South Korea Real Estate Market Size, Share, and COVID-19 Impact Analysis, By Property (Residential, Commercial, Industrial, Land), By Business (Sales and Rental), and South Korea Real Estate Market Insights, Industry Trend, Forecasts to 2035

Industry: Banking & FinancialSouth Korea Real Estate Market Insights Forecasts to 2035

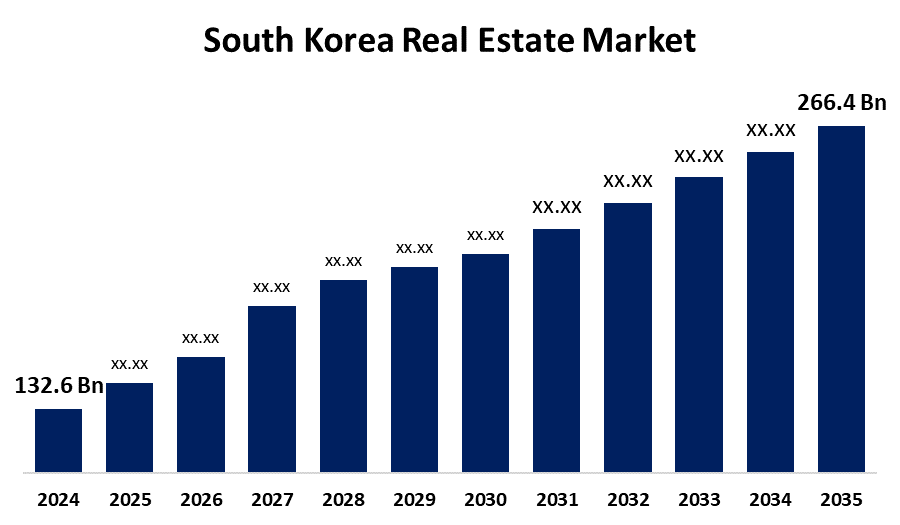

- The South Korea Real Estate Market Size was Estimated at USD 132.6 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.55% from 2025 to 2035

- The South Korea Real Estate Market Size is Expected to Reach USD 266.4 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The South Korea Real Estate Market Size is anticipated to reach USD 266.4 Billion by 2035, growing at a CAGR of 6.55% from 2025 to 2035.

Market Overview

The South Korean real estate market encompasses the purchase, construction, management, and investment of residential, commercial, and industrial properties in South Korea are all included in the country's real estate market. It encompasses a range of real estate types, including detached homes, apartments, office buildings, and mixed-use developments, and is impacted by a number of variables, including urbanization, demographic shifts, governmental regulations, and economic situations. Additionally, the Flexible office space is in high demand in the commercial real estate market, especially in Seoul and Busan, as companies embrace hybrid working practices. Although the e-commerce growth presents issues for retail real estate, technologies like augmented reality shopping experiences are improving customer engagement. The dynamics of commercial real estate financing and investment are significantly impacted by the monetary policies of the Bank of Korea, especially with regard to interest rates, which calls for stakeholders to adopt flexible approaches.

Report Coverage

This research report categorizes the market for the South Korea real estate market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea real estate market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea real estate market.

South Korea Real Estate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 132.6 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 6.55% |

| 2035 Value Projection: | USD 266.4 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 283 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Property and By Business |

| Companies covered:: | Hyosung Corporation, Dongbu Corporation, Daelim Corporation, Booyoung Group, Hyundai Development Company, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The industrial and logistics real estate market is still expanding as a result of South Korea's strategic location in international trade. Due to e-commerce and technological advancements, there is still a high demand for warehouses and logistics centers. As they take advantage of South Korea's position as a logistics hub, cities like Incheon and Busan are seeing an increase in activity. However, trade volumes and real estate demand may be at risk due to geopolitical unpredictability and tariff-related issues.

Restraining Factors

Concerns regarding possible asset bubbles have been raised by the sharp increase in housing prices in places like Seoul's wealthy neighborhoods. In the meantime, home values in other areas are stagnant or declining, which exacerbates wealth inequality and makes it harder for young people to afford housing.

Market Segmentation

The South Korea Real Estate Market share is classified into property and business.

- The residential segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea real estate market is segmented by property into residential, commercial, industrial, and land. Among these, the residential segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. In cities like Seoul, where the population is constantly growing, there is a significant demand for homes. Given the country's promising economic future and rising household incomes, residential real estate, including homes, apartments, and condominiums, is seen as a safe investment. Demand management is also impacted by fiscal measures meant to stabilize the residential sector, such as restrictions on mortgage credit. As a result, the residential sector plays a crucial role in supporting both market expansion and household financial stability.

- The sales segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea real estate market is segmented by business into sales and rental. Among these, the Sales segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. One of the main forces behind the South Korean real estate industry is sales, particularly in the residential and commercial markets. Because of urbanization, population growth, and economic stability, there is a high demand for both new and existing real estate, including apartments and office buildings. There is a high demand for homes in the housing market because people want to own real estate. Both domestic and foreign investors are regularly drawn to the sales market in the commercial real estate industry. Thus, the sales segment continues to be one of the most important market drivers, and the government uses policies and regulations to closely monitor price movements in order to preserve market stability.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea real estate market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hyosung Corporation

- Dongbu Corporation

- Daelim Corporation

- Booyoung Group

- Hyundai Development Company

- Others

Recent Developments:

- In March 2025, the government of South Korea had declared the opening of "Binjibae," an online tool for tracking unoccupied residences. The website offered information on sales and lease listings, redevelopment projects, and unoccupied properties. Supporting real estate transactions and making it easier to repurpose empty houses had been the goals of the platform.

- In October 2024, Heitman had acquired a distribution center in Anseong, extending its portfolio in South Korea. The property had complemented Heitman’s global core plus strategy and had strengthened the company’s commitment to the expanding logistics and real estate industries in the Asia-Pacific region by being close to major logistics hubs and Seoul.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea real estate market based on the below-mentioned segments:

South Korea Residential Real Estate Market, By Property

- Residential

- Commercial

- Industrial

- Land

South Korea Residential Real Estate Market, By Business

- Sales

- Rental

Need help to buy this report?