South Korea Rubber Molding Market Size, Share, and COVID-19 Impact Analysis, By Type (Compression Molding, Transfer Molding, and Injection Molding), By Material (Ethylene Propylene Diene Terpolymer, Natural Rubber, and Styrene Butadiene Rubber), By End-use (Automotive, Consumer Goods, Healthcare, Electrical & Electronics, Construction, and Others), and South Korea Rubber Molding Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsSouth Korea Rubber Molding Market Insights Forecasts to 2035

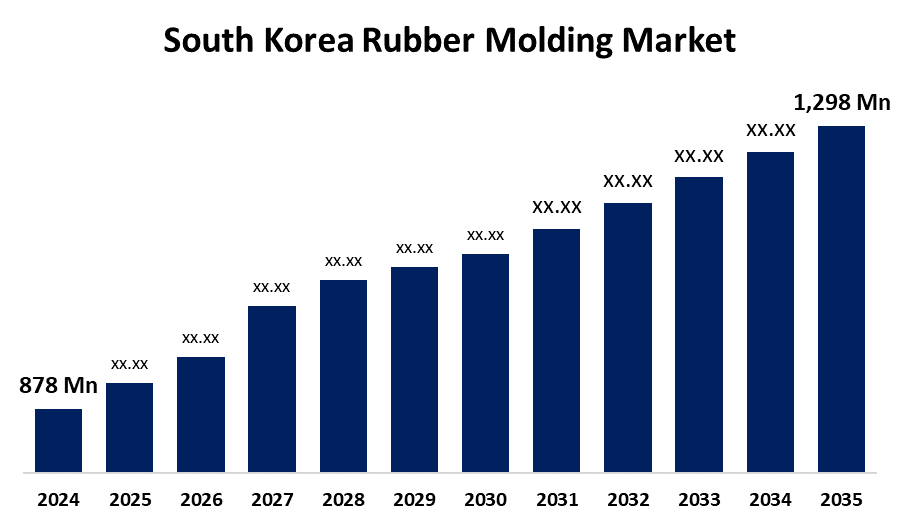

- The South Korea Rubber Molding Market Size Was Estimated at USD 878 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.62% from 2025 to 2035

- The South Korea Rubber Molding Market Size is Expected to Reach USD 1,298 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The South Korea Rubber Molding Market Size is anticipated to reach USD 1,298 Million by 2035, growing at a CAGR of 3.62% from 2025 to 2035. Technological developments and rising demands from a variety of industrial sectors are driving notable trends in the South Korea rubber molding market. The growing emphasis on lightweight materials in automotive manufacturing is one of the major market drivers, which is crucial considering South Korea's thriving automotive sector.

Market Overview

The industry that uses a variety of molding techniques to shape raw rubber materials into completed products is included in the rubber molding market. This covers procedures where uncured rubber is heated and compressed to cure and take the shape of a mold cavity, such as compression molding, injection molding, and transfer molding. Rubber molding makes it possible to produce premium, specially made rubber components that are suited to certain requirements and uses, improving functionality and performance. When compared to other manufacturing techniques, rubber molding specifically injection molding may be more economical, especially for large production runs, and it can also cut waste. A rising need for rubber-molded parts like gaskets, bumpers, and seals in the automobile industry, especially in emerging countries. Injection molding, compression molding, and transfer molding are examples of innovative rubber molding techniques that improve manufacturing efficiency, lower prices, and shorten lead times. Through integration and possible financial aid programs, efforts are being made to boost the farmer forums' part of the rubber trade market. It is thought that regulated futures trading can help with risk management and price discovery. To guarantee fair price discovery, the prospect of holding auctions for the nation's rubber trade is being investigated.

Report Coverage

This research report categorizes the market for South Korea rubber molding market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea rubber molding market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each South Korea rubber molding market sub-segment.

South Korea Rubber Molding Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 878 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 3.62% |

| 2035 Value Projection: | USD 1,298 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 278 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Material and By End-use |

| Companies covered:: | Shinhan Industrial Company, Goryeo Elastomers (GEM), KCC Corporation, Kumho Polychem, Donghee Holdings Co., Ltd., Kolon Industries, Taekwang Industrial Co., Ltd., Shin Chang Precision Industrial Co., Ltd., SC Global, Zetar Moulding, Korea Engineering Plastics (KEP), and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Rubber-molded components, such as tires, hoses, seals, and other elements, are widely used in the automotive industry. The need for rubber-molded parts is being driven by the rising need for lighter and more fuel-efficient automobiles as well as the expansion of global vehicle production. Applications for rubber molding in construction are numerous and include flooring, insulation, and roofing materials. The demand for rubber goods in the construction sector is being driven by the increasing urbanization and infrastructure development in developing countries.

Restraining Factors

Rubber compounds are among the raw materials whose prices can vary greatly, affecting producers profitability and production costs. Environmental standards and regulations have the ability to impede market expansion and raise compliance costs. It can be difficult for manufacturers to keep up with the constant improvements and specialized labor required by technological breakthroughs.

Market Segmentation

The South Korea rubber molding market share is classified into type, material, and end-use.

- The compression molding segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea rubber molding market is segmented by type into compression molding, transfer molding, and injection molding. Among these, the compression molding segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. In the rubber molding industry, compression molding is seeing a comeback because of its adaptability, affordability, and ability to work with intricate geometries. Rubber materials are shaped into desired shapes using this process, which gives producers more design freedom and production efficiency.

- The ethylene propylene diene terpolymer segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea rubber molding market is segmented by material into ethylene propylene diene terpolymer, natural rubber, and styrene butadiene rubber. Among these, the ethylene propylene diene terpolymer segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Its superior electrical insulation, thermal stability, and weather resistance, ethylene propylene diene terpolymer, or EPDM, is becoming more and more popular in the rubber molding sector. With its adaptability, EPDM is a popular option for a range of applications, such as electrical insulation, roofing membranes, and automobile seals, as industries place a higher priority on long-lasting and robust rubber components.

- The automotive segment dominated share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea rubber molding market is segmented by end-user into automotive, consumer goods, healthcare, electrical & electronics, construction, and others. Among these, the automotive segment dominated share in 2024 and is expected to grow at a significant CAGR during the forecast period. The market for lightweight, high-performance components is expanding in the automotive industry due to rising vehicle production. Rubber molding is increasingly being used by automakers for gaskets, seals, and vibration dampers to improve the comfort and efficiency of their vehicles.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea rubber molding market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Shinhan Industrial Company

- Goryeo Elastomers (GEM)

- KCC Corporation

- Kumho Polychem

- Donghee Holdings Co., Ltd.

- Kolon Industries

- Taekwang Industrial Co., Ltd.

- Shin Chang Precision Industrial Co., Ltd.

- SC Global

- Zetar Moulding

- Korea Engineering Plastics (KEP)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea rubber molding market based on the below-mentioned segments:

South Korea Rubber Molding Market, By Type

- Compression Molding

- Transfer Molding

- Injection Molding

South Korea Rubber Molding Market, By Material

- Ethylene Propylene Diene Terpolymer

- Natural Rubber

- Styrene Butadiene Rubber

South Korea Rubber Molding Market, By End-use

- Automotive

- Consumer Goods

- Healthcare

- Electrical & Electronics

- Construction

- Others

Need help to buy this report?