South Korea Release Liners Market Size, Share, and COVID-19 Impact Analysis, By Material Type (Silicone and Non-silicone), By Application (Labels, Pressure-Sensitive Tapes, Hygiene, Industrial, Graphic Arts, Medical, and Others), and South Korea Release Liners Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsSouth Korea Release Liners Market Insights Forecasts to 2035

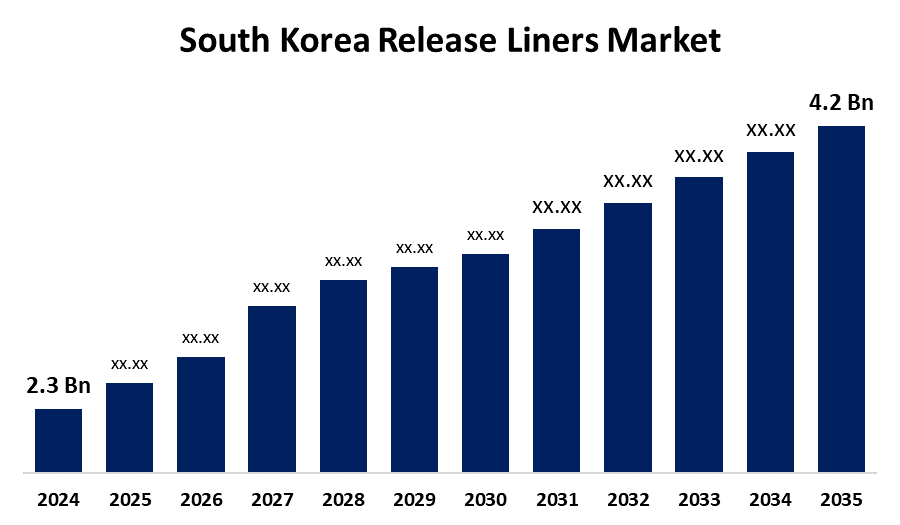

- The South Korea Release Liners Market Size was Estimated at USD 2.3 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.63% from 2025 to 2035

- The South Korea Release Liners Market Size is Expected to Reach USD 4.2 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The South Korea Release Liners Market Size is anticipated to reach USD 4.2 Billion by 2035, growing at a CAGR of 5.63% from 2025 to 2035. Some of the main factors propelling the market include the growth of the medical and healthcare sector, the increasing production of electronic devices such as smartphones, tablets, and displays, and the growing partnerships between government agencies, research institutions, and industry players.

Market Overview

The South Korea release liners market encompasses the manufacturing and use of specialty backing materials, usually made of paper or film, that are covered in a non-stick coating like silicone, are included in the South Korean release liners market. By acting as protective carriers for adhesive products, these liners ensure easy application when necessary and prevent premature adhesion. Labeling, healthcare, electronics, hygiene, and industrial applications are just a few of the industries that depend on them. Moreover, In South Korea, the need for precise manufacturing processes is being driven by the ongoing growth of the electronic sector and the rising production of electronic devices, such as smartphones, tablets, and displays. Release liners are widely used in electronics, including in adhesive parts and screen protective films. Furthermore, a positive market outlook for the nation is being provided by the growth of the medical and healthcare industries. Release liners are used in surgical tapes, transdermal patches, and wound dressings, among other medical devices.

Report Coverage

This research report categorizes the market for the South Korea release liners market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea release liners market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea release liners market.

South Korea Release Liners Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.3 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 5.63% |

| 2035 Value Projection: | USD 4.2 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 288 |

| Tables, Charts & Figures: | 111 |

| Segments covered: | By Material Type and By Application |

| Companies covered:: | LG Chem Ltd, SKC Co., Ltd, Toray Advanced Materials Korea Inc, Hansol Paper Co., Ltd., Dongwon Industries Co., Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market is being positively impacted by the increased focus on recyclable and environmentally friendly packaging options. In addition, the demand for release liners in South Korea is being driven by the growing need for labels and packaging materials. The demand for labels and packaging solutions is being driven by the growth of e-commerce and the ongoing expansion of the food and beverage (F&B) sector. Advanced release liner technologies are also being developed as such of growing partnerships between government agencies, research institutes, and industry participants. These collaborations encourage creativity and the development of specialized release liners that are suited to particular industry demands, which further accelerates market expansion.

Restraining Factors

The South Korea release liners market faces restraints such as high production costs, environmental concerns over waste, raw material price volatility, complex recycling regulations, and limited adoption of advanced, eco-friendly alternatives.

Market Segmentation

The South Korea Release Liners Market share is classified into material type and application.

- The silicone segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea release liners market is segmented by material type into silicone and non-silicone. Among these, the silicone segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. With their exceptional non-stick qualities, high durability, and numerous uses in the industrial, medical, and labeling sectors, silicone-based release liners are the industry standard. Although non-silicone liners are becoming more and more popular, especially in specialty and eco-friendly applications, silicone is still the most popular option for mainstream industries.

The labels segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period

The South Korea release liners market is segmented by application into labels, pressure sensitive tapes, hygiene, industrial, graphic arts, medical, and others. Among these, the labels segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Labels are widely used for product identification, branding, and packaging in a variety of industries, including consumer goods, pharmaceuticals, and food and beverage. Thanks to developments in smart labeling technologies and materials with an emphasis on sustainability, the market for pressure-sensitive labels is still expanding.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea release liners market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- LG Chem Ltd

- SKC Co., Ltd

- Toray Advanced Materials Korea Inc

- Hansol Paper Co., Ltd.

- Dongwon Industries Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea Release Liners Market based on the below-mentioned segments:

South Korea Release Liners Market, By Material Type

- Silicone

- Non-silicone

South Korea Release Liners Market, By Application

- Labels

- Pressure-Sensitive Tapes

- Hygiene

- Industrial

- Graphic Arts

- Medical

- Others

Need help to buy this report?