South Korea Perfumes Market Size, Share, and COVID-19 Impact Analysis, By Product (Mass and Premium), By End-User (Men and Women), By Distribution Channel (Offline and Online), and South Korea Perfumes Market Insights, Industry Trend, Forecasts to 2035.

Industry: Consumer GoodsSouth Korea Perfumes Market Insights Forecasts to 2035

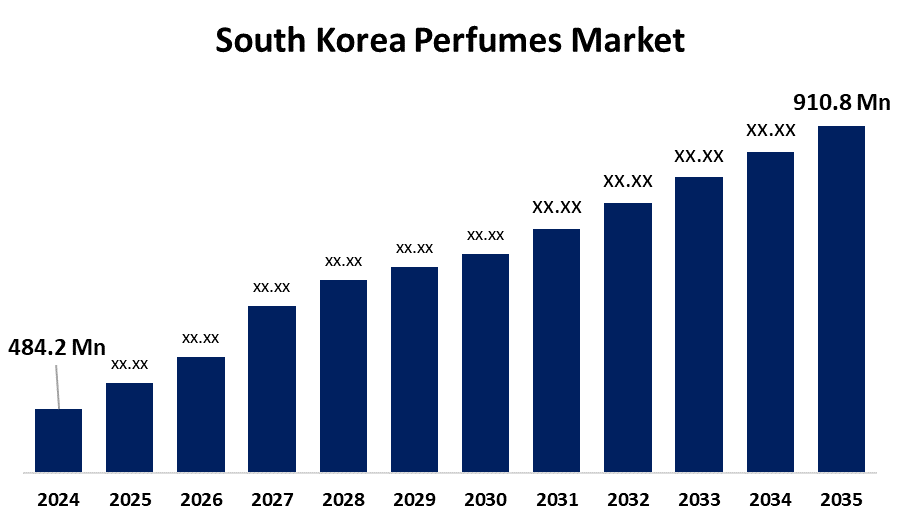

- The South Korea Perfumes Market Size Was Estimated at USD 484.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.91% from 2025 to 2035

- The South Korea Perfumes Market Size is Expected to Reach USD 910.8 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The South Korea Perfumes Market Size is anticipated to reach USD 910.8 Million by 2035, growing at a CAGR of 5.91 % from 2025 to 2035. The rising popularity of personal grooming and the rising desire for high-end and exotic scents are the main drivers of the industry expansion. Furthermore, the South Korea market is being driven by rising consumer expenditure on luxury and premium fragrances as a result of rising income levels and rising living standards. Perfumes have grown into a sizable market within the cosmetics and personal care sector in recent years. A component of pride and confidence, perfumes have become a necessary product due to the expanding trend of personal care.

Market Overview

The industry that manufactures, promotes, and distributes perfumes and fragrances worldwide, including different product kinds like cologne, eau de parfum, and eau de toilette, is included in the perfume market. High-profit margins are a hallmark of the perfume industry, where producers and sellers make significant sums of money. From perfumers and chemists to marketing and retail staff, the fragrance sector employs a diverse range of occupations. The market for perfumes is continuously examined and updated, offering insights into market dynamics, growth, and trends. Fragrances are a "platform technology" that helps businesses generate new value and stimulates innovation in other consumer goods. With brands providing distinctive blends and customized experiences, the market benefits from the demand for luxury fragrances. It is anticipated that the online channel will increase significantly, giving brands greater accessibility and reach. Luxury perfume companies and niche brands are benefiting from the growing demand for high-end, customized scents. Customers are looking for natural and environmentally friendly products more and more, which gives firms the chance to experiment with sustainable packaging and ingredients that are sourced responsibly. The government has put measures in place to promote exports, such as the Interest Equalization Scheme for Rupee Export Credit and the Merchandise Exports from India Scheme (MEIS). Government and business efforts to promote eco-friendly practices and supply chain transparency are being propelled by rising consumer awareness and the need for cruelty-free and sustainable products.

Report Coverage

This research report categorizes the market for South Korea perfumes market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea perfumes market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each South Korea perfumes market sub-segment.

South Korea Perfumes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 484.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.91% |

| 2035 Value Projection: | USD 910.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 201 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product (Mass and Premium), By End-User (Men and Women), By Distribution Channel (Offline and Online) |

| Companies covered:: | Amorepacific Corporation, LG Household & Health Care, Clio Cosmetics, Skin Food, Stylenanda, ABLE C&C, Inc., Korendy Cosmetics Inc., Elorea, Tamburins, Nonfiction, Hera, O Hui, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Customers are more inclined to purchase luxury and high-end goods, such as perfumes, when their disposable income increases. One significant factor is the trend toward self-care and personal grooming, as consumers spend more money on goods that improve their look and scent. The market is expanding as a result of the rising demand for distinctive and customized fragrances as well as the growing appeal of luxury and niche perfumes. Particularly among younger populations, social media platforms have a big impact on consumer tastes and the demand for particular perfumes. Demand for eco-friendly and ethically derived perfumes is rising as a result of consumers' growing knowledge of sustainability and their desire for natural and organic components.

Restraining Factors

The production of perfumes is becoming increasingly difficult and expensive for manufacturers due to the growing regulations pertaining to hazardous chemicals and their effects on the environment. Production costs can be greatly raised by the price of raw materials, particularly natural compounds, and the time-consuming extraction procedures. A broader range of consumers may find it more difficult to afford the high price of luxury and premium perfumes. Sales of synthetic perfumes may be impacted by the growing desire for natural and organic alternatives as a such of growing consumer awareness of the negative effects of synthetic fragrances.

Market Segmentation

The South Korea perfumes market share is classified into product, end-user, and distribution channel.

- The premium segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea perfumes market is segmented by product into mass and premium. Among these, the premium segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. With a stronger focus on exclusivity, quality, and individuality, the rise has outpaced that of mainstream scent items in recent years. Additionally, producers are concentrating on expanding their product lines to include luxury goods.

- The women segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea perfumes market is segmented by end-user into men and women. Among these, the women segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. In contrast to males, who typically buy new perfumes 1-2 times a year, women are seen to buy them as frequently as once a month. According to a report, compared to men, 41% of American women wear perfume daily. Despite their high cost, women are expected to purchase more perfumes since they view them as a necessary component of personal hygiene.

- The online segment held a dominated share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea perfumes market is segmented by distribution channel into offline and online. Among these, the online segment held a dominated share in 2024 and is expected to grow at a significant CAGR during the forecast period. Despite the fact that customers cannot try perfumes before buying, the development of online retail channels like Flaconi, Amazon, and Parfum Dreams has proven to be a novel and practical method of perfume distribution. To sell their products online, gamers use a variety of promotional tactics and advertising methods.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea perfumes market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amorepacific Corporation

- LG Household & Health Care

- Clio Cosmetics

- Skin Food

- Stylenanda

- ABLE C&C, Inc.

- Korendy Cosmetics Inc.

- Elorea

- Tamburins

- Nonfiction

- Hera

- O Hui

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea perfumes market based on the below-mentioned segments:

South Korea Perfumes Market, By Product

- Mass

- Premium

South Korea Perfumes Market, By End-User

- Men

- Women

South Korea Perfumes Market, By Distribution Channel

- Offline

- Online

Need help to buy this report?