South Korea Potash Market Size, Share, and COVID-19 Impact Analysis, By Product (Potassium Chloride, Potassium Sulphate, and Potassium Nitrate), By End-use (Agricultural and Non-Agricultural), and South Korea Potash Market Insights, Industry Trend, Forecasts to 2035

Industry: AgricultureSouth Korea Potash Market Insights Forecasts to 2035

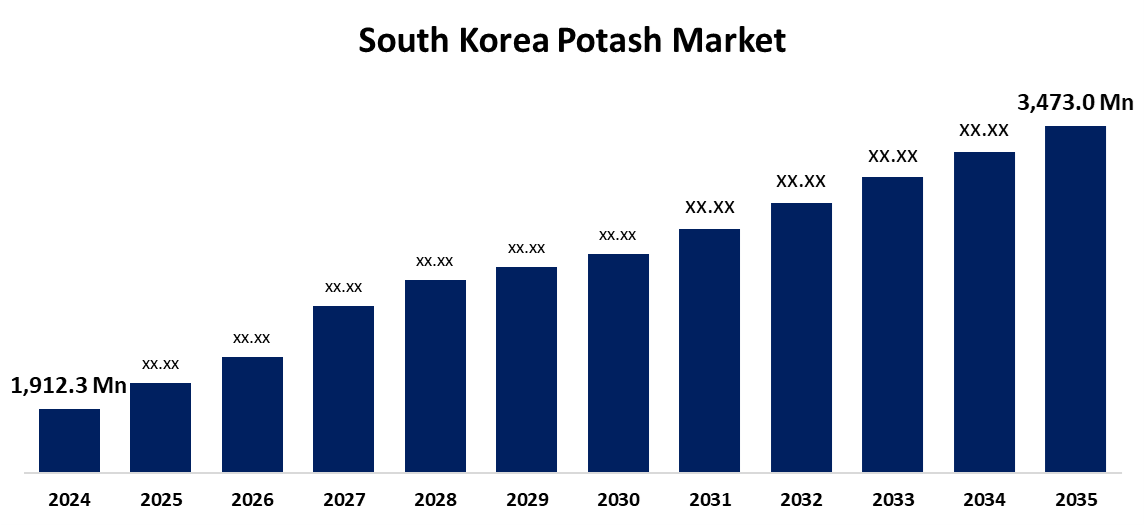

- The South Korea Potash Market Size Was Estimated at USD 1,912.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.57% from 2025 to 2035

- The South Korea Potash Market Size is Expected to Reach USD 3,473.0 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South Korea Potash Market is anticipated to reach USD 3,473.0 million by 2035, growing at a CAGR of 5.57% from 2025 to 2035. Potash is essential for agricultural development and indispensable to farming in all regions. As the world population grows, so does the need for food, which in turn drives the demand for potash as fertilizer.

Market Overview

The potash market in South Korea consists of various types of potash products that have demand and supply of potash, a potassium-rich mineral salt primarily used as a fertilizer in agriculture to improve soil fertility and enhance crop yields. The market is propelled by the need for increased agricultural productivity and the adoption of modern farming practices. Government incentives for sustainable agriculture and innovations in soil testing and customized fertilizer blends further stimulate demand. South Korea's robust infrastructure and technological advancements in agriculture support efficient fertilizer distribution and usage. The country's emphasis on food security and yield optimization underscores the strategic importance of potash in its agricultural policies. There is significant potential for growth in the potash market, driven by expanding agricultural exports and the increasing adoption of smart farming technologies. The government’s emphasis on supporting young farmers and advancing digital agriculture offers opportunities for innovation and market growth.

Report Coverage

This research report categorizes the market for the South Korea potash market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea potash market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea potash market.

South Korea Potash Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1,912.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.57% |

| 2035 Value Projection: | USD 3,473.0 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 170 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By End-use and COVID-19 Impact Analysis |

| Companies covered:: | JSC Belaruskali, Nutrien, Eurochem, Uralkali, Red Metal Ltd., BHP Billiton Ltd., Compass Minerals Intl. Ltd., Encanto Potash Corp. (EPC), K+S Aktiengesellschaft, Rio Tinto Ltd., Mosaic Company, ntrepid Potash Inc and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The potash market is a trend driven by various factors, including market demand, economies of scale, and strategic positioning. Since it is an essential ingredient in fertilizer production, potash is required for agricultural productivity. Consolidation efforts could be influenced by alterations in pricing dynamics and variations in potash demand. The market can enhance its negotiating capacity with suppliers and customers, broaden its range of products, and strengthen its foothold in the potash market. Government policies and regulations can influence the dynamics of industry consolidation and structure

Restraining Factors

The potash market, which is heavily impacted by global trade dynamics, can be greatly affected by fluctuations in currency values. Potash, an essential agricultural fertilizer, boosts crop yields, particularly for potassium-dependent crops like soybeans, corn, and wheat. Currency value fluctuations can affect potash producers' production costs.

Market Segmentation

The South Korea potash market share is classified into product and end-use.

- The potassium chloride segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product, the South Korea potash market is divided into potassium chloride, potassium sulphate, and potassium nitrate. Among these, the potassium chloride segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is due to the increasing demand for food, thereby boosting food production.

- The agricultural segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the end-use, the South Korea potash market is divided into agricultural and non-agricultural. Among these, the agricultural segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The segmental growth is due to the agricultural sector’s ability to improve crop growth, maximize yields, and ensure global food security. This serious nutrient helps facilitate plant growth, root development, and overall crop health.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea potash market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- JSC Belaruskali

- Nutrien

- Eurochem

- Uralkali

- Red Metal Ltd.

- BHP Billiton Ltd.

- Compass Minerals Intl. Ltd.

- Encanto Potash Corp. (EPC)

- K+S Aktiengesellschaft

- Rio Tinto Ltd.

- Mosaic Company

- ntrepid Potash Inc,

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea potash market based on the below-mentioned segments:

South Korea Potash Market, By Product

- Potassium Chloride

- Potassium Sulphate

- Potassium Nitrate

South Korea Potash Market, By End-use

- Agricultural

- Non-Agricultural

Need help to buy this report?