifestyle-related disorders like diabetes and obesity, which are driving up consumer demand for low-calorie sweeteners.

Market Overview

The industry that produces, distributes, and sells saccharin, a high-intensity artificial sweetener, is included in the saccharin market. It comes in different forms, such as sodium, calcium, and insoluble saccharin, and is utilized in a variety of industries, mostly in food and drink, but also in medications and personal hygiene products. Moreover, manufacturers and consumers find saccharin appealing since it is a reasonably priced substitute for sugar and other artificial sweeteners. Saccharin adds sweetness without adding a lot of calories, thus it's good for goods that help consumers with diabetes and maintain their weight. The usage of saccharin in beverages, baked goods, confections, and other food items is driven by the growing demand for low-calorie and sugar-free products. The uses of saccharin are growing as a result of advancements in food technology and sweetener mixes. Policies that encourage home production, including levying import taxes, contribute to the development of a more advantageous environment for domestic producers of saccharin. Saccharin's usage in food and beverages has been authorized by regulatory organizations such as the FDA and other international authorities, which promotes its broad use and propels market expansion.

Report Coverage

This research report categorizes the market for South Korea saccharin market based on various segments and regions forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea saccharin market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment South Korea saccharin market.

South Korea Saccharin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5.87 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.59% |

| 2035 Value Projection: | USD 11.84 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 211 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product, By Application |

| Companies covered:: | JMC Corporation, Shinwon Chemical & Trading Corp, Dae Lim Chemical Co., Ltd., MSC Co., Ltd., Choheung Corporation, KG Chemical (part of KG Group), Yuhan Corporation, Chong Kun Dang Pharmaceutical, Procter & Gamble Korea, Lotte Wellfood, Tradeasia International (Korea branch), Various chemical traders on TradeKorea, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing demand for low-calorie and sugar-free products across the food, beverage, and pharmaceutical industries. Rising health consciousness, increasing rates of diabetes and obesity, and shifting consumer preferences toward healthier lifestyles are major contributors. Additionally, saccharin’s cost-effectiveness, high sweetness intensity, and long shelf life make it a preferred sugar substitute. Expanding applications in personal care and oral hygiene products, along with supportive regulatory approvals for use in various countries.

Restraining Factors

The health concerns related to its potential side effects, which have led to regulatory scrutiny in some regions. Negative consumer perception of artificial sweeteners also hampers demand, as natural alternatives like stevia gain popularity. Additionally, taste limitations, such as a metallic aftertaste, reduce its appeal in certain food and beverage applications.

Market Segmentation

The South Korea saccharin market share is classified into product and application.

- The sodium saccharin segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea saccharin market is segmented by product into sodium saccharin, calcium saccharin, insoluble saccharin. Among these, the sodium saccharin segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period. Its wide usage in food, beverages, and pharmaceuticals for its high sweetness and stability. Its cost-effectiveness and regulatory approvals support continued demand, driving substantial CAGR growth amid rising health-conscious consumer preferences for low-calorie sweeteners.

- The food & beverage segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea saccharin market is segmented by application into food & beverage, pharmaceuticals, tabletop sweetener, and others. Among these, the food & beverage segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The increasing demand for low-calorie sweeteners in processed foods and beverages. Rising health awareness, diabetes concerns, and sugar-reduction trends are driving growth. Saccharin’s stability, affordability, and intense sweetness make it a preferred choice in food industry formulations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea saccharin market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- JMC Corporation

- Shinwon Chemical & Trading Corp

- Dae Lim Chemical Co., Ltd.

- MSC Co., Ltd.

- Choheung Corporation

- KG Chemical (part of KG Group)

- Yuhan Corporation

- Chong Kun Dang Pharmaceutical

- Procter & Gamble Korea

- Lotte Wellfood

- Tradeasia International (Korea branch)

- Various chemical traders on TradeKorea

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea saccharin market based on the below-mentioned segments:

South Korea Saccharin Market, By Product

- Sodium Saccharin

- Calcium Saccharin

- Insoluble Saccharin

South Korea Saccharin Market, By Application

- Food & Beverage

- Pharmaceuticals

- Tabletop Sweetener

- Others

Need help to buy this report?