South Korea Residential Real Estate Market Size, Share, and COVID-19 Impact Analysis, By Type (Apartments and Condominiums, Landed Houses and Villas), and South Korea Residential Real Estate Market Insights, Industry Trend, Forecasts to 2035.

Industry: Construction & ManufacturingSouth Korea Residential Real Estate Market Insights Forecasts to 2035

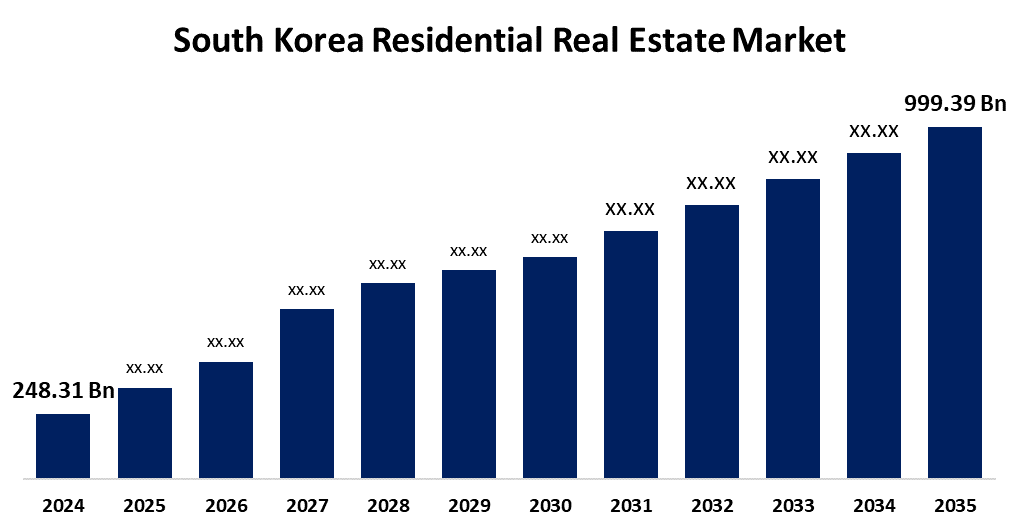

- The South Korea Residential Real Estate Market Size was estimated at USD 248.31 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 13.49% from 2025 to 2035

- The South Korea Residential Real Estate Market Size is Expected to Reach USD 999.39 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The South Korea Residential Real Estate Market Size is Anticipated to reach USD 999.39 Billion By 2035, Growing at a CAGR of 13.49% from 2025 to 2035. The mounting requirement for green and sustainable residential choices, the enhanced popularity of smart home devices and efficient energy features, and heightened emphasis on buying real estate for leisure are some of the leading drivers of the market.

Market Overview

The South Korea residential real estate market includes a variety of homes that are built for personal residence, including townhouses, condominiums, mobile homes, single-family dwellings, apartments, and houses. It can be an inflation hedge and assist property owners in preserving their purchasing power. It gives one the feeling of possession and control that other investments might not provide since property owners can decide on properties' improvements, rental periods, and property management. Additionally, the government of South Korea has made several measures to stabilize the housing sector, such as tax imposts on owners of more than one house and controlling high-value mortgages. These measures seek to limit speculative investment and regulate the affordability of housing. Moreover, the rising popularity of residential property, as it gives future generations a valuable asset and source of potential income, is one of the key positive influences on the South Korean market.

Report Coverage

This research report categorizes the market for the South Korea residential real estate market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea residential real estate market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea residential real estate market.

South Korea Residential Real Estate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 248.31 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 13.49% |

| 2035 Value Projection: | USD 999.39 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Type and COVID-19 Impact Analysis |

| Companies covered:: | Hyosung Corporation, Dongbu Corporation, Daelim Corporation, Booyoung Group, Korea Land and Housing Corporation, ShinYoung Greensys, Hyundai Development Company, Hines, Knight Frank, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The South Korean market is expanding in large part due to consumers' growing demand for smaller family units. Furthermore, a favourable environment for market expansion is being created by the strong demand for residential properties that is driven by the fast urbanisation and growing migration to metropolitan areas. Opportunities for domestic industry operators are further enhanced by the growing usage of energy-efficient solutions and smart home technologies. Furthermore, a major development engine that is solidifying South Korea's standing as a vibrant and alluring real estate market is the rising demand for rental property from foreign buyers, especially expats and international students.

Restraining Factors

Repeated changes in government housing policy have made the market uncertain. Although attempts to curb demand through restricted loans intend to keep speculative buying under check, these actions have also resulted in lowering purchaser confidence and market stagnation. In certain instances, these policies have inadvertently driven up rents, pointing to the difficulty in controlling supply and demand through policy alone.

Market Segmentation

The South Korea residential real estate market share is classified into type.

- The apartments and condominiums segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea residential real estate market is segmented by type into apartments and condominiums, landed houses and villas. Among these, the apartments and condominiums segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The apartments are often found in residential high-rise buildings with five to twenty stories. An apartment is the most common housing for South Koreans because the residential neighborhood is easily developed around the apartment complex. Hundreds or thousands of families live in an apartment complex that may include retail outlets, recreational facilities, and childcare centers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea residential real estate market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hyosung Corporation

- Dongbu Corporation

- Daelim Corporation

- Booyoung Group

- Korea Land and Housing Corporation

- ShinYoung Greensys

- Hyundai Development Company

- Hines

- Knight Frank

- Others

Recent Developments:

- In April 2023, Korea-based GS E&C unveiled its luxury modular home business, XiGEIST. GS E&C was an international player that covered civil engineering, construction, oil & gas, power plants, and renewable energy. They already had a luxury apartment brand, Xi, and were no strangers to the market for modular homes, having made some key acquisitions of major modular home businesses in Poland, Britain, and the USA over recent years. Their prefabricated houses were produced at the company’s new automated panelized prefabrication factory in South Korea, where they aimed to achieve a 30% time saving in construction, with an eight-week delivery time.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea residential real estate market based on the below-mentioned segments:

South Korea Residential Real Estate Market, By Type

- Apartments and Condominiums

- Landed Houses and Villas

Need help to buy this report?