South Korea Quant Fund Market Size, Share, and COVID-19 Impact Analysis, By Fund Type (Equity Funds, Fixed Income Funds, Multi-Asset Funds, and Alternative Funds), By Investment Strategy (Market Neutral, Statistical Arbitrage, Trend Following, Mean Reversion, and Others), and South Korea Quant Fund Market Insights, Industry Trend, Forecasts to 2035.

Industry: Banking & FinancialSouth Korea Quant Fund Market Insights Forecasts to 2035

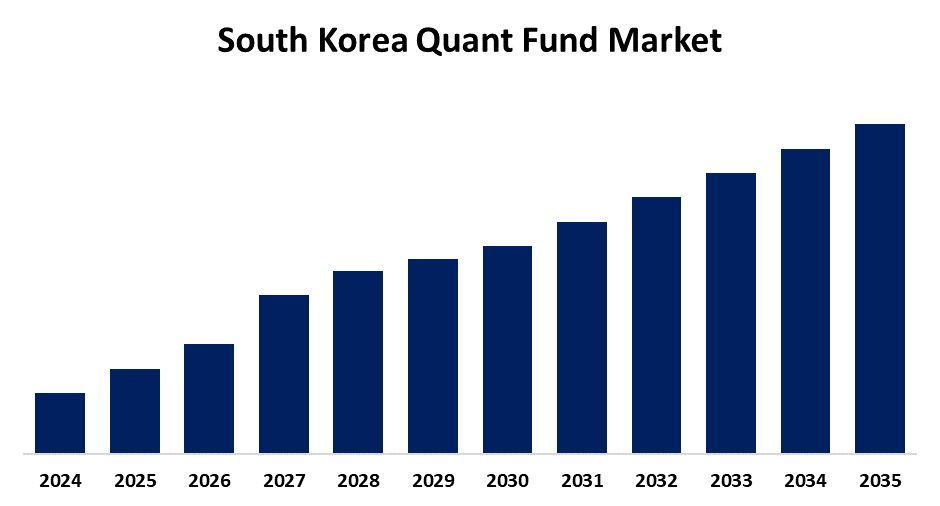

- The South Korea Quant Fund Market Size is Expected to Grow at a CAGR of around 8.2% from 2025 to 2035

- The South Korea Quant Fund Market Size is expected to hold a significant Share by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South Korea Quant Fund Market Size is anticipated to Grow at a CAGR of 8.2% from 2025 to 2035. The market is driven by increasing demand for data-driven, risk-adjusted investment strategies from both institutional and retail investors. Advancements in AI, big data, and fintech infrastructure further support the adoption and performance of algorithmic trading models.

Market Overview

South Korean quant fund market expanded exponentially in the last decade based on technology and appetite for systematic investing tools. The market is dominated by institutional investors, such as asset managers, pension funds, and hedge funds, investing with algorithms and big data analysis. South Korean quant strategies generally emphasize high-frequency trading, statistical arbitrage, and machine learning-based models in predicting market movements and locating inefficiencies. South Korea's mature technology infrastructure, high digitalization rate, and highly developed financial system offer a solid platform for quant funds. Though its growth has been swift, the market is confronted with regulatory pressures, international competition, and the possible dangers of being too dependent on computer systems. Nevertheless, as the market continues to mature, quant funds in South Korea will be increasingly predominant in the investment universe.

Report Coverage

This research report categorizes the market for the South Korea quant fund market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea quant fund market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea quant fund market.

South Korea Quant Fund Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.2% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 213 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Fund Type, By Investment Strategy |

| Companies covered:: | Renaissance Technologies, Citadel LLC, Millennium Management, Two Sigma Investments, PanAgora Asset Management, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

South Korea Quant Fund Market is fuelled by escalating demand for bodybuilding, muscle growth, and fitness among youth. Social media popularity of fitness influencers and spread of gym culture also fuel demand for performance-enhancing drugs further. Moreover, its therapeutic application in order to treat muscle-wasting disease and geriatric diseases also fuel further therapeutic demand. Despite regulatory control, internet access and black markets continue to fuel availability, thereby making trenbolone enanthate a widely used drug in both sporting and clinical contexts.

Restraining Factors

South Korea quant fund market key restraints are regulatory issues with governments enhancing surveillance of algorithmic trading and the use of data. Furthermore, over-competition by international players restrains the market share of local companies. Excessive dependency on automated systems has the ability to cause market shocks, and inadequate expert personnel in AI and machine learning can hinder growth.

Market Segmentation

The South Korea Quant Fund Market share is classified into fund type and investment strategy.

- The equity funds segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea quant fund market is segmented by fund type into equity funds, fixed income funds, multi-asset funds, and alternative funds. Among these, the equity funds segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The equity funds employ algorithmic techniques targeted towards stock picking and portfolio building on drivers like momentum, value, growth, and volatility. Institutional investors particularly need these funds for systematic exposure to equities without emotional or human judgment. These funds were popular during the COVID-19 era because of their systematic deployment and scalability in domestic and offshore equities.

- The statistical arbitrage segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The south korea quant fund market is segmented by investment strategy into market neutral, statistical arbitrage, trend following, mean reversion, and others. Among these, the statistical arbitrage segment dominated the market share in 2024 and is expected to grow at a significant cagr during the forecast period. This method uses statistical and econometric methods to find price inefficiencies between stocks. Applied in hft frequently, the funds demand high-performance computing hardware. Statistical arbitrage in pairs of equities and in etf trading is being used by korean quant managers more and more, especially based on real-time market data feeds using algorithmic execution.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea quant fund market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Renaissance Technologies

- Citadel LLC

- Millennium Management

- Two Sigma Investments

- PanAgora Asset Management

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea quant fund market based on the below-mentioned segments:

South Korea Quant Fund Market, Fund Type

- Equity Funds

- Fixed Income Funds

- Multi-Asset Funds

- Alternative Funds

South Korea Quant Fund Market, Investment Strategy

- Market Neutral

- Statistical Arbitrage

- Trend Following

- Mean Reversion

- Others

Need help to buy this report?