South Korea Performance Bank Guarantee Market Size, Share, and COVID-19 Impact Analysis, By Type (Tender Guarantee, Financial Guarantee, Advance Payment Guarantee, Foreign Bank Guarantee, and Others), By Application (Small and Medium Enterprise, Large Enterprise, and Others), By Service Deployment (Online and Offline), and South Korea Performance Bank Guarantee Market Insights, Industry Trend, Forecasts to 2035.

Industry: Banking & FinancialSouth Korea Performance Bank Guarantee Market Insights Forecasts to 2035

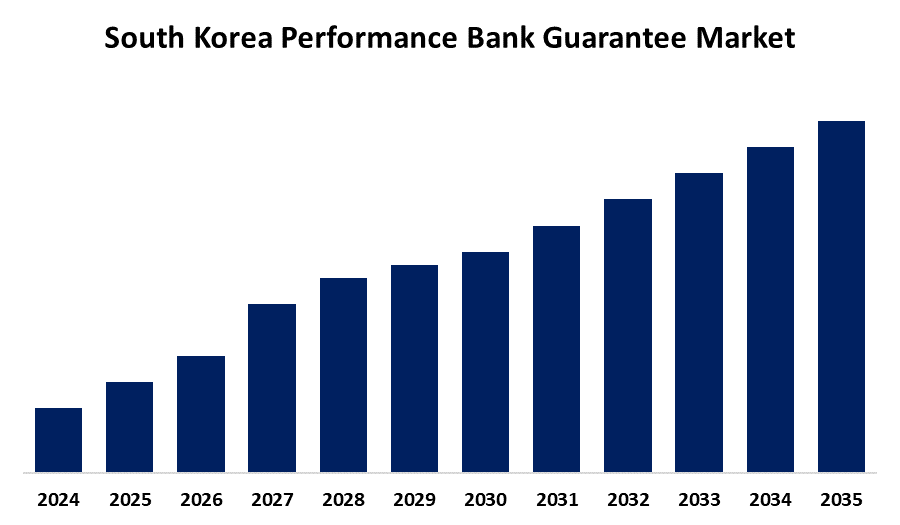

- The South Korea Performance Bank Guarantee Market size is Expected to Grow at a CAGR of around 7.9% from 2025 to 2035

- The South Korea Performance Bank Guarantee Market size is expected to Hold a Significant Share by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The South Korea Performance Bank Guarantee Market Size is anticipated to grow at a CAGR of 7.9% from 2025 to 2035. The market is driven by ongoing infrastructure development and rising public-private partnerships. Additionally, increased trade activity and the adoption of digital platforms for guarantee issuance are accelerating market growth.

Market Overview

South Korea's performance bank guarantee market is a major financial infrastructure employed for the securing of performance contract delivery, especially in construction, infrastructure development, and international trade. As an economically highly industrialized and export-driven economy with a strong project-based business environment, demand for performance guarantees remains firm. State-sponsored infrastructure projects and government-private partnership projects are the prime drivers, generating a consistent guarantee services demand. The sector is also headed for digitization with more automated platforms being adopted by banks and insurance companies and looking into blockchain technologies for accelerating the issuance and management of guarantees. The revolution brings about more transparency, faster processing, as well as advantages for small and medium businesses that are working to expand market presence. Domestic banks and insurers are the proponents, providing tailor-made guarantee solutions in compliance with homegrown regulations and international best practices. With regulatory compliance and risk avoidance increasingly making their presence felt, South Korea's PBG market will keep rising steadily in the traditional and emerging sectors.

Report Coverage

This research report categorizes the market for the South Korea performance bank guarantee market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea performance bank guarantee market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea performance bank guarantee market.

South Korea Performance Bank Guarantee Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.9% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Service Deployment |

| Companies covered:: | Seoul Guarantee Insurance, Korea Trade Insurance Corporation, Hyundai Insurance, DB Insurance, KB Insurance, Shinhan Bank, Woori Bank, KEB Hana Bank, Export-Import Bank of Korea, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

South Korea performance bank guarantee market is fueled by swift infrastructure development, expanding global trade, and rising SMEs' involvement in big-ticket projects. The nation's export-based economy needs secure financial products to guarantee project and contract fulfillment. The evolution of digital banking such as blockchain and AI adoption has made guarantees more accessible and efficient. Furthermore, regulatory backing for fintech innovation and online financial services is facilitating wider market acceptance, which demands assurances of performance to acquire risk management and commercial transaction trust.

Restraining Factors

South Korean performance bank guarantee market is constrained by high collateral requirements and administrative expenses, decreasing the level of availability of small and medium-sized businesses. There are also complicated documentation and regulatory compliance procedures that decrease the market efficiency. Dispersion and uncertainty of best practices within banks also impede digital adoption, with the scale and availability of performance guarantees being lower across a wide range of business segments.

Market Segmentation

The South Korea Performance Bank Guarantee market share is classified into type, application, and service deployment.

- The tender guarantee segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea Performance bank guarantee market is segmented by type into tender guarantee, financial guarantee, advance payment guarantee, and foreign bank guarantee. Among these, the tender guarantee segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Tender guarantees are also referred to as bid bonds. They are necessary in government contracts and major infrastructural projects involving tremendous financial outlay. Contractors bid and engage in government and major business undertakings under the assurance that the bidder would use the contract in case it was awarded. It reduces the risk of finance for project owners since serious and financially sound bidders only would engage in bidding. The growth of public works projects and stringent control on bidding procedures also increases the need for tender guarantees. Their capacity to provide assurance and financial security in large transactions places tender guarantees as the dominant part of the global performance bank guarantee market.

- The large enterprise dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea Performance bank guarantee market is segmented by application into small and medium enterprise, and large enterprise. Among these, the large enterprise segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Large firms deal with transactions that involve hard financial guarantees, and hence performance bank guarantees become essential to their operations. Large firms deal with sophisticated and worthwhile transactions, and there is a need for efficient use of powerful risk-hedging finance instruments. Large firms are also in a position to absorb the expense and maintain the high controls associated with securing performance guarantees. These financial products assist them in funding the supply chain, foreign trade compliance, and risk hedging as regards bulk projects.

- The online segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea performance bank guarantee market is segmented by service deployment into online and offline. among these, the online segment held the largest market share in 2024 and is expected to grow at a significant cagr during the forecast period. There is rapid movement to online platforms owing to the high speed of digitization of financial services and the uptake of new technologies. Online deployment is characterized by benefits such as increased accessibility, zero processing time, and greater transparency, which attract companies and financial institutions. Eased digital platform ease makes it convenient for companies to monitor guarantees remotely, lessening administration costs and hassle. Increasing utilization of secure web portals to submit and monitor performance bank guarantees is useful for small and medium-sized businesses (SMEs), who may not have availed the services previously because of complexity and unaffordable cost of offline operations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea performance bank guarantee market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Seoul Guarantee Insurance

- Korea Trade Insurance Corporation

- Hyundai Insurance

- DB Insurance

- KB Insurance

- Shinhan Bank

- Woori Bank

- KEB Hana Bank

- Export-Import Bank of Korea

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea Performance Bank Guarantee market based on the below-mentioned segments:

South Korea Performance Bank Guarantee Market, By Application

- Small and Medium Enterprise

- Large Enterprise

- Others

South Korea Performance Bank Guarantee Market, By Type

- Tender Guarantee

- Financial Guarantee

- Advance Payment Guarantee

- Foreign Bank Guarantee

- Others

South Korea Performance Bank Guarantee Market, By Service Deployment

- Online

- Offline

Need help to buy this report?