South Korea Probiotics Market Size, Share, and COVID-19 Impact Analysis, By Source (Bacteria and Yeast), By Application (Functional Food and Beverages, Dietary Supplements, Animal Nutrition, and Others), and South Korea Probiotics Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesSouth Korea Probiotics Market Insights Forecasts to 2035

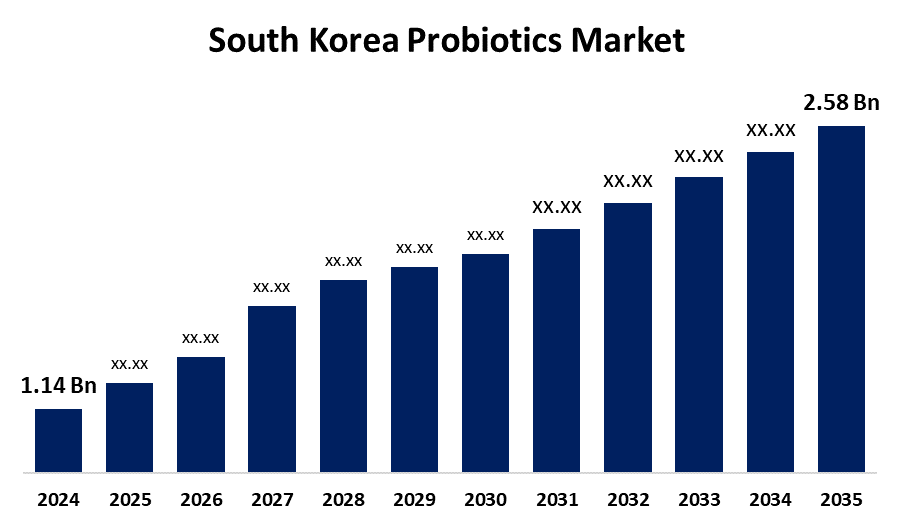

- The South Korea Probiotics Market Size was estimated at USD 1.14 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.71% from 2025 to 2035

- The South Korea Probiotics Market Size is Expected to Reach USD 2.58 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South Korea Probiotics Market is anticipated to reach USD 2.58 billion by 2035, growing at a CAGR of 7.71% from 2025 to 2035. Increasing as a result of a strong shift toward preventive wellness and increased health awareness, particularly with regard to immune and gut health. The demand for high-end, scientifically supported probiotic products is being driven by government support for functional foods, product innovation, and the growth of digital retail.

Market Overview

The South Korea probiotics market refers to the industry focused on the creation, manufacturing, and marketing of goods containing live, advantageous microorganisms that support immunity, gut health, and general well-being is known as the probiotics market in South Korea. Additionally, functional foods and drinks with probiotics are growing in popularity because they appeal to younger consumers and those who are health-conscious. Further, the government has been promoting research and development in the field of functional foods and supporting businesses engaged in probiotic breakthroughs. Moreover, in the South Korean probiotics market, innovation is vital, and businesses are always working to create new goods that satisfy consumer demands and health requirements. The industry's flexibility and responsiveness to consumer demand is demonstrated by the launch of numerous probiotic strains and forms, such as food products, powders, and capsules.

Report Coverage

This research report categorizes the market for the South Korea probiotics market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea probiotics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea probiotics market.

South Korea Probiotics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.14 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.71% |

| 2035 Value Projection: | USD 2.58 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Source, By Application and COVID-19 Impact Analysis |

| Companies covered:: | CJ BIO, Cell Biotech, Microbiome Inc., hyLabs, EWOO BIO Co. Ltd., Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The probiotics market in South Korea is being greatly impacted by the country's population's notable shift towards functional foods that provide health advantages beyond basic nourishment. Over the previous five years, the market for functional foods has grown by roughly 15% yearly, according to data from the Korean food and drug administration. This increase is partially explained by shifting lifestyle patterns and consumers' growing propensity to choose health-conscious products. To meet this demand, businesses like CJ Cheil Jedang have increased their production of food products with probiotics.

Restraining Factors

The probiotics market in South Korea is growing rapidly, but it is still constrained by high product costs, low consumer awareness in rural areas, and complicated regulations. Furthermore, persistent product differentiation and enduring brand loyalty are hampered by strain stability problems and fierce competition.

Market Segmentation

The South Korea probiotics market share is classified into source and application.

- The bacteria segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea probiotics market is segmented by source into bacteria and yeast. Among these, the bacteria segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Their numerous advantages, which include enhancing gut health, strengthening the immune system, and facilitating digestion, have made bacteria highly sought-after in a variety of industries, including food and drink, dietary supplements, and functional foods. Furthermore, consumer interest in bacterial probiotics has increased as a result of increased awareness of the significance of gut microbiota.

- The functional food and beverages segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea probiotics market is segmented by application into functional food and beverages, dietary supplements, animal nutrition, and others. Among these, the functional food and beverages segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growing demand for functional foods and drinks is notable as consumers look for goods that improve immunity and digestive health.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea probiotics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CJ BIO

- Cell Biotech

- Microbiome Inc.

- hyLabs

- EWOO BIO Co. Ltd.

- Others

Recent Developments:

- In July 2025, Amway expanded its partnership with Korean microbiome firm HEM Pharma to develop new probiotic products and advance microbiome testing. Since launching “My Lab by Nutrilite” in South Korea in 2022, the initiative collected approximately 95,000 gut microbiome samples. These included multiple samples per individual to monitor changes over time, which enabled the identification of beneficial bacterial strains and the development of personalized nutrition products tailored to specific health functions.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea Probiotics Market based on the below-mentioned segments:

South Korea Probiotics Market, By Source

- Bacteria

- yeast

South Korea Probiotics Market, By Application

- functional food and beverages

- dietary supplements

- animal nutrition

- others

Need help to buy this report?