South Korea Pico Projectors Market Size, Share, and COVID-19 Impact Analysis, By Type (Embedded Pico Projectors, Non-Embedded Pico Projectors), By Technology (Digital Light Processing (DLP), Laser Beam Steering, Liquid Crystal on Silicon (LCOS)), and South Korea Pico Projectors Market Insights Forecasts to 2033

Industry: Information & TechnologySouth Korea Pico Projectors Market Insights Forecasts to 2033

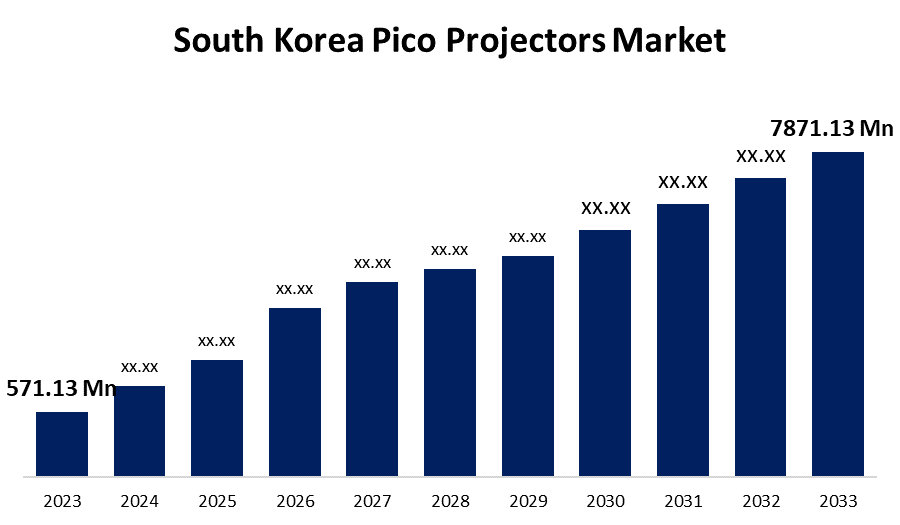

- The South Korea Pico Projectors Market Size was valued at USD 571.13 Million in 2023.

- The Market Size is Growing at a CAGR of 30% from 2023 to 2033.

- The South Korea Pico Projectors Market Size is Expected to Reach USD 7871.13 Million by 2033.

Get more details on this report -

The South Korea Pico Projectors Market Size is expected to reach USD 7871.13 Million by 2033, at a CAGR of 30% during the forecast period 2023 to 2033.

Market Overview

The operation of a pico projector is the same as that of a conventional projector, but with a smaller footprint. Pico projectors are small, handheld devices also known as mobile projectors or pocket projectors. Pico projectors can also be connected to tablets, smartphones, cameras, notebooks, and other memory devices to project videos, photos, presentations, and other electronic documents onto any surface. Pico projectors use a variety of technologies, including DLP (Digital Light Processing), LCoS (Liquid Crystal on Silicon), LBS (Laser Beam Steering), and HLP (Holographic Laser Projection). DLP technology uses tiny mirrors on a chip to direct light from a white light source, whereas LCoS controls how much light each pixel receives via a small liquid crystal display and laser beam steering. Pico projectors are used primarily in consumer electronics, automotive, defense and aerospace, healthcare, educational institutions, gaming, retail, and electronics industries. Pico projectors are used in consumer electronics such as laptops, smartphones, digital cameras, and wearables, as well as in automotive infotainment and battery management systems. In educational institutions, a Pico projector is used to project information to students about the subject.

Report Coverage

This research report categorizes the market for South Korea pico projectors market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea pico projectors market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the South Korea pico projectors market.

South Korea Pico Projectors Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 571.13 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 30% |

| 2033 Value Projection: | USD 7871.13 Million |

| Historical Data for: | 2021-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 114 |

| Segments covered: | By Type, By Technology |

| Companies covered:: | LG Electronics Inc., Cremotech Co. Ltd., SK Telecom, M Korea Ltd., Celluon, Inc., Sony Korea Corporation, Optoma Corporation, Samsung Electronics Co. Ltd., BenQ Korea Co., Ltd., AAXA Technologies, AIPTEK International Inc., and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

Several factors contribute to the market's rapid growth, including the technology's optoelectronic system capability and widespread adoption in industries such as automotive, aerospace and defense, consumer electronics, healthcare, media and entertainment, marketing agencies, and others. As a result, the market for pico projectors is expected to grow significantly. Pico projectors are extremely lightweight and small in size when compared to traditional business projectors, which are considered bulky projectors. Furthermore, they are adaptable and can be connected to a wide range of devices, including DVD players, laptop computers, gaming stations, and cell phones. As a result, the user can transport it with ease. For example, a pre-sales or salesperson can easily carry a pico projector and give an on-the-spot presentation or demonstration. Such advantages of pico projectors help to drive market growth.

Restraining Factors

The low brightness of projectors has a significant impact on market growth. When compared to business projectors, which have brightness levels of 1,000/1,200 lumens, the pico projector has a brightness level of 10-1,000 lumens, requiring the room to be dark enough to see the image clearly. This restricts the growth of the pico projectors market.

Market Segment

- In 2023, the embedded pico projectors segment accounted for the largest revenue share over the forecast period.

Based on the type, the South Korea pico projectors market is segmented into embedded pico projectors, non-embedded pico projectors. Among these, the embedded pico projectors segment has the largest revenue share over the forecast period. Because of its portability, it has become increasingly popular in the consumer electronics sector. Furthermore, the growing popularity of smartphones with features like virtual keyboards and the proliferation of BYOD will hasten the growth of the embedded projector market.

- In 2023, the digital light processing (DLP) segment accounted for the largest revenue share over the forecast period.

Based on the technology, the South Korea pico projectors market is segmented into digital light processing (DLP), laser beam steering, liquid crystal on silicon (LCOS). Among these, the digital light processing (DLP) segment has the largest revenue share over the forecast period. The sealed imaging chip and filter-free chips are two major factors driving the expansion of digital light processing. DLP chips are used in the vast majority of digital light processing projectors, eliminating the possibility of dust particles entering the projected image. Furthermore, DLP chips do not require air filters, which means less maintenance because the filter does not need to be cleaned. The digital light processing market is likely to be driven by novel DLP chip applications, such as LED pico projectors that fit in the palm of a human hand and are the size of a mobile phone.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea pico projectors market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- LG Electronics Inc.

- Cremotech Co. Ltd.

- SK Telecom

- M Korea Ltd.

- Celluon, Inc.

- Sony Korea Corporation

- Optoma Corporation

- Samsung Electronics Co. Ltd.

- BenQ Korea Co., Ltd.

- AAXA Technologies

- AIPTEK International Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2022, AAXA Technologies has launched the AAXA P8 Mini Projector. The AAXA P8 Mini Projector is a compact, high-power next-generation solid-state mini projector. The AAXA P8 Mini HD Projector has a 4th generation Texas Instruments DLP imager and runs Android 10.0, which includes wireless screen mirroring, Bluetooth networking, and video streaming capabilities. The P8 produces a bright 430 Lumens and can display a stunning 100" image thanks to extremely efficient Luminus 30,000-hour LEDs.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the South Korea pico projectors market based on the below-mentioned segments:

South Korea Pico Projectors Market, By Type

- Embedded Pico Projectors

- Non-Embedded Pico Projectors

South Korea Pico Projectors Market, By Technology

- Digital Light Processing (DLP)

- Laser Beam Steering

- Liquid Crystal on Silicon (LCOS)

Need help to buy this report?