South Korea Physical Security Market Size, Share, and COVID-19 Impact Analysis, By Component (System (Physical Access System, Video Surveillance System, Perimeter Intrusion and Detection, Physical Security Information Management, Others), Services (System Integration, Remote Monitoring, Others)), By Industry Vertical (Retail, Transportation, Residential, IT and Telecom, BFSI, Government, and Others), and South Korea Physical Security Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologySouth Korea Physical Security Market Insights Forecasts to 2035

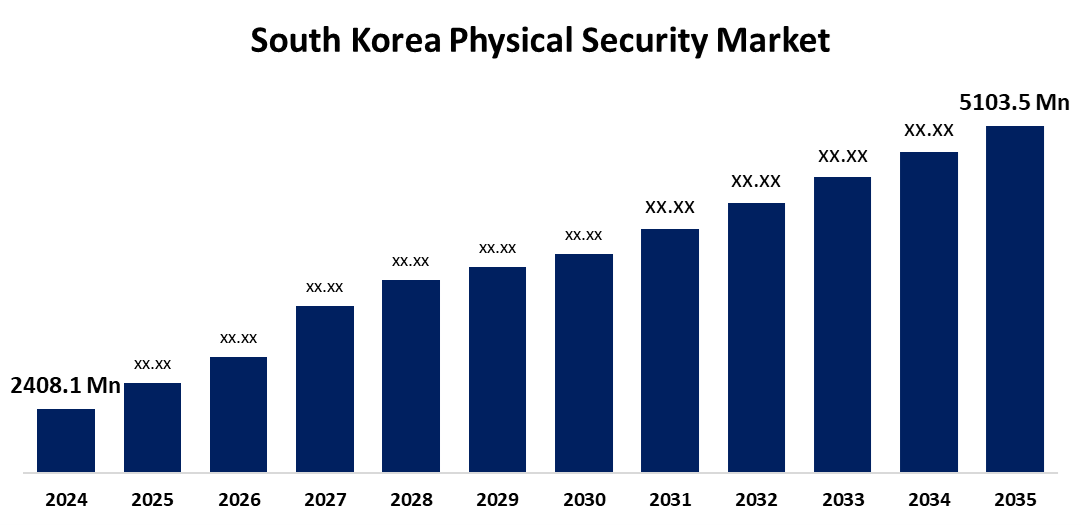

- The South Korea Physical Security Market Size was estimated at USD 2,408.1 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.07% from 2025 to 2035

- The South Korea Physical Security Market Size is Expected to Reach USD 5,103.5 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The South Korea Physical Security Market Size is anticipated to reach USD 5,103.5 Million by 2035, Growing at a CAGR of 7.07% from 2025 to 2035. The market is being driven by a number of factors, including the growing concerns about crime, terrorism, and unauthorized access the expansion of businesses and infrastructure projects; strict government regulations; the growing awareness of potential security risks; and the growing need for proactive risk management strategies.

Market Overview

The South Korea Physical Security Market Size refers to the technologies, services, and infrastructure used to safeguard people, property, and physical facilities against physical threats such as terrorism, theft, damage, and unauthorized access are referred to as the physical security market in South Korea. Additionally, government laws requiring security improvements in vital areas, like public areas and transit, serve as important market stimulators, promoting investment in strong physical security solutions. The need for advanced alarm, access control, and surveillance systems is growing as South Korea deals with a number of security issues, such as geopolitical tensions. The field of incorporating analytics and artificial intelligence into physical security systems offers opportunities.

Report Coverage

This research report categorizes the market for the South Korea physical security market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea physical security market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea physical security market.

South Korea Physical Security Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2,408.1 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 7.07% |

| 2035 Value Projection: | USD 5,103.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 205 |

| Tables, Charts & Figures: | 107 |

| Segments covered: | By Component, By Industry Vertical |

| Companies covered:: | Nedap, Bosch, LG CNS, Samsung Techwin, Pelco, Hanwha Techwin, SK Telecom, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

A greater need for asset, facility, and personnel protection results from increased economic activity, which is especially noticeable in industries like manufacturing, finance, and critical infrastructure. Many security solutions are becoming more widely used as a result of this expansion. Advanced physical security measures are more important than ever due to the growing trend of urbanization and the creation of smart cities. The complexity of security issues increases with the size of urban areas, requiring advanced solutions. The need for integrated security systems that can successfully handle the changing security landscape is further fueled by South Koreas emphasis on building smart, connected cities. Furthermore, the nations growing prominence as a host of important international gatherings, like the Olympics and conferences, spurs improvements in physical security. Investments in cutting-edge technologies and extensive security infrastructure are prompted by the need for increased security during these events, which is further bolstering market expansion.

Restraining Factors

The extensive use of surveillance and facial recognition technologies, which have the potential to gather private information, is the root cause of privacy concerns in South Koreas physical security industry. Numerous citizens are concerned about the storage of this data, who can access it, and whether it could be abused or result in excessive surveillance. Public opposition and more stringent laws may result from these worries, which could impede the uptake of cutting-edge security measures.

Market Segmentation

The South Korea physical security market share is classified into component and industry vertical.

- The services segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea physical security market is segmented by component into system and services. Among these, the services segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The increasing demand for end-to-end security solutions, particularly in commercial spaces, government buildings, and urban infrastructure, is driving this growth. Scalability, real-time responsiveness, and the capacity to integrate various security technologies make services like system integration and remote monitoring more and more popular.

- The government segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea physical security market is segmented by industry vertical into retail, transportation, residential, IT and telecom, BFSI, government, and others. Among these, the government segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Government buildings are among the first to implement integrated physical security solutions since they frequently need sophisticated perimeter defense, access control, and surveillance systems. Consistent government funding and regulatory requirements also help the industry, which increases demand for innovative technologies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea physical security market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nedap

- Bosch

- LG CNS

- Samsung Techwin

- Pelco

- Hanwha Techwin

- SK Telecom

- Others

Recent Developments:

- In March 2023, EQT announced that EQT Infrastructure VI (EQT Value-Add Infrastructure) had agreed to acquire SK Shieldus Co Ltd (SK Shieldus or the Company) from SK Square—an affiliate of South Koreas second-largest conglomerate, SK Group—and Macquarie Asset Managements Infrastructure business (Macquarie). Following the closing of the transaction, EQT Value-Add Infrastructure owned 68 percent of SK Shieldus, while SK Square remained as a minority shareholder with 32 percent.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea Physical Security Market based on the below-mentioned segments:

South Korea Physical Security Market, By Component

- System

- Physical Access System

- Video Surveillance System

- Perimeter Intrusion and Detection

- Physical Security Information Management

- Others

- Services

- System Integration

- Remote Monitoring

- Others

South Korea Physical Security Market, By Industry Vertical

- Retail

- Transportation

- Residential

- IT and Telecom

- BFSI

- Government

- Others

Need help to buy this report?