South Korea Reinsurance Market Size, Share, and COVID-19 Impact Analysis, By Type (Facultative Reinsurance, Treaty Reinsurance (Proportional Reinsurance and Non-Proportional Reinsurance)), By Mode (Online, Offline), and South Korea Reinsurance Market Insights, Industry Trend, Forecasts to 2035

Industry: Banking & FinancialSouth Korea Reinsurance Market Insights Forecasts to 2035

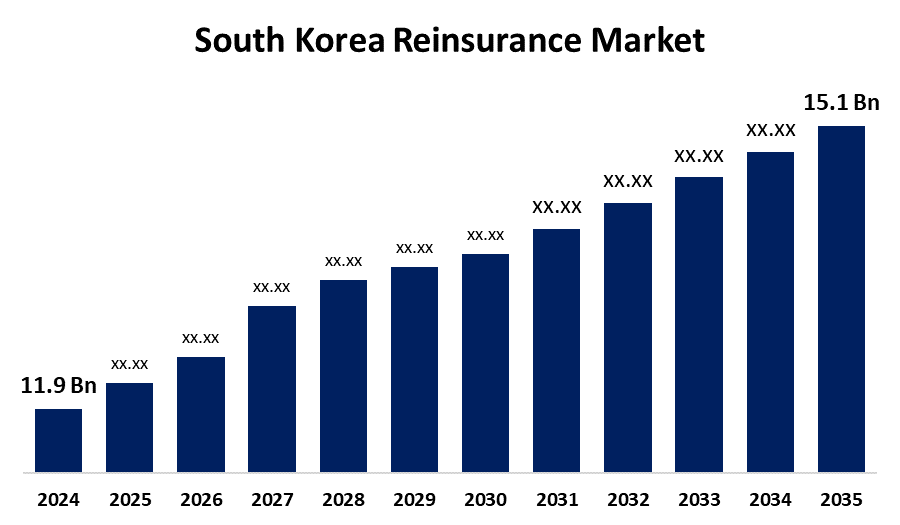

- The South Korea Reinsurance Market Size was Estimated at USD 11.9 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 2.19% from 2025 to 2035

- The South Korea Reinsurance Market Size is Expected to Reach USD 15.1 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The South Korea Reinsurance Market Size is anticipated to reach USD 15.1 Billion by 2035, growing at a CAGR of 2.19% from 2025 to 2035.

Market Overview

The South Korea reinsurance market the industry in which insurance companies assign some of their risks to reinsurers in order to improve financial stability and reduce possible losses is known as the South Korean reinsurance market. Reinsurance guarantees the long-term viability of the insurance sector while enabling primary insurers to diversify risk, raise more money, and grow their businesses. Additionally, the reinsurance market in South Korea gives insurers the freedom to modify terms and conditions according to the particular risks being transferred, increasing the flexibility of risk management strategies. Primary insurers in South Korea can obtain extra funding by taking part in the reinsurance market, which will allow them to grow their businesses and provide a strong defense against unforeseen losses. Additionally, the cooperative efforts of insurers, reinsurance brokers, and reinsurance brokerages support the general stability and resilience of the South Korean insurance market, which is anticipated to support the regional market during the projected period.

Report Coverage

This research report categorizes the market for the South Korea reinsurance market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea reinsurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea reinsurance market.

South Korea Reinsurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 11.9 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 2.19% |

| 2035 Value Projection: | USD 15.1 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 97 |

| Segments covered: | By Type and By Mode |

| Companies covered:: | Korea Reinsurance Company, Samsung Reinsurance, Hana Reinsurance, Hyundai Marine & Fire Insurance, Meritz Fire & Marine Insurance, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The reinsurance market in South Korea is essential to supporting the nation's insurance industry's risk management plans and financial stability. Insurance firms, referred to as primary insurers, assign some of their risks to reinsurers under this arrangement. Furthermore, by distributing risks among several entities, this practice helps primary insurers to reduce possible losses, which is another important factor driving growth.

Restraining Factors

The non-life insurance industry in South Korea faces underwriting challenges, which makes it more dependent on foreign reinsurers.

Market Segmentation

The South Korea Reinsurance Market share is classified into type and mood.

- The treaty reinsurance segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea reinsurance market is segmented by type into reinsurance and treaty reinsurance. Among these, the treaty reinsurance segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Is dominant because it offers insurance companies stable risk management and financial security through long-term agreements between insurers and reinsurers.

- The Offline segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea reinsurance market is segmented by mode into online and offline. Among these, the Offline segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. In this conventional mode, insurers and reinsurers engage directly, frequently through brokers or in-person discussions. Because of established procedures, legal frameworks, and the complexity of reinsurance agreements which frequently call for individualized conversations and customized solutions the offline segment continues to dominate the market despite the growing influence of digital platforms.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea reinsurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Korea Reinsurance Company

- Samsung Reinsurance

- Hana Reinsurance

- Hyundai Marine & Fire Insurance

- Meritz Fire & Marine Insurance

- Others

Recent Developments:

- In December 2024, Supported by a robust domestic market base and expanding international business, Korean Reinsurance Company (KRE), the sole and dominant local reinsurer in South Korea, had been ranked as the sixth-largest IFRS 17 reporting reinsurer in the global reinsurance market in terms of gross insurance service revenue (ISR) in 2023, according to AM Best

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea reinsurance market based on the below-mentioned segments:

South Korea Reinsurance Market, By Type

- Facultative Reinsurance

- Treaty Reinsurance

- Proportional Reinsurance

- Non-Proportional Reinsurance

South Korea Reinsurance Market, By Mode

- Online

- Offline

Need help to buy this report?