South Korea Private Equity Market Size, Share, and COVID-19 Impact Analysis, By Fund Type (Buyout, Venture Capital (VCs), Real Estate, Infrastructure, and Others), and South Korea Private Equity Market Insights, Industry Trend, Forecasts to 2035

Industry: Banking & FinancialSouth Korea Private Equity Market Insights Forecasts to 2035

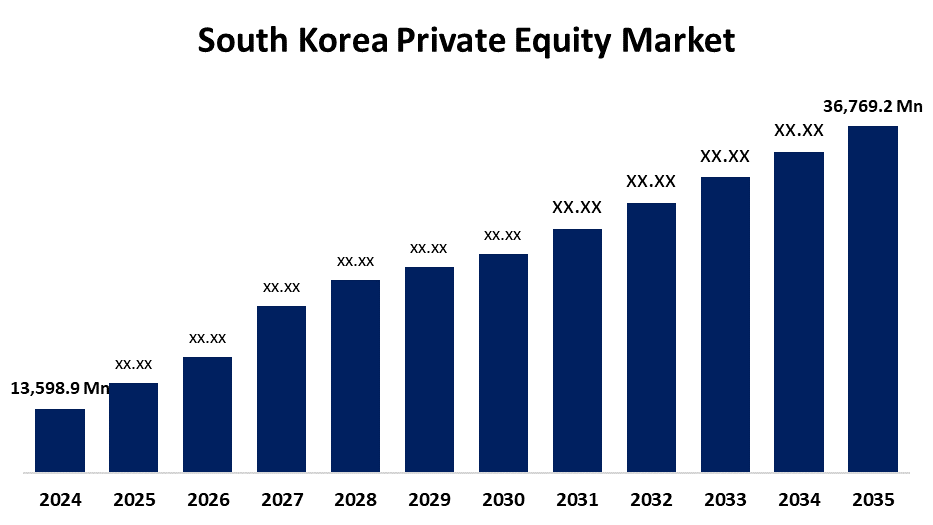

- The South Korea Private Equity Market Size was Estimated at USD 13,598.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.46% from 2025 to 2035

- The South Korea Private Equity Market Size is Expected to reach USD 36,769.2 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The South Korea Private Equity Market Size is anticipated to reach USD 36,769.2 Million by 2035, growing at a CAGR of 9.46% from 2025 to 2035. Market expansion nationwide is mostly being driven by businesses' increasing focus on obtaining long-term capital that is difficult to obtain through traditional financing channels.

Market Overview

The private equity (PE) market in South Korea is the area of the financial sector where private equity firms obtain funds from accredited and institutional investors in order to buy, restructure, and oversee privately held businesses. These companies usually concentrate on infrastructure, real estate, venture capital, buyouts, and other niche investment approaches. Additionally, the market is expanding as a result of the South Korean government's implementation of policies to encourage private equity investment, such as incentives to draw in foreign investors and regulatory reforms. The market demand is also being driven by the technology and innovation sectors, such as fintech and biotech, which are gaining a lot of attention because of their potential for growth and the nation's strong emphasis on technological advancements.

Report Coverage

This research report categorizes the market for the South Korea private equity market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea private equity market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea private equity market.

South Korea Private Equity Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 13,598.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 9.46% |

| 2035 Value Projection: | USD 36,769.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 279 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Fund Type |

| Companies covered:: | MBK Partners, Affinity Equity Partners, IMM Private Equity, Hahn & Company, STIC Investments, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Investors are drawn to South Korea's private equity market because it fosters innovation and uses tried-and true traditional methods. This area's electronics and technology sector is so robust that investors find both well established businesses and fresh biotech and AI startups to be highly appealing. Additionally, interest in eco-friendly projects and green energy has increased as a result of consumers growing concern for sustainability. In addition to providing SMEs with the capital they want private equity helps them with strategies for global competition. Businesses can now respond to changing consumer habits by investing in new areas due to digital platforms and e-commerce. South Korea's private equity market is flourishing and contributing to the country's economy as it strikes a balance between its cultural heritage and modern advancements.

Restraining Factors

The market's expansion is being hampered by the fierce competition and strict regulations among major players.

Market Segmentation

The South Korea Private Equity Market share is classified into fund type.

- The buyout segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea private equity market is segmented by fund type into buyout, venture capital (VCs), real estate, infrastructure, and others. Among these, the buyout segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Buyouts entail obtaining a majority stake in a business, frequently with the goal of expanding or restructuring the enterprise to increase its worth. Numerous well-established, mature businesses in South Korea are prime candidates for buyouts. These businesses are desirable targets for buyout firms aiming to carry out strategic growth plans or operational enhancements because they frequently have steady cash flows and strong market positions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea private equity market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- MBK Partners

- Affinity Equity Partners

- IMM Private Equity

- Hahn & Company

- STIC Investments

- Others

Recent Developments:

- In May 2025, DOV Management, a New York-based investment firm specializing in structured opportunities and alternative assets, opened a new office in South Korea under the name DOV KOREA. The launch marked a significant milestone in the company’s global expansion and reinforced its long-term commitment to the Asia-Pacific region.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea private equity market based on the below-mentioned segments:

South Korea Private Equity Market, By Fund Type

- Buyout

- Venture Capital (VCs)

- Real Estate

- Infrastructure

- Others

Need help to buy this report?