South Korea Precious Metals Market Size, Share, and COVID-19 Impact Analysis, By Metal Type (Gold, Platinum, Silver, Palladium, and Rhodium), By Application (Jewelry, Investment, Electricals, Automotive, Chemicals, and Others), and South Korea Precious Metals Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsSouth Korea Precious Metals Market Insights Forecasts to 2035

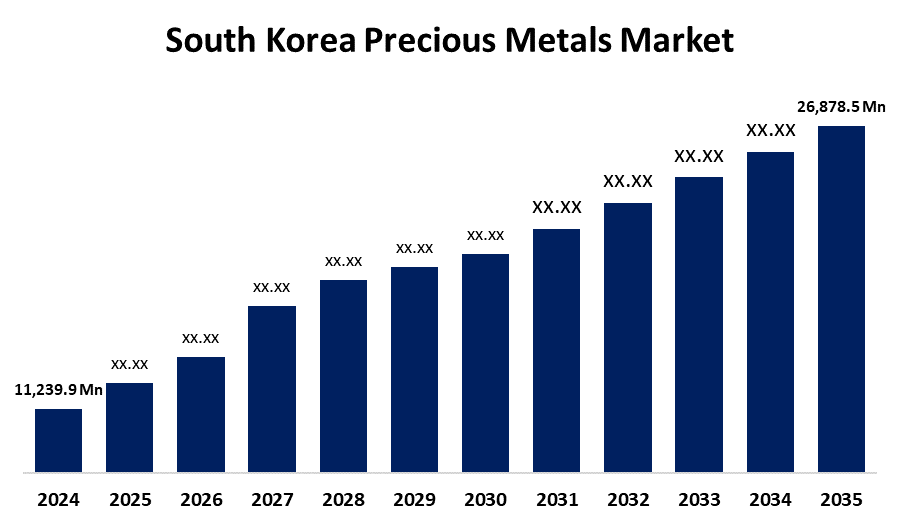

- The South Korea Precious Metals Market Size was Estimated at USD 11,239.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.25% from 2025 to 2035

- The South Korea Precious Metals Market Size is Expected to Reach USD 26,878.5 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The South Korea Precious Metals Market Size is anticipated to reach USD 26,878.5 Million by 2035, growing at a CAGR of 8.25% from 2025 to 2035. The countrywide market growth is mostly being driven by the growing acceptance of physical assets as a popular form of investment and the escalating popularity of holding them outside of the financial system.

Market Overview

The South Korea precious metals market encompasses the production, distribution, and consumption of rare and valuable metals, such as gold, silver, platinum, palladium, and rhodium, are all included in the South Korean precious metals market. These metals are essential to a number of industries, including chemicals, jewelry, investments, electronics, and automobiles. The market is distinguished by its substantial contribution to both domestic and foreign trade. Additionally, the market for precious metals in South Korea is influenced by both domestic and economic factors. The primary factor propelling the market's expansion is the rising demand for gold and silver, which stems from their historical use as safe-haven investments during uncertain economic times. Furthermore, the strong economy of South Korea and the knowledge of precious metals as a safe investment have an impact on this. In addition, the technology sector of which South Korea is a major player in electronics is a significant driver.

Report Coverage

This research report categorizes the market for the South Korea precious metals market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea precious metals market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea precious metals market.

South Korea Precious Metals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 11,239.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 8.25% |

| 2035 Value Projection: | USD 26,878.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 239 |

| Tables, Charts & Figures: | 98 |

| Segments covered: | By Metal Type and By Application |

| Companies covered:: | LT METAL LTD., LS MnM Inc., KOREAZINC, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market is growing as such of the use of precious metals like rhodium, palladium, and platinum in catalytic processes and electronic components. Furthermore, demand is consistently maintained by the cultural significance of precious metals, particularly gold, in jewelry and customary rituals. Interest in recycled precious metals is increased by South Korea's dedication to sustainability, which is in line with the growing trend of eco-friendly practices. Over the course of the forecast period, this is then anticipated to support the regional market.

Restraining Factors

The Geopolitical unrest, currency fluctuations, and worldwide economic conditions can all have an impact on the price volatility of the precious metals market. Such volatility may discourage investors and have an impact on the profitability of companies operating in the sector.

Market Segmentation

The South Korea Precious Metals Market share is classified into type and application.

- The gold segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea precious metals market is segmented by type into gold, silver, palladium, platinum, rhodium. Among these, the gold segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Driven by its cultural significance and high demand for investment. As consumers look for safe-haven assets amid economic fluctuations, the market has witnessed a surge in gold purchases, especially in the form of mini gold bars.

- The jewelry segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea precious metals market is segmented by application into jewelry, investment, electricals, automotive, chemicals, and others. Among these, the jewelry segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. driven by the cultural significance of gold and silver ornaments as well as the high consumer demand for them. Rising disposable income and consistent investments in fine craftsmanship benefit the market, fostering further expansion in this sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea precious metals market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- LT METAL LTD.

- LS MnM Inc.

- KOREAZINC

- Others

Recent Developments:

- In February 2025, the precious metals market was affected when the Korea Minting Corp. stopped selling gold bars to banks. The demand for silver bars increased, creating a supply-demand imbalance that essentially prevented banks from selling silver bars

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea precious metals market based on the below-mentioned segments:

South Korea Precious Metals Market, By Metal Type

- Gold

- Platinum

- Silver

- Palladium

- Others

South Korea Precious Metals Market, By Application

- Jewelry

- Investment

- Electricals

- Automotive

- Chemicals

- Others

Need help to buy this report?