South Korea Pet Food Market Size, Share, and COVID-19 Impact Analysis, By Animal Type (Dog, Cat, Bird, Others), By Distribution Channel (Supermarkets & Hypermarkets, Online Stores, Specialty Stores, Others), and South Korea Pet Food Market Insights Forecasts to 2032

Industry: Food & BeveragesSouth Korea Pet Food Market Insights Forecasts to 2032

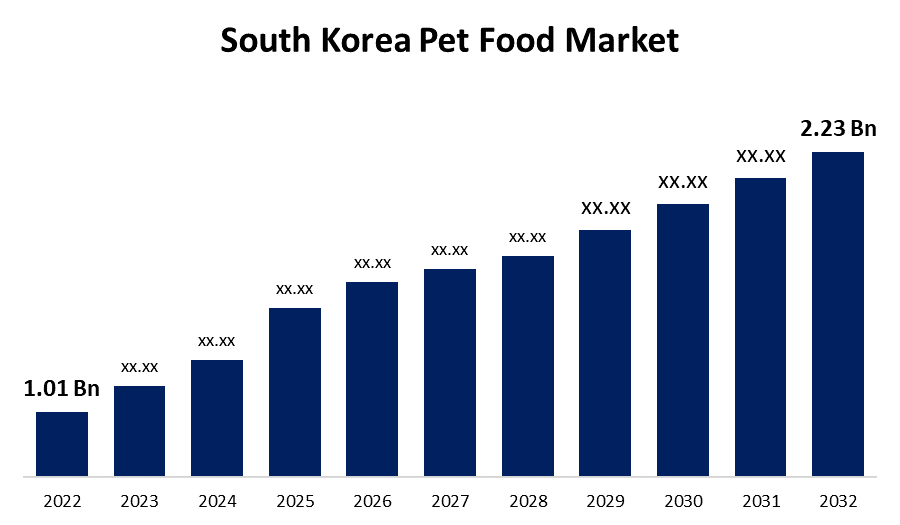

- The South Korea Pet Food Market Size was valued at USD 1.01 Billion in 2022.

- The Market Size is Growing at a CAGR of 8.2% from 2022 to 2032.

- The South Korea Pet Food Market Size is Expected to Reach USD 2.23 Billion by 2032.

Get more details on this report -

The South Korea Pet Food Market Size is Expected to Reach USD 2.23 Billion by 2032, at a CAGR of 8.2% during the forecast period 2022 to 2032.

Market Overview

Pet food is defined as processed plant or animal extracts that are safe for pets to consume. It has been painstakingly designed to provide a balanced blend of essential nutrients for a dog's health and well-being. Pet food commonly contains fish derivatives, animal derivatives, fruit and vegetable derivatives, cereal and cereal by-products, fats and oils, vitamins and minerals, and other additives. This food has numerous health benefits for pets, including increased immunity, weight maintenance, increased life expectancy, a lower risk of skin ailments and allergies, and a lower risk of digestive disorders. It also offers pet owners a convenient and time-saving solution. South Koreans consider their pets to be family members, so they take good care of them. The major factors driving the South Korean pet food market are rising per capita income, rising disposable income, and pet humanization. As a result, consumer spending on a variety of premium and super-premium high-quality pet foods, as well as specialized healthy and therapeutic pet foods, has increased. This is compelling manufacturers to produce high-quality foods using natural and organic ingredients. South Korea's most popular product is dry food. However, due to wet food's high digestibility, demand for wet food is increasing.

Report Coverage

This research report categorizes the market for South Korea’s pet food market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea pet food market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea pet food market.

South Korea Pet Food Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 1.01 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 8.2% |

| 2032 Value Projection: | USD 2.23 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Animal Type, By Distribution Channel, and COVID-19 Impact Analysis. |

| Companies covered:: | Mars, Incorporated, LG UNICHARM, ANF, CJ CheilJedang Corp., Nestle purina, Cargill Incorporated, CJ CheilJedang Corporation, Hill’s Pet Nutrition Inc. (Colgate-Palmolive Company), Mars Incorporated, Nestlé S.A., WellPet LLC and other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

One of the primary market drivers is expected to be the rising rate of pet ownership in South Korea, particularly in developing areas. Rising urbanization and pet humanization are encouraging pet owners to choose nutritious and high-quality food for their pets, which is increasing the growth rate of the South Korean pet food market. The rising per capita income of consumers encourages them to spend money on healthy and organic food products for their pets in order to improve their health. Furthermore, the easy availability of products in a range of price ranges is encouraging growth in the South Korean pet food market. They offer consumers with varying financial situations and options. Rising pet food manufacturers' innovation will have a positive impact on the market. The key market players are focusing on the introduction of a wide range of pet food products to meet the needs of different types of animals of varying ages. During the forecast period, this is expected to drive growth in the South Korean pet food market.

Restraining Factors

Pet food is one of the most strictly regulated food products, particularly in South Korean markets. Pet animal foods are rigorously tested in South Korean markets at every stage, from the ingredients used in food preparation to sales and marketing. The high stringency associated with commercialization may be a major impediment to the expansion of the South Korean pet food market. Furthermore, lower acceptance of premium or high-priced pet food in some developing markets may impede the growth of the South Korean pet food market.

Market Segment

- In 2022, the dog segment accounted for the largest revenue share over the forecast period.

Based on animal type, the South Korea pet food market is segmented into dogs, cats, birds, and others. Among these, the dog segment has the largest revenue share over the forecast period. Customers in South Korea spend a lot of money on premium dry dog food. Dogs are gaining popularity, particularly due to the increasing urbanization and apartment living trend. With the increased popularity of dogs as pets, dog food manufacturers have increased their efforts to provide more dog food options. Gourmet products for dogs play a major role in driving South Korea pet food market growth over the forecast period, as dog owners are increasingly feeding their dogs premium food treats and mixers, and manufacturers are entering the lucrative South Korean dog food market.

- In 2022, the specialty stores segment accounted for the largest revenue share over the forecast period.

Based on distribution channels, the South Korea pet food market is segmented into supermarkets & hypermarkets, online stores, specialty stores, and others. Among these, the specialty stores segment has the largest revenue share over the forecast period. In South Korea, importers and wholesalers to specialized pet food stores, and in some cases, secondary wholesalers to retailers, are the most common distribution channels for pet foods. In the case of South Korean manufacturers with overseas manufacturing facilities, products are imported directly within the company or through subsidiaries and then distributed to retailers via wholesalers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea pet food market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mars, Incorporated

- LG UNICHARM

- ANF

- CJ CheilJedang Corp.

- Nestle purina

- Cargill Incorporated

- CJ CheilJedang Corporation

- Hill's Pet Nutrition Inc. (Colgate-Palmolive Company)

- Mars Incorporated

- Nestlé S.A.

- WellPet LLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2022, Mars Petcare agreed to buy Champion Pet Food, a global pet food brand with a strong presence in South Korea. Champion Pet Food was a well-known brand in the premium and natural pet food categories, with a large consumer following. This acquisition seeks to combine Champion Pet Food's expertise in this field, as well as the country's and Mars' brand loyalty.

Market Segment

This study forecasts revenue at regional, and country levels from 2021 to 2032. Spherical Insights has segmented the South Korea pet food market based on the below-mentioned segments:

South Korea Pet Food Market, By Animal Type

- Dog

- Cat

- Bird

- Others

South Korea Pet Food Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Online Stores

- Specialty Stores

- Others

Need help to buy this report?